The bullishness in the markets is boosting new dematerialised account openings at brokerages on the back of growing retail interest.

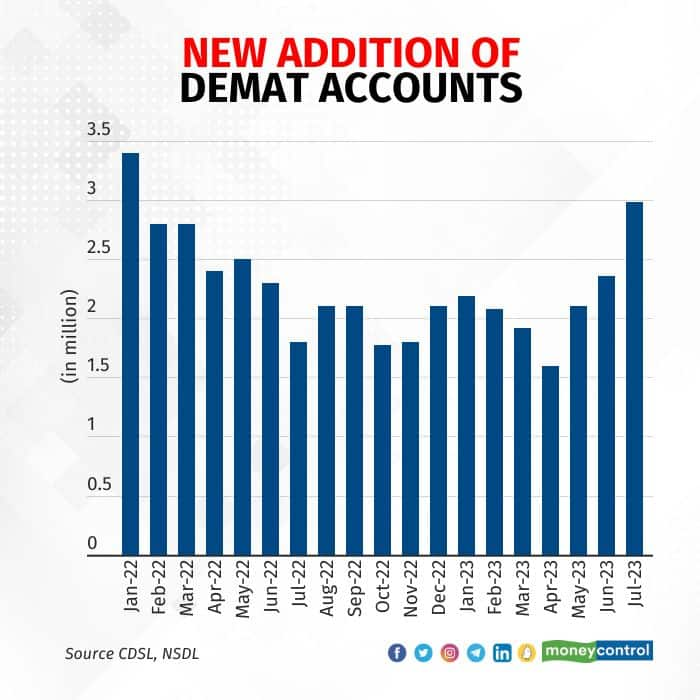

In July, around 30 lakh new demat accounts were opened with two depositories, CDSL and NSDL, which are highest since January 2022 and about 50 percent more than the previous 12-month average of 20 lakh.

The total count has also hit a fresh high of 12.35 crore.

Retail investors' interest in the equity market is influenced by market sentiments. Lately, micro-cap and small-cap indices have outperformed Nifty and Sensex, reigniting general interest in equities.

According to Arvinder Singh Nanda, Senior Vice President, Master Capital Services, the continued new demat opening was due to the booming market performance, with Sensex and Nifty reaching new heights, and the popularity of derivatives trading contributed to this fervour. The influx of funds from Foreign Institutional Investors and domestic institutional investors along with vibrant IPOs boosted the stock market's allure, enticing more investors to open demat accounts.

Strong participation

Meanwhile, since the last few sessions, markets witnessed a correction with both benchmark indices Sensex and Nifty declining for seven out of nine trading sessions. Despite this, investor participation is unlikely to go down because analysts are confident in India's multi-year economic upcycle, driven by increased infrastructure development, a new upcycle in real estate, and private sector capex, which is expected to boost corporate profits.

"We see corrections as an opportunity to accumulate quality stocks with an investment horizon of 3-5 years. The recent global sell-off seems to be triggered by a downgrade in the credit rating of the US by Fitch. We expect this to get absorbed quickly and markets are likely to stabilise over the next few weeks," said Parminder Varma, Chief Business Officer, Sharekhan by BNP Paribas.

Valuation boost

On the valuation front also, Nifty trades at around 19-19.5x one-year forward earnings which is at a slight premium to long-term average multiples but way below all-time high valuations, Varma said, adding, “Moreover, the earnings growth is expected to remain very strong for the next few years."

A few analysts expect the addition of new clients to remain healthy going ahead. This is because of the increasing awareness and acceptance of equities as a significant component of investment portfolios. Moreover, the rise in disposable income and personal savings among millennials has significantly contributed to the growing interest in the financial markets. This enduring optimism is projected to continue, highlighting India's potential as a compelling investment hub.

"As a result, we are optimistic that equities, as an asset class, will capture more than their fair share of these investible funds in the years ahead," Varma added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.