The Indian equity markets were rattled by the Middle East headwinds and the fear of outflow of FII money to cheaper Asian peers like China, dragging the benchmark indices down nearly 4.5 percent for the week ended October 4 with spike in volatility. The market was also worried due to the jump in oil prices after rise in Middle East tensions.

According to experts, the sentiment may remain negative amid likely consolidation, advising sell on rally strategy as they doubt over sustainability of rebound if happens. The focus would be on the major events like RBI monetary policy meeting, corporate earnings, geopolitical tensions, and US inflation. The counting of votes on October 8 for both the Haryana and Jammu and Kashmir assembly elections will also be watched.

The BSE Sensex plunged 3,883 points to 81,688, and the Nifty 50 declined 1,164 points to 25,015, underperforming the broader markets as the Nifty Midcap 100 and Smallcap 100 indices were down 3 percent and 2.5 percent respectively.

The selling was broad-based with the Nifty Auto, Bank, Oil & Gas and FMCG indices declining 4-6 percent, followed by Nifty Pharma (down 1.8 percent). The impact in Nifty IT was minimal (down 1 percent) as sentiment seems to have improved after easing US Fed monetary policy, while the Nifty Metal outperformed, up half a percent post stimulus measures from China.

"The market is likely to witness a consolidation phase as the expensive valuation and unfavourable macro situation may influence investors to adopt a sell-on-rally strategy," Vinod Nair, head of research at Geojit Financial Services said.

Siddhartha Khemka, head - research, wealth management at Motilal Oswal Financial Services, too, expects markets to consolidate next week amid cautiousness due to fear of increasing tensions in West Asia.

Here are 10 key factors to watch:

After the higher-than-expected cut in interest rates (50 basis points) as well as hint about more rate cuts going ahead by the US Federal Reserve, all eyes will be on the conclusion of three-day Monetary Policy Committee meeting of the Indian central bank on October 9. Most experts don't expect the Reserve Bank of India (RBI) to cut in interest rates, but its commentary with respect to the timing of beginning of rate cut cycle is the key to watch. The six-member committee will consider several factors in the meeting, including moderating economic growth, lower capex from the government, above-average monsoon, declining global food inflation, war in the Middle East region and possible further increase in oil prices.

Hence, the interest rate sensitive sectors like banks, auto, real estate will be in focus next week.

The next key event to focus on would be the September quarter earnings season starting next week with Tata Consultancy Services, Tata Elxsi, Avenue Supermarts, and Indian Renewable Energy Development Agency (IREDA). The management commentary over the macro recovery post US Fed rate cut, and demand outlook for 2025 will be key to watch in the IT companies' earnings.

Anand Rathi Wealth, Transformers and Rectifiers India, Navkar Corporation, GTPL Hathway, Lotus Chocolate, Den Networks, GM Breweries, Hathway Cable & Datacom, and Reliance Industrial Infrastructure will also release their September quarter earnings, while newly listed Western Carriers India, and Arkade Developers will announce their June quarter numbers. Hence, the stock-specific action will be seen.

Middle East Tensions & Oil Prices

Globally, the market participants will keep an eye on the situation in the Middle East as Israel continued its war against Hezbollah and Hamas, increasing its bombardment in Lebanon with fresh airstrikes attack on the suburbs of Beirut late Saturday. And media reports suggested that Israel is planning for major attacks on Gaza and Iran. Market experts are likely be worried if the Israel army starts significant attack on Iran in response to recent Iran's ballistic missiles launch on Israel.

All this caused spike in oil prices last week and India is the net oil importer, though Brent crude futures, the international oil benchmark still traded below $80 a barrel since August. Any major increase in oil prices from here on will create the risk of input cost inflation for several domestic companies from sectors like paint, tyre etc. Brent crude futures closed the week at $78.05 a barrel, up 9.1 percent during the week and the volatility in prices is likely to increase going ahead.

US Inflation & FOMC Minutes

Globally investors will closely watch the FOMC minutes, US inflation numbers and speeches by several Fed officials as all this will decide the next policy path of the US Federal Reserve. The recent US jobs data raised hopes for soft landing of the world's largest economy and seems to have reduced the chances of another 50 bps rate cut by the end of this year. The US inflation continued to fall for fifth consecutive month, dropping to 2.5 percent in August, from 2.9 percent in July.

Additionally, PPI and wholesale inventories data from the US, retail sales from Europe, household spending & PPI numbers from Japan, and vehicle sales from China will also be watched.

Further, the street will also keenly focus on the activity at the FIIs' (foreign institutional investors) desk, as they heavily sold last week, although DIIs (domestic institutional investors) managed to compensate the FII outflow to a major extent. The market participants are worried about the risk of likely shifting serious FII money from India to China which cut its Reserve Requirement Ratio by 50 bps in September to stimulate the economy. Another reason behind the FII selling is the elevated valuations in Indian equities against cheap valuations in Asian peers. China's Shanghai Composite index jumped more than 17 percent in September, while Hong Kong's Hang Seng surged 31 percent since August.

If the momentum persists in these Asian peers, then the more FIIs selling can't be ruled out going ahead, according to experts. FIIs have net sold Rs 40,500 crore worth shares in the cash segment last week, however DIIs have net bought Rs 33,074 crore worth shares.

Domestic Economic Data

On the economic data front, the foreign exchange reserves for the week ended October 4 will be released on October 11, while on the same day, the industrial and manufacturing production numbers for August will also be announced.

The primary market is going to be slightly quiet in the next week as there will be only one IPO launch each in the mainboard and SME segments, may be impacted by the significant correction of the last week in the secondary market. Garuda Construction and Engineering will be opening Rs 264-crore IPO on October 8, while from the SME segment, Shiv Texchem will also be launching its Rs 101-crore initial public offering on the same day.

Apart from this, most of activity will be seen in the SME segment with Khyati Global Ventures closing its IPO on October 8, while the trading in HVAX Technologies, Saj Hotels, Subam Papers, Paramount Dye Tec, NeoPolitan Pizza and Foods, and Khyati Global Ventures shares will commence next week.

Technical View

Technically, the market structure is looking weak with the Nifty 50 index forming long bearish candlestick pattern, recording lower high-lower low formation, falling below 5-and-10-week EMA (Exponential Moving Average) with negative bias in the momentum indicator RSI (Relative Strength Index) on the weekly timeframe. Considering heavy selling last week, the bounce back in initial part of the next week can't be ruled out but the sustainability of that bounce is the key to watch. As long as the index holds 25,000 on closing basis, the rebound towards 25,300-25,500 is likely next week, but the decisive fall below it may drive the index down to 24,750 (the September low) followed by 24,500 (20-week EMA) being crucial support, according to experts.

F&O Cues, India VIX

The weekly options data indicated that the Nifty may face hurdle at 25,400-25,500 on the higher side, however on the lower side, the immediate support lies at 25,000, followed by 24,800 and 24,500.

On the Call side, the maximum open interest was seen at the 26,000 strike, followed by the 25,500 and 25,400 strikes, with maximum writing at the 26,000 strike, and then the 25,400 and 25,200 strikes. On the Put front, the 24,000 strike holds the maximum open interest, followed by the 24,500 and 25,000 strikes, with maximum writing at the 24,000 strike, and then the 24,800 and 24,200 strikes.

The volatility spiked significantly in the week gone by, making the bulls cautious. The India VIX, the fear indicator, jumped by 18.1 percent during the week to 14.13, from 11.96 levels. If the index sustains above 14 mark, then the bulls need to be more cautious.

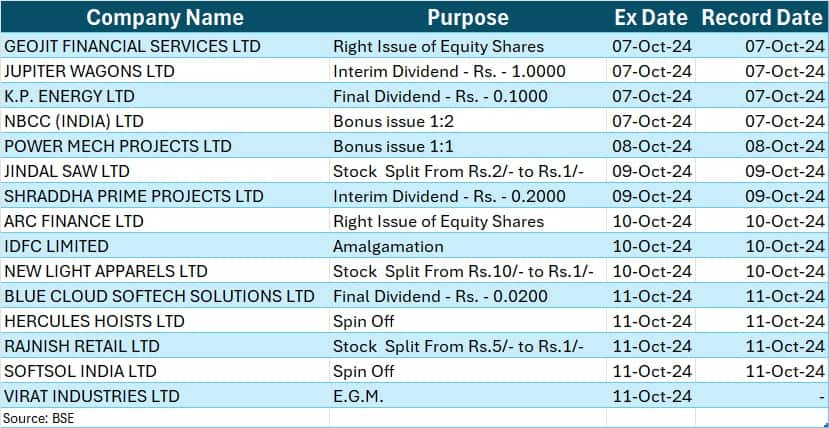

Corporate Action

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.