Foreign portfolio investors net bought $854 million in India in November, including emerging market inflow of around $463 million which is called as EPFR universe India flows by Kotak Institutional Equities in its report dated December 28.

Indian equities also rallied nearly 5 percent in November after sharp fall in September and October, which was largely driven by foreign institutional investors along with domestic institutional investors.

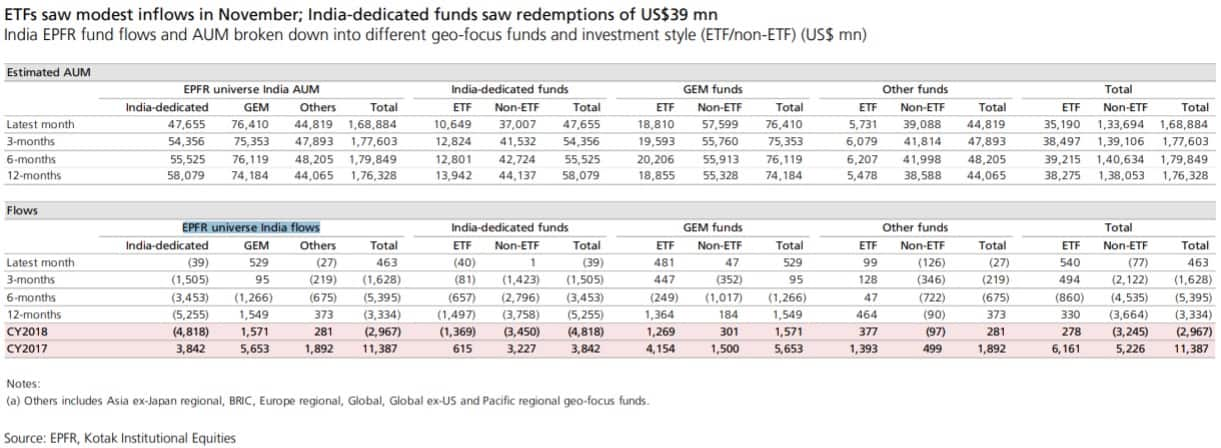

Listed funds inflows of $463 million during the month, which was after large outflows in May-October CY2018, were largely driven by ETF inflows of $540 million while non-ETF outflows were at $77 million, Kotak said.

Listed funds inflows were completely driven by global emerging markets funds ($529 million) while India dedicated funds ($39 million) and other funds ($27 million = ETF inflow $99 million and non-ETF outflow $126 million) were net sellers during the month, it added.

ETFs (exchange traded funds) is known as passive investment and non-ETFs is an active investment by investors. There is a difference between EPFR-reported fund flows and FPI flows reported by NSDL. EPFR is Emerging Portfolio Fund Research.

EPFR fund-flow data primarily tracks mutual funds, ETFs, closed-end funds and variable annuity funds/insurance-linked funds, whereas FPI flows reported by NSDL also capture investments from hedge funds, proprietary desks and sovereign wealth funds.

The research house said global emerging markets (GEM) funds inflows were largely led by $481 million of ETF inflows (and $47 million of non-ETF inflows), but India-dedicated funds saw outflows of $39 million led by ETF outflows of $40 million during the month (non-ETF inflow was $1 million).

In fact, India-dedicated funds have been net sellers not only for November but also for last three-month ($1,505 million), six-month ($3,453 million) and last 12 months ($5,255 million).

Kotak said overall listed emerging market fund flows were mostly positive in November. India saw inflows of $463 million, China saw inflows of $3.8 billion and South Korea $1.8 billion during the month whereas Russia saw outflows of $106 million. "Total FPI activity and EPFR activity showed similar trends for most countries."

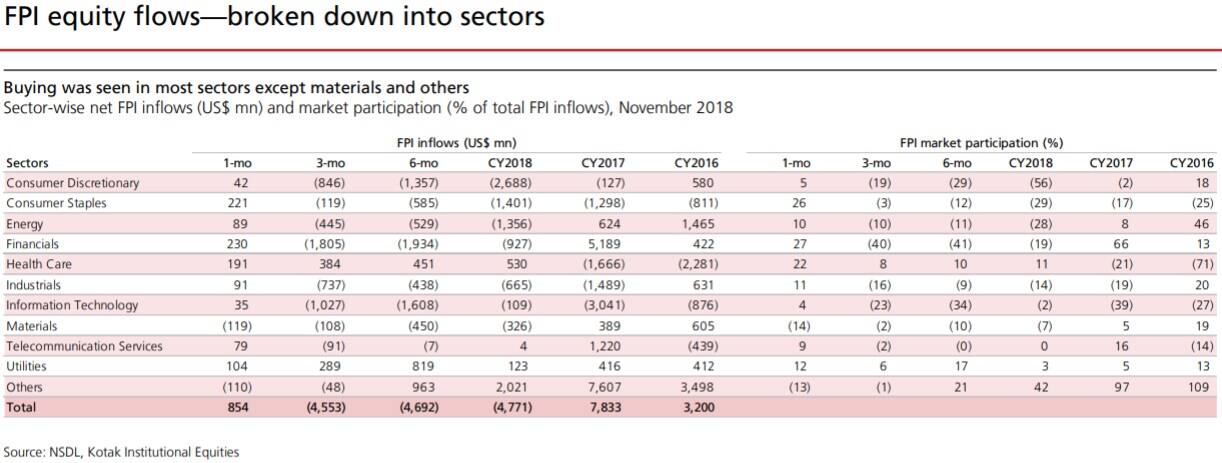

Of total FPI inflow of $854 million, the research house said major contribution was seen in financials ($230 million), consumer staples ($221 million, healthcare ($191 million) and utilities ($104 million) sectors. However, there were major outflows from materials ($119 million) and others ($110 million) segments of the country.

However, overall FPI, so far (Jan-Nov), turned net sellers to the tune of $4,771 million against net buying of $7,833 million in 2017 and $3,200 million in 2016. It included net EPFR universe India outflow of $2,967 million in 2018 against net buying of $11,387 million in 2017.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.