Bears continued to dominate the headlines, with the benchmark indices recording the biggest weekly loss of the current year as well as reporting the fifth consecutive month of decline. In fact, this was the longest monthly losing streak of the current century, given the escalation in trade tariff concerns, fear of weakening US business environment signalled by Q4-2024 GDP numbers. Rupee depreciation, and FII outflow also dampened sentiment.

In the coming week, on Monday, the market is expected to react to the improved Q3FY25 GDP growth numbers and monthly auto sales data, however, overall, the conditions are likely to remain favourable for bears with focus more on global cues (including US jobs data, manufacturing & services PMI numbers, ECB interest rate decision, China's two sessions, and Fed Chair Powell speech) due to lack of domestic cues.

The Nifty 50 plunged 671 points (2.94%) to 22,125, and the BSE Sensex plummeted 2,113 points (2.81%) to 73,198, while the selling pressure was more in broader markets, with the Nifty Midcap 100 index tanked 5.09% and Smallcap 250 index dropped 5.71%.

Every sector contributed to the fall, though the pressure was much less in Banking & Financial Services compared to others.

Siddhartha Khemka, Head - Research, Wealth Management at Motilal Oswal Financial Services expects the market to continue to trade with weakness due to weak global sentiments and lack of domestic triggers.

In the near term, Vinod Nair, Head of Research, Geojit Financial Services is also of the week that market conditions are expected to remain weak, with a gradual recovery anticipated as earnings improve from Q1 FY26 and global trade policy uncertainties subside.

Investors will be closely watching key upcoming events, including the tariff policy, and jobless claims, he said.

Here are 10 key factors to watch next week:

Tariffs Policies

Globally all eyes will remain on further developments related to tariff policies from the Trump administration as it has been one of the major reasons for correction in the Indian equities in the past months. Also, experts see its impact on global growth and some increase in inflation.

In the passing week, US President Donald Trump said 25% tariffs on goods from the Canada and Mexico will come into effect as per the schedule of March 4. Further, he announced additional 10% duty on goods from China effective from the same date, and threatened to impose 25% tariffs on goods (including cars) from the European Union, increasing fears of global trade war.

US Jobs Data, Fed Chair Powell Speech

The markets will also focus on the US jobs report (including unemployment rate, non-farm payrolls and Challenger job cuts data for February), which is one of the important factors for deciding the interest rate cut by the US Federal Reserve. The recent disappointing economic data already increased expectations for a rate cut in June.

The speeches by Federal Reserve Chair Jerome Powell and other Fed officials scheduled next week will also be eyed for indication about further rate cuts and commentary on the growth and jobs numbers.

The US dollar index snapped three-week fall, rising 0.87% to 107.564, while the US 10-year Treasury yields remained below 4.5 percent, falling significantly by 5.15 percent to 4.203%, continuing downtrend for seventh consecutive week.

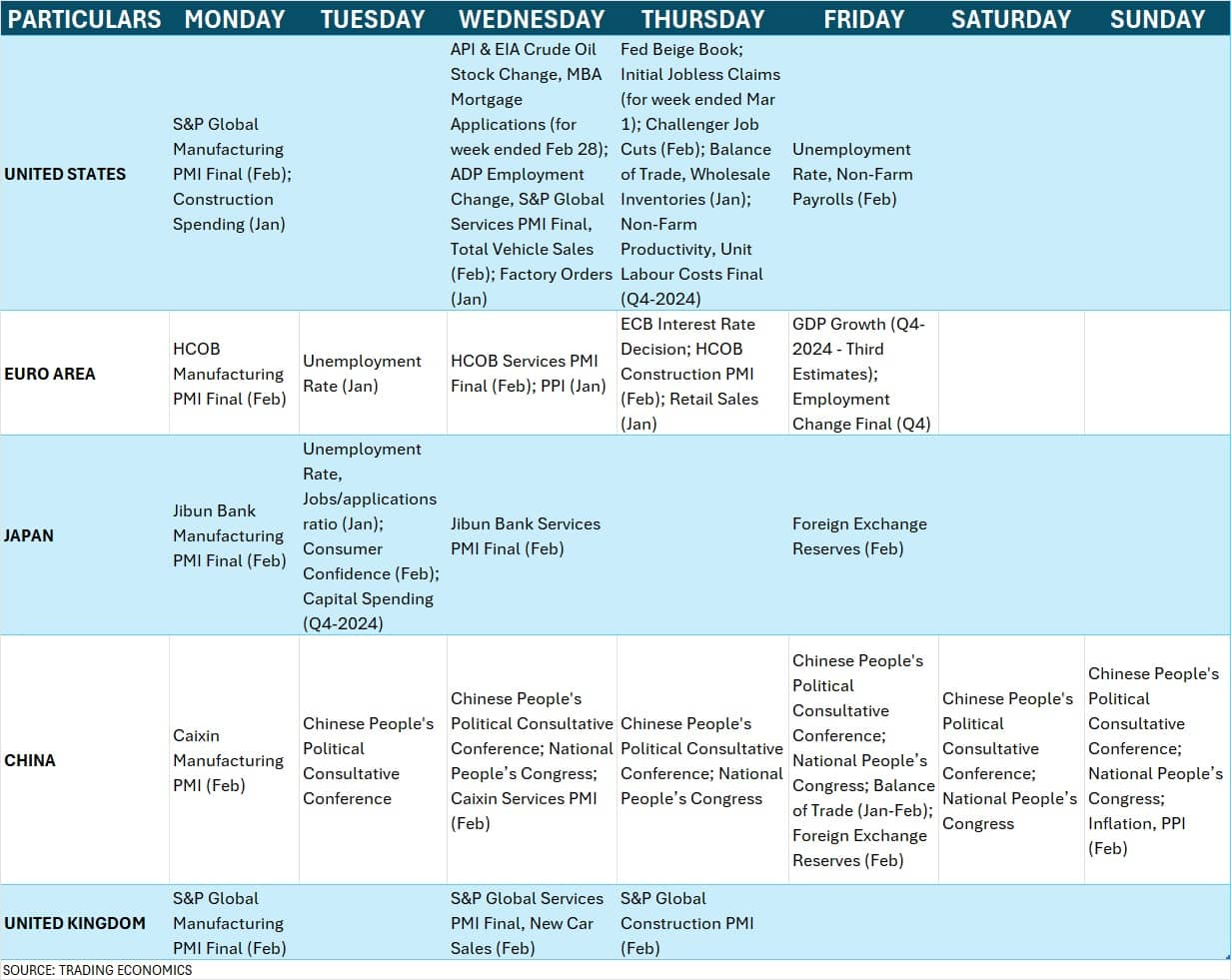

Manufacturing & Services PMI, ECB interest rate decision

Further, globally the focus will also be on the Services and Manufacturing PMI final numbers for February by several key nations including US, China, Japan and UK.

Apart from that, the market participants will take cues from third estimates for December 2024 quarter GDP growth by Euro zone. As per the preliminary estimates, the GDP growth was at 0.9% in Q4-2024, unchanged compared to same period last year.

Further, European Central Bank's monetary policy decision scheduled on March 6 will also be eyed. Most economists expect the central bank to cut interest rate further to focus on growth, as they concerned about the Euro zone economic growth after Trump signalled 25% tariffs.

China's Two Sessions Meeting, Inflation

The market participants will also keep an eye on the announcements by the China's foreign minister and heads of economic departments, after the end of country's annual parliamentary gathering which is known as 'two sessions'. Chinese People's Political Consultative Conference (the top advisory body) will start from March 4, and the gathering of National People’s Congress (legislature) will kick off from March 5. Both these sessions will end on March 9.

The two sessions are expected to focus more on the regaining economic growth when the country confronted with US trade tensions. Fixing the year's GDP growth target, downward revision in annual consumer price inflation target, and increasing quota for special sovereign bond sales and special local government bond issuance are expected to be some of the important things on the agenda of these two sessions, according to media reports.

Apart from that, the country will release its inflation and PPI numbers for February due on March 9.

Oil Prices

The focus will also be on the oil prices as Brent crude futures, the international oil benchmark, corrected sharply after the rangebound trading in the previous three weeks, falling 2.18% during the week (ended February 28) to finish at $72.81 a barrel and declining 3.78 percent in February after two-month gains. It remained below all key moving averages on the weekly as well as monthly charts, signalling weakness which is favourable for oil importing nations like India.

The oil markets are concerned about the demand due to Trump's tariff threats and fears of a supply surge from the potential resumption of oil exports from the Kurdistan region. Further developments over the Ukraine-Russia peace talks will also be watched, especially after a meeting between Trump and Ukraine’s President Zelensky ended abruptly last week.

Further, "oil market participants are particularly eager to see if OPEC+ members reach a consensus before the March 5-7 deadline for setting April's production targets," said Kaynat Chainwala of Kotak Securities.

Domestic Economic Data

Back home, the HSBC Manufacturing PMI and Services PMI numbers for February scheduled on March 3 and 5, respectively, along with foreign exchange reserves for week ended February 28 will be closely watched. As per the preliminary estimates, the manufacturing PMI dropped to 57.1 in February, from 57.7 in January, whereas services PMI jumped to 61.1, increasing from 56.5 during the same period.

The market participants will also check the mood at FIIs desk as foreign institutional investors remained on the selling side and shifting their money to countries where valuations are lower like China. FIIs have net sold more than Rs 22,000 crore worth shares last week in the cash segment, however, domestic institutional investors fully compensated the FII outflow not only last week but also February. DIIs have net bought Rs 22,252 crore worth shares during the week, taking the total inflow to Rs 64,853 crore in February, whereas FIIs net sold Rs 58,988 crore during the month. According to experts, the revival in earnings growth and further uptick in GDP numbers can bring the FIIs back to India.

The effects of bloodbath in the secondary market are also be seen in the primary market as the mainboard segment will remain quiet with no new IPO launch for the second consecutive week starting from March 3, though there is some action in the SME segment.

NAPS Global India will be opening its Rs 11.88-crore IPO on March 4, and Balaji Phosphates will close its public issue on the same date. On the listing front, Beezaasan Explotech, Nukleus Office Solutions, Shreenath Paper Products, and Balaji Phosphates will make their debuts next week.

Technical View, F&O Cues, India VIX

Technically, the market is looking weak now with the formation of long bearish candlestick pattern on the weekly charts following Doji formation in the previous week. The index might rebound initially toward 22,300-22,500 zone after the significant fall and oversold conditions, but the same is unlikely to sustain considering the sell on rally market. The index is near the crucial support of 22,000 (which coincides with 100-week EMA), followed by 21,800 where the experts feel the market may get stabilised as failure of that can open doors for 21,281 (the Lok Sabha election results low).

According to the weekly options data, the Nifty 50 is expected to be in the range of 21,800-22,500 in the short term. On the Call side, the maximum open interest was seen at the 22,500 strike, followed by the 23,000 and 22,300 strikes, with the maximum writing at the 22,500 strike, followed by the 22,300 and 23,000 strikes. On the Put side, the 21,800 strike holds the maximum open interest, followed by the 21,500 and 22,000 strikes, with the maximum writing at the 21,800 strike, and then the 21,300 and 21,500 strikes.

Meanwhile, the India VIX, the fear index, dropped below all key moving averages, falling by 4.27% during the week to finish at 13.91, which is favourable for bulls.

Corporate Action

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.