In the week ended May 3, the market maintained its upward journey yet broadly remained rangebound, with support from March quarter earnings, subdued oil prices, and healthy monthly auto sales numbers. However, caution about elevated inflation (the US Fed maintained benchmark interest rates at 5.25-5.5 percent), rising volatility, and FII selling capped the market upside.

The market is expected to consolidate further with a positive bias in the coming week starting from May 6, with a focus on corporate earnings, the third phase of the Lok Sabha (LS) elections, UK's first quarter GDP numbers, and Bank of England's (BoE) policy meeting, experts said.

On Monday, market participants will first react to lower-than-expected non-farm payrolls data and rising unemployment in the US (which raised hopes of at least two rate cuts by the Fed in 2024), as well as quarterly earnings from Kotak Mahindra Bank.

The Nifty 50 rose 56 points during the past week to 22,476, and the BSE Sensex gained 148 points, at 73,878, while the broader markets were mixed, with the Nifty Midcap 100 index rising 0.6 percent and the Smallcap 100 index down 0.3 percent.

Moving forward, "The ongoing results season will be a key detrimental factor for investors, who may need to align their portfolios. The market will also remain vigilant about the BoE policy and GDP data from the UK," said Vinod Nair, Head of Research at Geojit Financial Services.

He expects a degree of consolidation in the market due to expensive valuations and election-led jitters.

Siddhartha Khemka, Head, Retail Research, Motilal Oswal Financial Services, also expects the market to consolidate in a broader range and the base to gradually shift higher.

Here are 10 key things to watch next week:

Market participants will continue focussing on the March quarter earnings season, which will enter its fifth week now, and has been broadly in-line with analysts' expectations. More than 300 companies will release their quarterly earnings, including key names like Dr Reddy's Laboratories, Hero MotoCorp, Larsen & Toubro, Asian Paints, State Bank of India, Cipla, Eicher Motors, and Tata Motors.

Other important non-Nifty50 companies such as Lupin, Bharat Petroleum Corporation, Hindustan Petroleum Corporation, Union Bank of India, Punjab National Bank, Bank of Baroda, Bank of India, Indian Bank, Canara Bank, ABB India, Tata Power, TVS Motor, Escorts Kubota, Marico, PB Fintech, Godrej Consumer Products, JSW Energy, Voltas, Bharat Forge, and Alembic Pharmaceuticals will also announce their earnings next week.

Lok Sabha elections

The street will also keenly watch the third phase of voting in the elections next week, on May 7, following a lower voter turnout in phase 1 and 2, at 66.14 and 66.71 percent, respectively, against 69.53 and 69.50 percent in the 2019 elections.

In the third phase, voting will take place in 96 LS constituencies from 12 states, including Gujarat, Karnataka, Madhya Pradesh, Maharashtra, Uttar Pradesh, and West Bengal.

Global economic data

Globally, investors will keep an eye on the BoE's policy decision scheduled on May 9, and preliminary estimates of the Q1'24 UK GDP numbers on the same date.

Weak growth and cooling inflation in the UK set a favourable ground for a policy shift; however, its MPC (Monetary Policy Committee) officials remain split on the timing of the first rate cut in four years, experts said. UK's consumer price inflation came in at 3.2 percent for March and experts expect it to fall further in April, while the economy entered a technical recession with the GDP coming in at -0.3 percent in the last quarter (October-December 2023), against 0.1 percent contraction reported in the previous quarter (Q3 2023).

Apart from this, focus will also be on the weekly jobs data from the US; services PMI numbers for April from Europe, Japan, and China; and inflation and PPI data for April from China.

Further, the speeches by FOMC (Federal Open Market Committee) officials will also be watched for cues with respect to the Fed's interest rate decision.

Domestic economic data

On the domestic front, market participants will focus on the HSBC Services PMI (final) numbers for April, due on May 6. In March, services PMI stood at 61.2, up from 60.6 in the previous month, and experts expect it to improve further in April.

Further, foreign exchange reserves for the week ended May 3, and industrial production numbers for March, will also be released next week, on May 10. Industrial output in February accelerated to 5.7 percent, from 3.8 percent in January this year.

While the inflow from domestic institutional investors (DIIs) remains strong, action at the desks of foreign institutional investors (FIIs) will also be closely watched by the Street.

In the week gone by, FIIs sold stocks worth Rs 2,115 crore in the cash segment, while DIIs bought equities worth Rs 4,164 crore. Thus, DII inflows in the equity market remained much higher than FIIs outflows for yet another week. In the previous week, FIIs sold stocks worth Rs 14,704 crore, and DIIs bought shares worth Rs 20,796 crore.

"More than anything else, FIIs will respond to changes in the US bond yields. If US bond yields fall and the Indian economy and markets do well, they will turn aggressive buyers," said V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

The US 10-year treasury yield fell from 4.67 percent to 4.52 percent on a week-on-week (WoW) basis, while the US dollar index declined from 105.94 to 105.08 WoW.

Technical view

Technically, the market seems to be in consolidation mode with the hurdle for Nifty 50 at 22,800 on the higher side, and immediate support at 22,300 in the coming week. The index has formed a Bearish Engulfing candlestick pattern on the daily charts, which is a bearish reversal pattern, and there was a Doji kind of pattern formation on the weekly timeframe, indicating indecision. According to experts, if the index decisively takes out 22,800 on the higher side, then 22,950-23,000 are the levels to watch, which coincides with the upper range of the rising channel.

"The Nifty 50 has demonstrated resilience around the 22,300 level, suggesting a potential upward trajectory towards 22,700-22,800 levels following the ongoing consolidation phase, provided the index maintains closure above this level. However, a breach below 22,300 could lead to downward movement towards the 22,000 level," said Arvinder Singh Nanda, Senior Vice President, Master Capital Services.

F&O cues

Weekly options data indicated that 22,700-22,800 is expected to be the resistance for Nifty 50, with support at the 22,000 level. It means the 22,000 mark is going to be crucial to watch for further downside.

On the Call side, there was maximum open interest at 22,800 strike, followed by 23,000 and 22,700 strikes, with maximum writing at 22,800 strike, then 22,500 and 23,000 strike. On the Put side, 22,000 strike saw the maximum open interest, followed by 21,800 and 22,500 strikes, with maximum writing at 22,000 strike, then 21,900 and 22,100 strikes.

India VIX

Volatility increased significantly in the past week for the seventh consecutive session, after falling nearly 20 percent on April 23, which put the bulls in an uncomfortable position. Going forward, 16.5 is the crucial level to watch, where it has faced resistance multiple times in January and February this month.

India VIX, the fear gauge, jumped 33.8 percent during the week to 14.62, the highest closing level since the beginning of March.

IPOs

Primary market activity will be strong next week with nine IPOs hitting Dalal Street, including three from the mainboard segment. Indegene will open its Rs 1,842-crore initial share sale on May 6 and close on May 8, while TBO Tek's Rs 1,551-crore IPO, and Aadhar Housing Finance's Rs 3,000-crore public issue will open May 8 and close on May 10.

In the SME segment, the IPOs of Winsol Engineers and Refractory Shapes will open for subscription on May 6, while Finelistings Technologies and Silkflex Polymers (India) will launch their initial public offerings on May 7. Further, the TGIF Agribusiness IPO will hit the street on May 8, and the Energy-Mission Machineries public issue will open on May 9.

Storage Technologies and Automation, Sai Swami Metals & Alloys, and Amkay Products will debut on the BSE SME platform on May 8, while trading in Slone Infosystems shares will commence on the NSE Emerge platform from May 10.

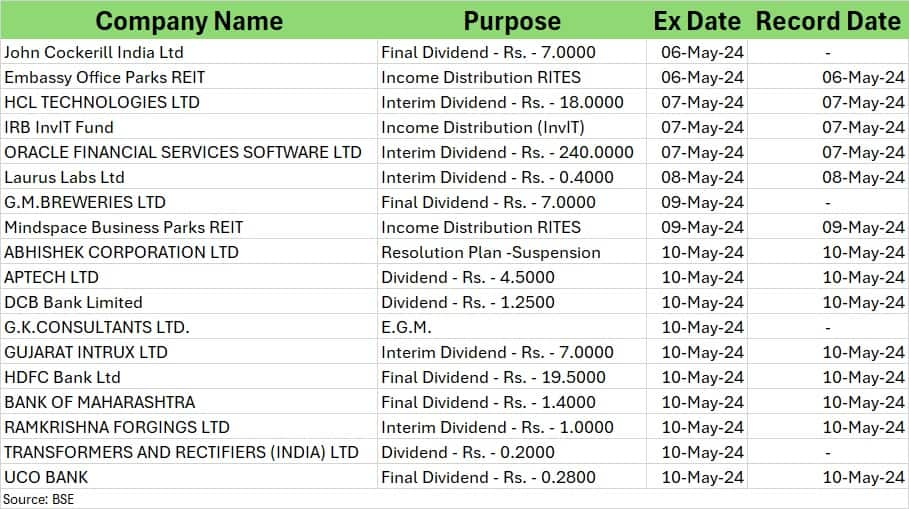

Corporate action

Here are the key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.