The Indian benchmarks staged a smart recovery from their early lows as of afternoon trade on October 9. The benchmarks opened sharply lower, caught amidst the fallout from the conflict between the Palestinian militant group the Hamas and Israel. However, the bargain buying from the key support level of 19,500 helped the Nifty rebound from its day's low.

On that account, analysts do not anticipate much downside as long as the Nifty holds firm above 19,500. At noon, the Sensex was down 326.74 points or 0.50 percent at 65,668.89, and the Nifty was down 97.80 points or 0.50 percent at 19,555.70. About 893 shares advanced, 2,287 declined, and 101 were unchanged.

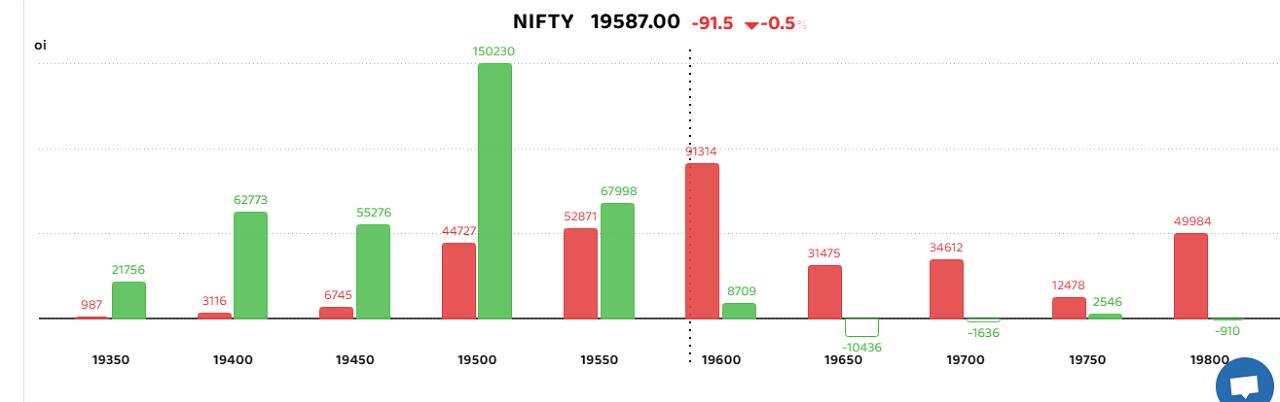

Options data also suggests significant put writing at 19,500, which reflects the strong support coming from that level. Aside from that, put writers were also active at 19,400 and 19,450. On the other side, call writers accumulated positions at 19,600, suggesting a hurdle for the Nifty as it attempts to inch higher.

Follow our live blog for all the market action

"From a technical standpoint, the 19,300–19,250 range is a critical demand zone. Until the market stabilizes within this range, it's likely to remain in a sideways pattern, facing a notable obstacle at 19,800. A breach below 19,250 could lead to a healthy correction, potentially reaching the 18,800 level," said Santosh Meena, Head of Research, Swastika Investmart.

"For short-term traders, it's advisable to exercise caution and not rush into trades. On the other hand, a substantial correction could present an excellent buying opportunity for long-term investors," Meena added.

Among individual stocks, GMR Infra, Voltas, Adani Ports and Special Economic Zone, Hero Motocorp, and Tata Power were prominent names that saw addition of short positions.

On the other hand, a surge of long positions was seen in MCX after the company finally received an approval to launch the new derivatives platform. Open interest in the counter also surged 20 percent along with a sharp rise in the stock price within the cash market.

Metropolis Health also witnessed addition of long positions after the company reported double digit on year growth for its core business in the July-September quarter, along with a sequential expansion in operating margins.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.