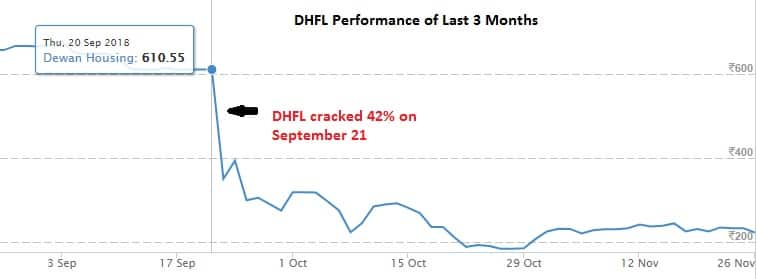

Non-banking finance company's, DHFL's, shares gained nearly 21 percent in last one month after declining more than 70 percent to 52-week low of Rs 176.05 on October 25 due to IL&FS-led liquidity crisis.

On September 21, news surfaced that DSP Mutual Fund has sold the company's AAA-rated commercial papers at a steep discount in the market to manage liquidity after IL&FS crisis. The stock closed 42 percent lower on the day.

The recovery in the stock has largely been due to attractive valuations and strong earnings reported for the quarter ended September 2018 by the company on November 21.

DHFL reported a better-than-expected 52 percent YoY healthy growth in Q2 profit despite sharp rise in provisions and liquidity crisis. Net interest margin in Q2 contracted to 3.15 percent versus 3.44 percent in Q1.

"It was bit of a surprise to see Q2 AUM at Rs 1.3 lakh crore, an increase of 38 percent YoY. On overall basis, the result gives an optimistic outlook on the earning performance," Prashanth Tapse, AVP Research, Mehta Equities told Moneycontrol.

It has been seen that DHFL has taken every step towards mitigating the issues that rose in mid-September due to the funding crunch triggered by the crisis at IL&FS.

Since then, the company has been careful towards all its repayments and fulfilling every financial obligation which sends a strong signal for investors.

Dewan Housing Finance Corporation has repaid Rs 14,000 crore of liability during September 24-November 16 period post-IL&FS triggered liquidity crisis, and was able to raise Rs 11,600 crore primarily through direct assignment route (Rs 7,400 crore) — clearly showing funding pressure.

"Going forward, DHFL would be selling down the portfolio to maintain liquidity and will particularly run down the developer segment to 5 percent from current 17 percent of the book. Hence, growth is expected to slow down significantly in near term," Deepak Kumar, Research Analyst, Narnolia Financial Advisors told Moneycontrol.

He said rising cost, change in assets mix and pricing pressure on sell down portfolio will compress the NIMs significantly, going ahead.

But due to low valuation, he has a buy rating on the stock with a target price at Rs 302 based on 0.8x P/BV FY20e.

Prashanth Tapse, AVP Research, Mehta Equities feels technically, the stock would be trading in rangebound manner. He advised traders to buy in the range of Rs 210-220 and keep strict stop loss near Rs 189 with trading target near Rs 261 for the short term.

For medium term, he remains cautious on DHFL, as the overhang of liquidity crunch would be felt for the next two quarters with a rise in borrowing costs, which have gone up by as much as 100 basis points in recent times. This puts further pressure on the company that is trying to get back the trust of investors.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.