The merger of India's largest private sector bank HDFC Bank, and the home loan major, Housing Development Finance Corporation, has created a behemoth in the Indian banking industry, second only to the State Bank of India in terms of assets. As per the Moneycontrol research, the loan book or advances of the merged entity is expected to increase by 38.77 percent to Rs 22.21 lakh crore.

HDFC and HDFC Bank have been part of the top 10 holdings of many equity-oriented mutual fund schemes which helped multiply unitholders’ wealth over the years. Believing in the long-term growth story of these companies, many fund managers continued holding these stocks in their portfolios, irrespective of the market gyrations. As per the latest data, the overall mutual fund industry has held about Rs 1,17,456 crore of the investment in HDFC Bank while Rs 61,805 crore in HDFC Ltd.

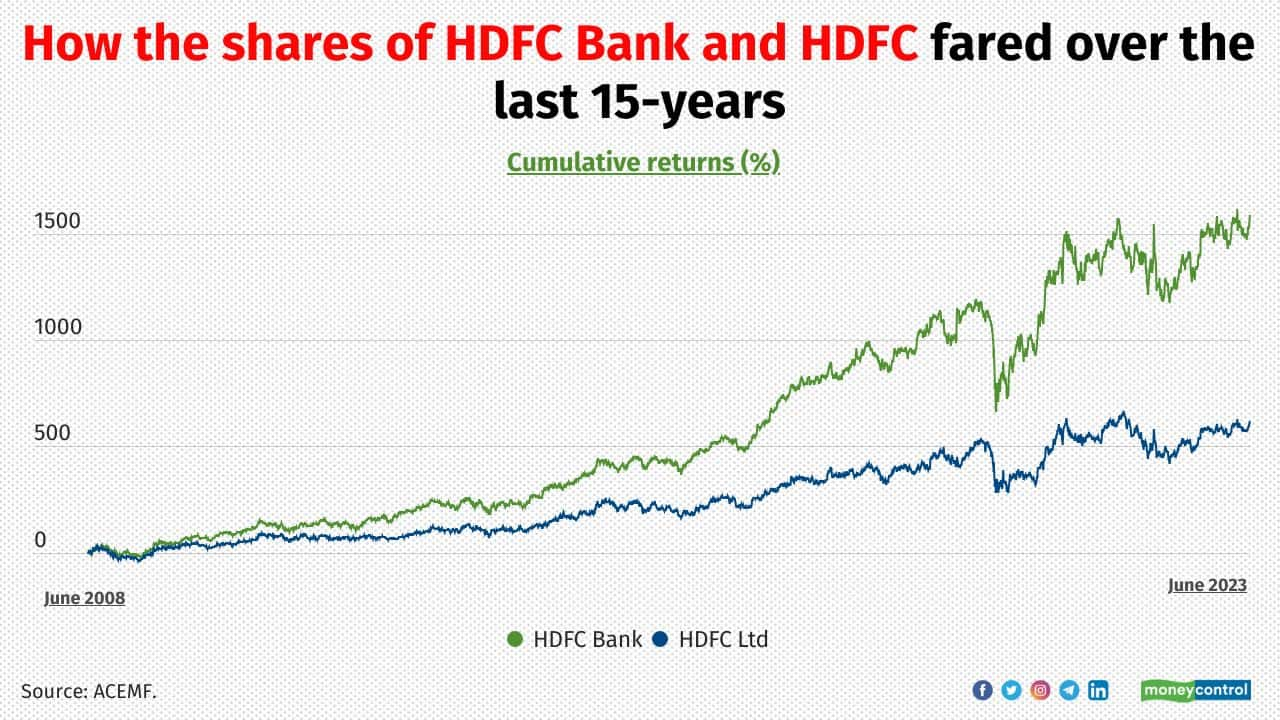

Largecap multibaggersBoth HDFC bank and HDFC multiplied the investors’ money. As of June 30, 2023, HDFC Bank and HDFC shares rewarded the investors with returns of 1,589 percent and 618 percent respectively over the last 15 years.

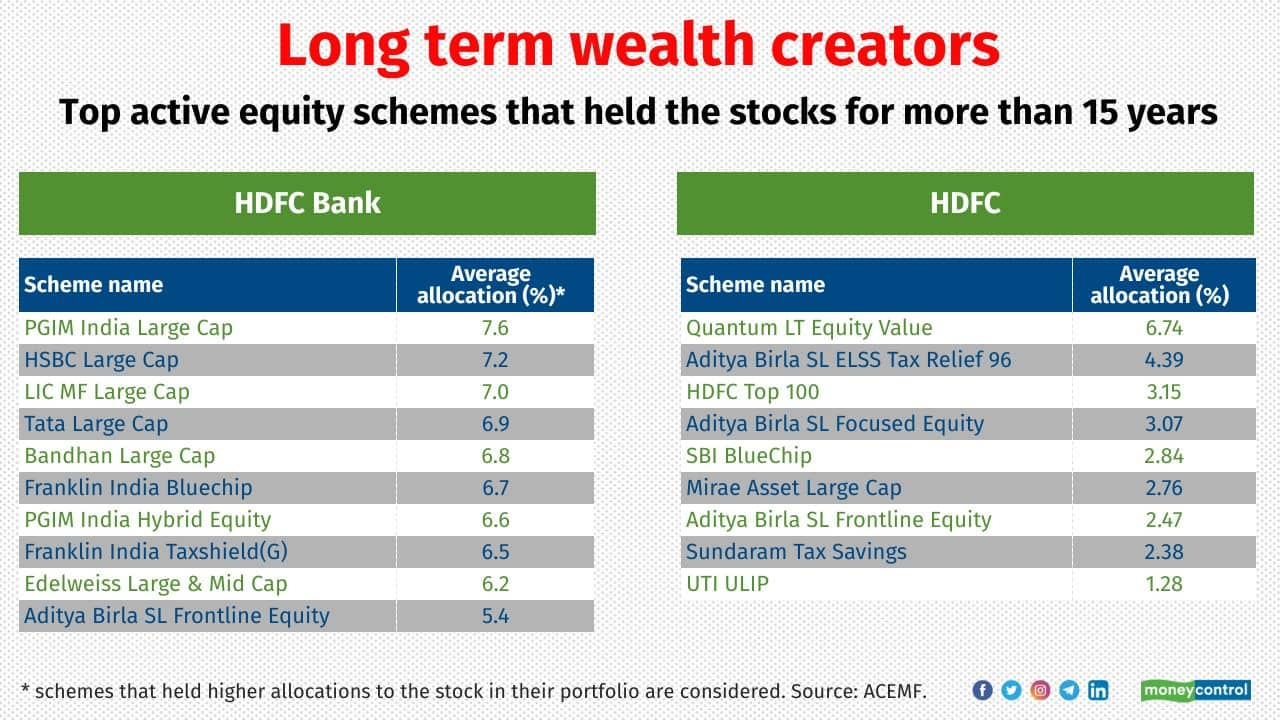

Both HDFC Bank and HDFC were the most favourite stocks of many actively managed schemes over period. Data compiled from ACEMF shows that there were 22 actively managed schemes (except sector funds) held the stock of HDFC bank in their portfolio for more than 15 years. Meanwhile, as much as nine active schemes held the stocks of HDFC in their portfolio for the 15 years.

Also read: Smallcap mutual funds outshine: here’s the top schemes that surge up to 12 times in 10 years

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.