Selling pressure sustained with bears tightening their grip over Dalal Street in the week ended December 16. The hawkish tone with hints of more rate hikes to control inflation by Federal Reserve after 50 bps hike in interest rates in December policy meeting, and growing recession fears in developed nations weighed on the market sentiment.

After recent correction from record high levels, the market is largely expected to be volatile and rangebound in the coming week, with focus mostly on global cues given the lack of domestic triggers, experts said.

Most of sectors slipped into the red with maximum pressure in FMCG, technology, and MNC, while Bank Nifty also fell nearly a percent for the week largely on profit booking after crossing 44,000 mark during the week passing by.

The BSE Sensex fell 461 points to 61,338, and the Nifty50 dropped 146 points to 18,269, the lowest level since November 23, while there was a mixed trend in broader markets. The Nifty Midcap 100 index was down a percent, whereas the Nifty Smallcap 100 index gained half a percent.

"Global sentiments have taken a turn for the worse as the year-end holiday period approaches. Recessionary fears have resulted in markets eroding across the globe," Deepak Jasani, Head of Retail Research at HDFC Securities said.

Since all the sectors are largely trading in tandem with the benchmark, participants should plan their exits in profitable trades and stay selective for fresh positions, Ajit Mishra of Religare Broking advised.

Here are 10 key factors that will keep traders busy next week:

1. US Growth Numbers

Investors around the world will await the final US growth numbers for the quarter ended September 2022 (Q3 CY22) scheduled to be released on December 22 (Thursday).

In the last estimates, the US economy registered a 2.9 percent (annualised) growth in the third quarter of 2022 against its first estimates of 2.6 percent, aided by increasing exports, fall in imports, and rising consumer spending. If it comes actual then that would be better than the decline of 0.6 percent in Q2CY22 and fall of 1.6 percent in Q1CY22, and this will be another data points to be watched by the Federal Reserve before its next policy meeting towards January-end.

2. Global Macroeconomic Data

Here are key global macroeconomic data points to watch out for next week:

3. Monetary Policy Meeting Minutes

The street will also closely look at the recent monetary policy meeting's minutes which are expected to be released by the RBI on December 21 (Wednesday).

In the recent concluded Monetary Policy Committee meeting on December 7, the Reserve Bank of India raised repo rate by 35 bps to 6.25 percent to fight against inflation, which was on expected lines given the falling inflation, but maintaining focus on withdrawal of the accommodative stance made the street more cautious, may be indicating the rate hike is not over yet.

4. FII Flow

The hawkish commentary by Fed and increasing global growth concerns seem to have dampened sentiment at FIIs desk, as they have net sold more than Rs 1,800 crore worth of shares last week, causing selling pressure in the market.

Even on the monthly basis, they remained net sellers to the tune of nearly Rs 7,500 crore worth shares. Hence, experts largely expect the volatility in FII flow to continue in coming weeks at least till we get the clear indication of pause in rate hikes by Federal Reserve.

On the other side, domestic institutional investors continued to be net supporters for the market and in fact they have managed to fill the gap created by FIIs. They have net bought nearly Rs 3,500 crore worth shares during the week, and more than Rs 10,500 crore of buying in December.

5. Oil Prices

Oil prices hovering way below $90 a barrel for a month now and further decline are definitely good factors for the Indian equity market and easing worries over deficit. Hence, it is one of key factors that can be closely watched going ahead and if it falls further then there could be a rebound in equity markets, experts said.

Oil prices have seen decent recovery during the week gone by after 11 percent correction in previous week, due to softening dollar ahead of Fed meet outcome and uncertainty related to reopening of Keystone pipeline, but there was some retreat in later part of the week following hawkish tone by Federal Reserve and partial restart of Keystone pipeline.

Net net, the international benchmark Brent crude futures settled with nearly 4 percent gains at $79.04 a barrel.

"As the market falls into last leg of the year, volumes are expected to dry up and we are bound to see erratic moves. Overall trend for crude oil remains bearish with expected drop in demand during Q1-2023, we expect prices to fall under $70 a barrel in short term," Mohammed Imran, Research Analyst at Sharekhan by BNP Paribas said.

6. IPO

We have two initial public offerings worth nearly Rs 2,000 crore getting launched in the coming week. With this, there will be total 5 IPOs in December.

KFin Technologies, a technology-driven financial services platform, will be the first public issue to open for subscription next week on December 19, with a price band of Rs 347-366 per share.

The company intends to mobilise Rs 1,500 crore via offering that comprises only offer for sale by its promoter General Atlantic Singapore Fund Pte Ltd. Of which, Rs 675 crore has already been raised via anchor book on December 16.

The offer will close on December 21.

The second IPO will be from electronics manufacturing services (EMS) provider Elin Electronics. The offer will be opened for bidding during December 20-22, with a price band of Rs 234-247 per share.

The company aims to mop up Rs 475 crore via public issue that comprises a fresh issue of Rs 175 crore and an offer for sale of Rs 300 crore by promoters. The debt repayment, and expansion of facilities at Ghaziabad (Uttar Pradesh) and Verna (Goa) are the main objectives of fresh issue money.

Apart from IPOs, there will also be three listings next week with leading wine producer Sula Vineyards on December 22, while financial service firm Abans Holdings and premium automobile retailer Landmark Cars debut will take place on December 23.

7. Technical View

The Nifty50 has formed bearish candle which resembles Inverted Hammer kind of pattern formation on the daily as well as weekly charts, while there has been lower highs lower lows formation for second straight day on last Friday, and lower highs for second consecutive week.

Generally Inverted Hammer formation at downtrend is a bullish reversal pattern but given the current sentiment, experts feel the market may remain subdued and rangebound for some more time with crucial support at around 18,100-18,000 levels, while the resistance is expected to be at around 18,500-18,700 levels.

"Technically, Nifty has formed lower top lower bottom on the daily chart, which is a bearish sign for the short term. Index on the daily chart has closed below its 9 and 21 – day exponential moving average and RSI on the other hand has drifted below 50 levels with bearish crossover," Apurva Sheth, Head of Market Perspectives at Samco Securities said.

Previous week on the weekly chart, Nifty50 had formed bearish Dark Cloud Cover candlestick pattern at all-time high levels and index continued to drift lower post that.

The support for the index is placed near 18,100 and any move below the same will extend the fall till 17,900 levels, the market expert said, adding on the higher side, 18,500 will be an immediate resistance and followed by 18,650 levels.

8. F&O Cues

After recent correction, the options data clearly indicated that the expected trading range for the Nifty50 has been shifted lower to 18,100-18,500 for the near term, from 18,400-18,700(/18,800) levels, though the 19,000 strike continued to see maximum Call open interest.

On the options front, we have seen maximum Call open interest at 19,000 strike, followed by 18,500 and 18,700 strikes, with Call writing at 18,300 strike then 18,400 strike.

On the Put side, the maximum Put open interest was seen at 18,000 strike followed by 18,300 and 17,500 strikes, with writing at 18,300 strike then 18,000 strike.

"A sharp decline post the Federal Reserve meet resulted in heavy Call writing at ATM (at the money) and OTM (out of the money) strike. While the Put base is at ATM 18,300 strike, Call bases are much stronger at 18,400 and higher strikes. Hence, a move above 18,400 should be looked for fresh longs in the index," ICICI Direct said.

9. India VIX

The fear index India VIX has risen significantly by more than 23 percent, from 11.43 level (weekly low) to 14.07, making the bulls more discomfort at Dalal Street, though on the weekly closing basis, the index was up 4.38 percent.

In fact, the sharp rising seems to be an indication that there could be some uncertainty at higher levels. Hence, if the VIX increases further then the trend may turn favourable for bears.

10. Corporate Action

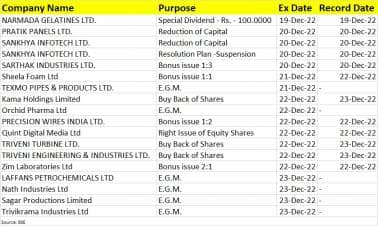

Sheela Foam, Precision Wires India, Zim Laboratories, and Sarthak Industries will trade ex-bonus next week.

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.