We have seen bulls roaring at Dalal Street as the benchmark indices hit historic highs in the week ended June 30, with buying across sectors. The strong progress of the southwest monsoon, positive global data (including US Q1CY23 GDP and surprise fall in jobless claims), and narrowing current account deficit in Q4FY23 along with healthy FII inflows and HDFC-HDFC Bank merger update boosted investors' sentiment during the week.

The benchmark indices ended at a record closing high. The BSE rallied 1,739 points or 2.8 percent to 64,719, and the Nifty50 jumped 524 points or 2.8 percent to 19,189 during the week, taking monthly gains to around 3.5 percent.

The Nifty Midcap 100 and Smallcap 100 indices gained 2.7 percent and 2 percent in a week, taking June month rally to 6 percent and 6.6 percent respectively.

The market this week will first react to June auto sales numbers announced over the weekend and further updates related to the HDFC-HDFC Bank merger effective from July 1. Overall, the markets may remain buoyant in this week too, but small correction or consolidation given a healthy run can't be ruled out intermittently, with the focus gradually shifting to June FY24 quarter earnings expectations, experts said. Corporate earnings season will start in the second week of July.

"We expect the uptrend in Indian equities to continue in the near term. This week, the market will take cues from economic data to be released locally as well as globally," Siddhartha Khemka, Head - Retail Research at Motilal Oswal Financial Services said.

He further said investors would also watch out for FOMC minutes to get insights into the US Central Bank’s future course of direction.

Here 10 key factors to watch out for this week:

1) FOMC Minutes

FOMC minutes for the June policy meeting along with unemployment rate and non-farm payroll data for June month will be keenly watched by global investors this week.

Federal Reserve kept the fed funds rate unchanged at 5.00-5.25 percent in June, after consistent rate hikes since March 2022, but the policymakers say the inflation fight is not done. Fed Chair Jerome Powell several times signalled the possibility of two more rate hikes in the year ahead, to bring inflation at a 2 percent target.

"Looking ahead, nearly all Committee participants view it as likely that some further rate increases will be appropriate this year to bring inflation down to 2 percent over time," Powell said in a press conference after the policy decision in June.

Also read: How HDFC and HDFC bank multiplied the wealth of MF investors

The unemployment rate in May 2023 increased to 3.7 percent in May, the highest level since October last year, but labour market remained tight.

"The unemployment rate moved up but remained low in May. There are some signs that supply and demand in the labour market are coming into better balance," Powell said, adding FOMC participants expect supply and demand conditions in the labor market to come into better balance over time, easing upward pressures on inflation.

2) Domestic Economic Data Points

We will have S&P Global Manufacturing PMI numbers for June on July 3, while S&P Global Services PMI & Composite PMI data for June will be released on July 5.

In May, we have seen continued expansion in India's manufacturing sector activity, with the S&P Global Purchasing Managers' Index (PMI) climbing to a 31-month high of 58.7, up from 57.2 in April, while services activity was also robust, though the S&P Global Purchasing Managers' Index dropped to 61.2 from 62.0 in April. A reading above 50 indicates expansion in activity, while a sub-50 print is a sign of contraction.

Also read: Aim to double every four years: HDFC Bank MD Sashidhar Jagdishan after merger

Foreign exchange reserves for the week ended June 30 will be released on July 7.

3) FII Flow

Sustained FII inflow backed by improving economic numbers is one of the major drivers for the record highs in the equity markets. Fed rate hike cycle possibly at a peak and likely rate cut in 2024 beginning quarter is also one of the reasons for flowing money into emerging markets including India, experts said.

We have more than Rs 27,000 crore worth of buying by FIIs in May as well as June, and the buying continued for the fourth straight month in Indian equities. Domestic institutional investors also provided support in June with over Rs 4,400 crore worth of inflow against Rs 3,300 crore of selling in May, as per Moneycontrol data.

4) Oil Prices

The stable oil prices broadly remained in a range of $70-80 a barrel since May and continued to provide great support to the Indian equity markets, earnings, and economic numbers. We are the net importer in the case of oil. Technically, the price remained below 200-day EMA (exponential moving average of $82.55) since November 2022 and faced strong resistance at the 50-day EMA ($76.28) in June, which are crucial levels to watch.

International benchmark Brent crude futures closed higher on daily (up 1.2 percent), weekly (up 1.9 percent), as well as monthly (up 3.9 percent) basis, but fell for the fourth consecutive quarter (down 5.6 percent). It settled at $75.41 a barrel on Friday, supported by a substantial fall in US inventories and positive US Q1CY23 GDP numbers. But overall, it still deals with supply tightness concerns and rate hike fears with slower recovery in China.

Experts feel the prices are expected to remain rangebound in the near future. Now all eyes will be on the OPEC (Organization of the Petroleum Exporting Countries) meeting scheduled on July 5-6 in Austria.

Crude prices are also supported by Saudi Arabia's production cuts of 1 million barrels per day from July, and the rest of the OPEC producers extending earlier cuts through the end of 2024, in line with the broader OPEC+ agreement to limit supply until 2024, experts said.

5) IPO

We will continue to see action in the primary market this week too, as two IPOs - one each in the mainboard and SME segments - will be opening for subscription this week.

The Rs 405-crore IPO by Kolkata-based jewellery retailer Senco Gold will open on July 4, with a price band of Rs 301-317 per share and the closing date will be July 6, while in the SME segment, Alphalogic Industries, a subsidiary of BSE listed software development company Alphalogic Techsys, will launch Rs 12.88-crore IPO on July 3 and the bidding will remain open till July 6, with an issue price of Rs 96 per share.

In addition, Mumbai-based construction and development company PKH Ventures will close its Rs 379-crore public issue on July 4, while the Rs 13-crore IPO by PET stretch blow moulding machines manufacturer Global Pet Industries in the SME segment will close on June 3. IT solutions companies Synoptics Technologies and Tridhya Tech will also be closing their public issues on July 5.

Meanwhile, frozen buffalo meat exporter HMA Agro Industries will debut on the BSE & NSE on July 4, while in the SME segment, we will have the listing of Veefin Solutions on July 5, and Essen Speciality Films, Greenchef Appliances, and Magson Retail and Distribution on July 6.

6) Technical View

The Nifty50 has formed a bullish candlestick pattern on the daily as well as weekly charts, making higher tops for the 14th consecutive week, while on the monthly timeframe, it seems to have formed a Three White Soldiers kind of pattern formation after Doji formation in March.

Also read: Financial sector to see moderation in earnings, JM Financial's Vinay Jaising

The index has seen a breakout of upward sloping resistance trendline adjoining the previous two record highs (October 2021 and December 2022), with momentum indicator RSI (relative strength index) giving a bullish crossover on daily, weekly, and monthly timeframes, which is a positive sign. Hence, 19,500 on the higher side and 19,000-18,800 on the lower side are expected to be key levels to watch.

"We recommend maintaining the “buy on dips” approach as we are eyeing the 19,350-19,500 zone in Nifty. In case of any dip, the 18,700-18,900 zone would provide the needed cushion. With the surge in banking and recovery in IT, all the key sectors are now in sync," Ajit Mishra, SVP - of Technical Research at Religare Broking said.

7) F&O Cues

The weekly Options data indicated that the immediate trading range for the Nifty50 could be 19,000 to 19,400 levels, while 18,800-19,500 can be the broader range.

We have seen the maximum Call open interest at 19,500 strike, indicating the Nifty may be having another 300 points rally in the coming future, followed by 19,200 and 19,400 strikes, with meaningful Call writing at 19,400, then 19,200 & 19,300 strikes.

On the Put side, the maximum open interest was at 19,000 strike, which can be immediate support for the Nifty50, followed by 19,100 & 18,900 strikes, with Put writing at 19,100 strike, then 19,000 & 19,200 strikes.

"Heavy Put writing was observed at 19,000 Strike, which was immediate support for Nifty. The support has become even stronger after Friday’s closing," Ashwin Ramani, Derivatives & Technical Analyst at SAMCO Securities said, adding the Nifty can face a hurdle of around 19,200 on the back of more Call writing compared to Put writing.

8) India VIX

The volatility dropped to near-historic lows, giving more comfort to bulls at record-high levels and bringing more stability to the market. The range of the fear index India VIX narrowed in June and fairly remained below the 12 mark on a closing basis for the sixth consecutive week. It settled on Friday at 10.8, the lowest level since December 2019, down 3.87 percent for the week.

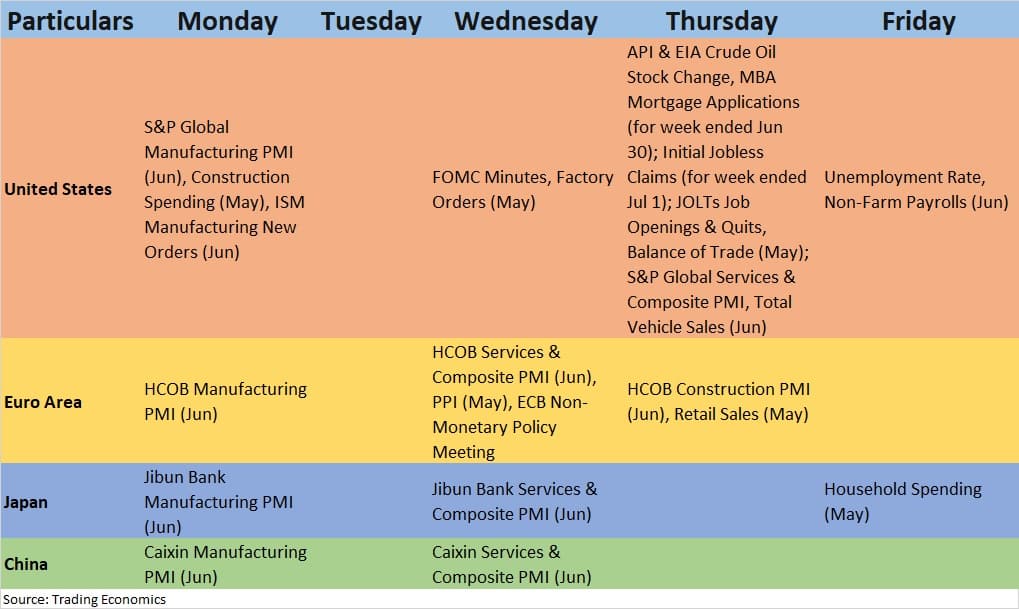

9) Global Economic Data Points

Here are key global economic data points to watch out for:

10) Corporate Action

Several companies will turn ex-dividend this week including Axis Bank, ACC, Ambuja Cement, Adani Enterprises, Ashok Leyland, Bharat Forge, Biocon, Happiest Minds Technologies, Mphasis, IDBI Bank, Kalpataru Projects International, L&T Technology Services, and Navin Fluorine International.

Here are key corporate actions taking place this week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!