The market had a fantastic week ended on April 1, registering more than 3 percent gains with easing volatility, falling oil prices, buying by FIIs, pick up in industrial activities and a bit of positive newsflow on the Ukraine-Russia crisis.

The BSE Sensex climbed 1,914 points to 59,277, and the Nifty50 jumped 517 points to 17,670, while the Nifty Midcap and Smallcap indices also traded in line with benchmarks, rising 3 percent each.

All key sectors, barring metal and pharma, participated in run up, with Auto, Bank, Financial Services, FMCG and Infra being the prominent gainers.

The market is expected to stay with positive bias and a bit of consolidation if there is no negative news on Ukraine-Russia front, experts feel. All eyes are on the Monetary Policy Committee meeting outcome, FOMC minutes, March quarter earnings expectations, and provisional numbers getting released by select banks and few other companies, oil price movement, and Covid concerns in China.

"Markets are moving largely in sync with their global counterparts and positive developments on the Russia-Ukraine front could further fuel the rebound," says Ajit Mishra, VP Research at Religare Broking.

Besides, "we expect stock-specific moves on earnings expectations. Almost all the sectors are contributing to the rebound now, however the contribution of the banking pack is critical for Nifty to test the 17,800-18,100 zone ahead," says Mishra who advised that participants should align their positions accordingly and avoid contrarian trades.

Here are 10 key factors that will keep traders busy next week:

RBI Monetary Policy

The Monetary Policy Committee will begin their three-day meeting on April 6 and conclude on April 8. Experts largely feel the rate hike is very much unlikely, though most of central banks globally hiked interest rates, as the key priority is to boost domestic demand and bring economy on proper growth track, but the commentary will be keenly watched by the street given the change in macro situation with inflation concerns caused by Ukraine-Russia war, and more rate hikes planned by Federal Reserve ahead.

Also read - Top healthcare investors Orbimed, CDC Group look to exit Asian Institute of Medical Sciences

"Unlike its peers abroad, RBI has thus far prioritised growth over inflation. The shifting macro-dynamics caused by the war, the FED's planned rate hikes, and the need to foster domestic demand and support the government's increased borrowing indicated in the budget have placed the RBI in a tricky situation and all eyes will be on how the RBI decides to approach these," says Yesha Shah, Head of Equity Research at Samco Securities.

The easing of geopolitical crisis brought a great relief for the markets especially after positive developments in peace talks held between Ukraine and Russia resulting into regaining control of the capital city of Kyiv by Ukraine after pulling out troops by Russia from north, but as per CNBC reports, the UK Ministry of Defence said Russian air activity has increased over southeastern Ukraine in the past week as invading forces shift their efforts to that part of the country.

Reports indicated that the peace talks between Ukraine and Russia in Turkey seem to be showing some progress.

Click Here To Know Latest Updates on Ukraine-Russia War

Ukrainian negotiator David Arakhamia said draft peace treaty documents have advanced far enough to allow for direct talks between Ukrainian President Volodymyr Zelenskyy and Russian leader Vladimir Putin, and the talks would likely take place in Turkey. (CNBC reported).

Experts already indicated that the worst related to the Ukraine crisis is already discounted by the market and if there is a complete resolution from both countries then there could further boost market sentiment.

Oil Prices

The cooling down oil prices caused rally in the passing week, hence the market participants will closely watch price movement as if the prices fall further and settle below $100 a barrel for a longer time then that could bring a relief for oil importers like India and corporates which ultimately could act as a great support for market.

Also read - New income tax forms are out for new assessment year 2022-23. Find out which one you should use

International benchmark Brent crude futures settled at $104.4 a barrel, down sharply by 13.5 percent compared to $120.65 a barrel on a week-on-week basis amid easing of supply concerns on improving the situation with respect to Ukraine-Russia crisis and the release of US oil reserves announced by US President Joe Biden from May. The demand worries due to lockdowns in China, the world's second largest economy, after a surge in Covid cases also put a bit of pressure on oil prices.

The renewed buying interest from foreign institutional investors after a relentless selling since October 2021 brought a sigh of relief for the market. If the buying continues then the market could easily cross the crucial 18,000 mark in coming days, experts feel.

FIIs have net bought Rs 5,590 crore worth of shares on the weekly basis after several weeks, as before this renewed buying interest, they had net sold shares worth more than Rs 2.3 lakh crore since October 2021.

The market has consistently been getting strong support from domestic institutional investors and the same support was also seen in the passing week, which act as a double support for the market. They have net purchased shares worth more than Rs 5,000 crore during the week.

"It will be important to see how FIIs will behave in FY23 after relentless selling in the second half of FY22," says Santosh Meena, Head of Research at Swastika Investmart.

Also read - India to be one of brighter pockets with likely growth of around 8.5%: Asheesh Chanda of Kristal AI

Economic Data

On the macro front, all eyes will be on S&P Global Manufacturing PMI, and S&P Global Services & Composite PMI data for the month of March which will be released on Monday and Wednesday respectively.

Foreign Exchange Reserves for the week ended on April 1, and bank loan and deposits growth for the fortnight ended on March 25 will also be released next week, on Friday.

Global Cues

The Federal Open Market Committee, on Wednesday, will release the minutes from its March meeting. Experts feel the Federal Reserve is likely to provide more details about further policy tightening to fight inflation worries. In March, the Fed raised interest rates for the first time since 2018.

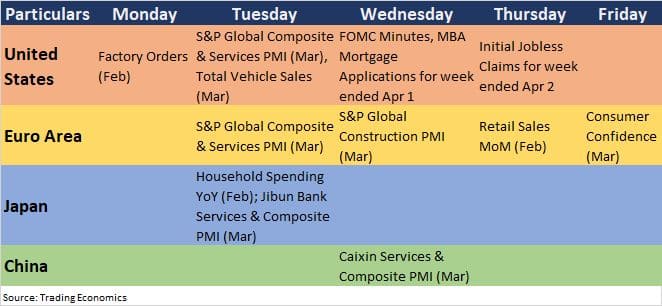

Here are key global data points to watch out for next week:

Technical View

The Nifty50 has strongly defended crucial 17,000 mark and has decisively broken the consolidation range to climb above 17,600 mark during the passing week, forming bullish candle on the weekly scale, while there was also bullish candle formation on the daily charts, indicating the positive bias ahead with hope the index could cross 18,000 soon with crucial support at 17,300-17,000. The index gained more than 1 percent on Friday and 3 percent during the week.

"The market is now surpassing the hurdles one after another. There is consolidation/minor weakness at the resistance before showing sharp upside breakouts. The next overhead resistance of the previous swing high is placed at 17,795 and that is going to be tested soon. The sharp upside movement continued in Nifty as per weekly chart (formation of long bull candle), after a pause of last week," says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

According to him, the Nifty is expected to move towards 17,800-18,000 levels by next week, before showing another round of minor downward correction from the highs. "Immediate support is placed at 17,550."

F&O Cues

The Nifty50 started off the April series on a strong note after a quiet monthly settlement for the March series.

As per the option data, the Nifty50 is likely to trade in the range of 17,500-18,000 levels on an immediate basis, while the broad trading range would be 17,300-18,000.

At the beginning of April series, on a weekly basis, maximum Call open interest was seen at 18,000 strike followed by 17,600 and 17,500 strike, with Call writing 18,000 strike then 17,600 & 17,800 strikes and Call unwinding at 17,500 strike. Maximum Put open interest was seen at 17,500 strike followed by 17,400 strike and 17,600 strike, with Put writing at 17,400 strike then 17,300 & 17,500 strikes.

"FIIs have formed significant net longs both in index as well as stock futures. We should remain positive on the Nifty till no major change is observed in their positions," says ICICI Direct.

"On the options front, major open interest build up is visible at ATM Call and Put strikes of 17,500. Hence, the Nifty may continue to consolidate with positive bias with immediate support near 17,300. We believe BFSI stocks would continue to perform well due to noteworthy short open interest along with PSU stocks," the brokerage added.

India VIX

The volatility cooled down significantly below 20 levels, providing healthy push to the market. India VIX, the fear index fell by 21.3 percent on a week-on-week basis to 18.44, the lowest level since February 10 this year.

Experts feel if the volatility stabilises below 20 mark for a longer period then that could be a good supportive factor for the market going ahead.

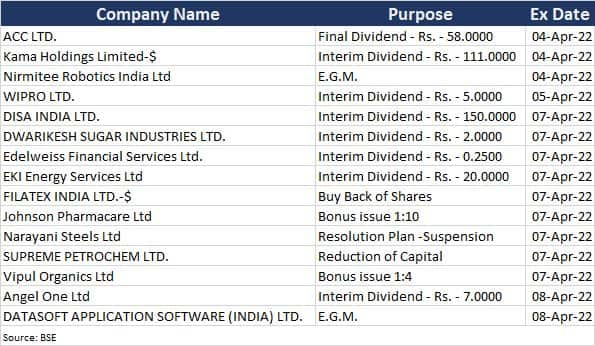

Corporate Action

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.