Sneha Joshi

Equality for women "remains the great unfinished business of the 21st century".

The quote by former United State Secretary of State Hillary Clinton did really press the nerve in the 2014 United Nations event. The reality has, however, been slow and swampy.

Gender is a crucial aspect that is intertwined with Environment, Social and Governance (ESG).

As per the International Labour Organization Database, the world average percentage of total women employed was around 39 percent in 2020. Strikingly, the average women participation in India is barely close to 19 percent.

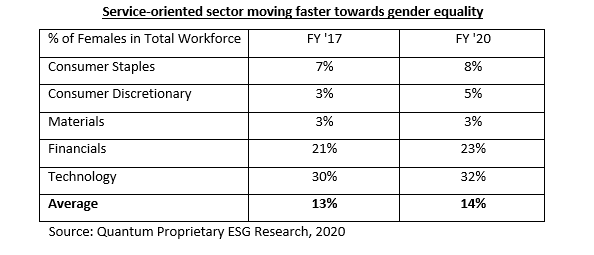

A quick glance at the sample of Indian companies shows women employment in proportion to the total employed across different sectors continues to be well below the global average.

A mere 1 percent increase in the percentage of women employed from 2017 to 2020 strongly indicates the need to address the issue of gender parity on a high priority basis.

If this trend continues, it would take India approximately 80 years to be on par with the global average!

Historically, the financial sector absorbs more female workers, given the fixed nature of the job and security of employment. In the case of India, the share of women employed is yet far off from the global average.

The technology sector has certainly emerged as a female-friendly sector and manages to employ up to 30 percent plus females. The gender pay parity is something that needs further investigation.

Traditionally, sectors like materials, industrials, manufacturing, and mining were male-dominated as the jobs demanded extensive physical tenacity and commitment of long working hours. The social aspect was another hurdle in increasing the participation of women in these sectors.

In the current scenario, the share of women in sectors like consumer staples, consumer discretionary and materials continues to disappoint. These sectors have been revolutionised by automation and technology that can enable the management to increase women's representation.

Data continues to be supported by stereotypes and biases even in 2020.

It is time to walk the talk. Make a difference before it is too late.

It is clear that the pandemic has further affected women disproportionately and the need for a greater push towards making gender parity a priority is being felt more than ever.

How does this affect investors?

The latest McKinsey & Company report on “diversity wins” shows that women contribute positively to the company’s decision-making, innovation capacity, financial strength, and good governance.

Gender diversity is crucial for profitability and value creation. Gender equality, thus, becomes an important essential for the longevity of the company.

As investors, it is in our best interest to demand more disclosures and improvement on gender diversity. One of the crucial aspects to consider while investing in a company is the assessment of gender diversity.

• Women representation at the management and board level

• Equal and fair compensation to men and women

• Diverse approach to hiring and promotions

Improving disclosures on gender parity is just an initial step to understand the truer picture of woman employment and the depth of gender inequality across different sectors.

On the positive side, regulators are also supporting the issue of addressing gender inequality at work place.

The Securities and Exchange Board of India (SEBI) is taking cognisance of the fact that investors are now investing mindfully and the material aspects of ESG play a bigger role in making an investment decision.

The new disclosures by the top 100 listed companies about healthcare benefits to women, the composition of women employees as per skillset, percentage of women employees earning less than median wage will nudge the companies to assess their business from a different perspective.

As more and more investors choose to invest responsibly based on ESG framework, especially with intent towards gender parity, it will provide a new vantage point to steer a change in the way companies have been operating.

Regulators, asset managers, investors, employers and employees, let’s all collaborate to finish this unfinished business of closing the gender gap and stop paying lip service to gender equality.

(The author is Associate Fund Manager–Alternative Investments, Quantum AMC)

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.