Markets opened flattish in sync with mixed global cues but all sectoral indices turned positive by the afternoon with the capital goods index rising 2 percent and Midcap and Smallcap indices 0.3-0.5 percent.

As of 12:48pm, the Nifty index was up 0.62 percent or 122.75 points at 19,803.35, while Nifty Bank climbed 0.30 percent or 136.75 points at 45,981.75.

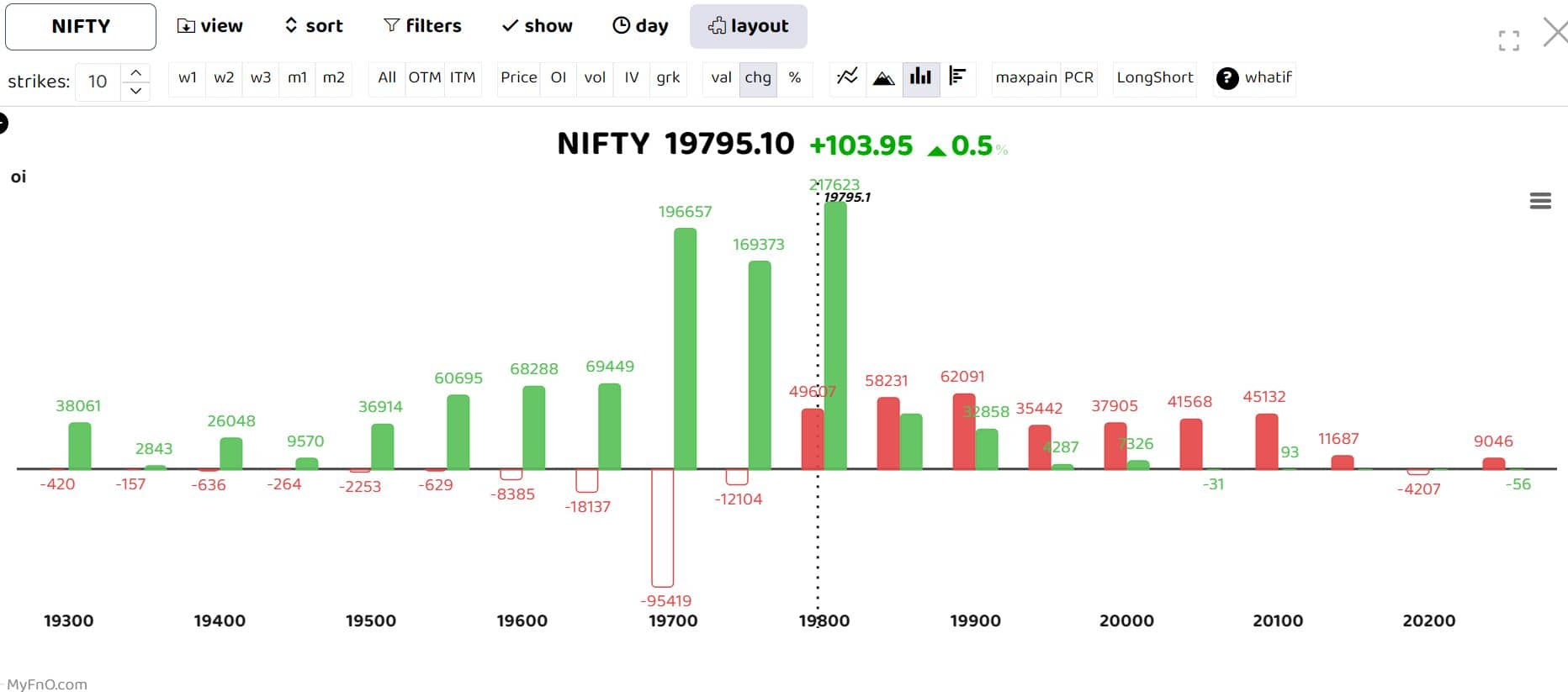

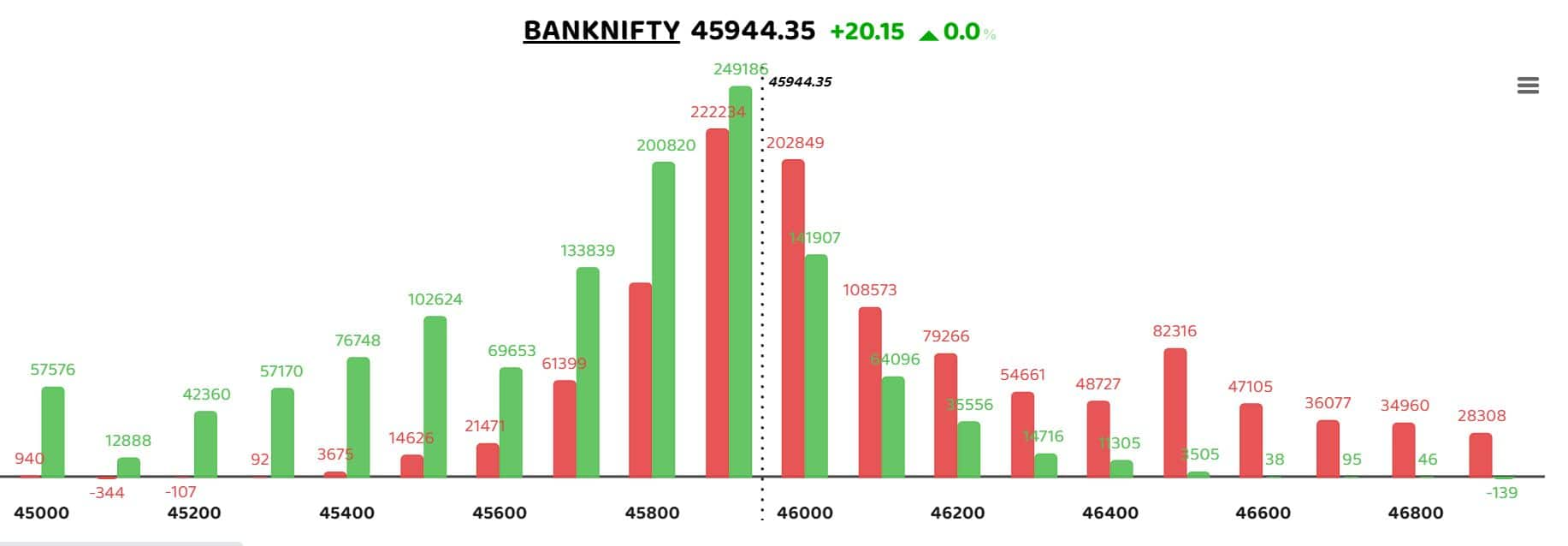

Bars reflect the change in OI during the day. Red bars show call option OI, and green bars show put option OI

The Nifty sees an uptrend after three sessions in the red. Put writers are dominant for the day with heavy put writing at around 19,700 levels. The bullish momentum in the Nifty continues with key resistance at 19,950 and 20,000 levels.

ICICI securities expect, "Nifty to prolong the ongoing consolidation in the 20,000-19,500 range ahead of FOMC meet and monthly expiry session that would make the market healthy by cooling off the overbought conditions after a 1,350-point rally seen over the past four weeks."

Structurally, the Nifty has not corrected for more than 400 points while sustaining above 20 days EMA. ICICI Securities retained the support base upward at 19,500, being confluence of 38.2 percent retracement of current up-move (18,645-19,991), at 19,478 and 20 days EMA is placed at 19,468.

Bank Nifty saw a volatile session majorly oscillating within 150 points range. The option data showed that the 45,850-46,000 range was the battle zone for the index. Call writers were relatively more active as they tried to push the index lower. Analysts believe that consolidation near 46,000 is likely to continue. However, move beyond 46,250 may attract short-covering among the call writers.

Strong support can be seen at 45,500, while key resistance is at 46,300.

Among individual stocks, Tata motors, PEL and Escorts saw long buildup, while CanFinHome and JindalSteel saw short buildup.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!