Bulls kept on trotting the Street on December 8, charging the benchmark indices to fresh all-time highs. The 50-stock NSE index surged to 21,006.10 and the 30-share BSE index hit 69,888.33.

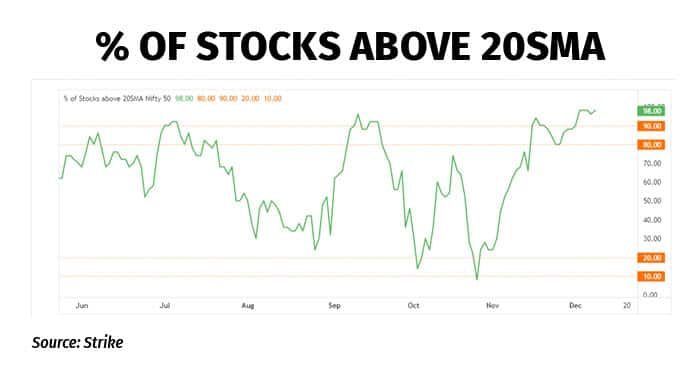

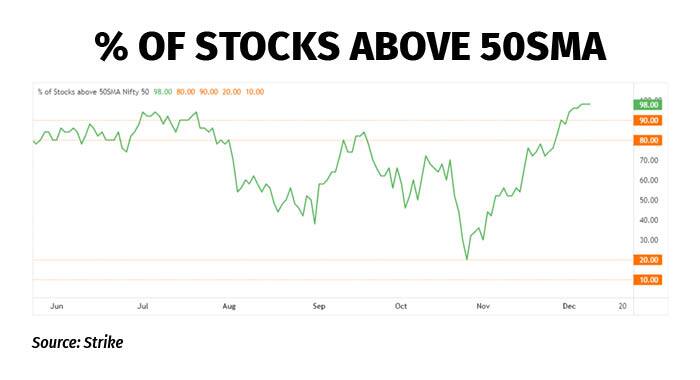

In the Nifty 50 index, 49 stocks were trading above their 20 and 50 DMA/SMA (daily moving average/simple moving average) and 48 stocks were above 200 DMA.

A simple moving average (SMA) or a daily moving average (DMA) is calculated by adding the closing price of the index or stock for the last n-periods and dividing it by the total number of periods. “Even though this indicator is very widely used by traders and investors, it also has its shortcomings. SMA places equal weightage on every candle or time period which can be misleading,” said AR Ramachandram of Tips2Trade.

Around 98 percent of Nifty 50 stocks are trading above with Cipla being the only stock trading below the 20-DMA.

98 percent of Nifty 50 stocks are trading above while Bajaj Finance Cipla is the only stock trading below the 50-DMA.

96 percent of Nifty 50 stocks are trading above the 200-DMA, while Hindustan Unilever Limited and UPL are below the 200-DMA.

The Nifty and the Sensex hit highs after the Reserve Bank of India (RBI) lived up to the market expectation and announced its decision to keep the repo rate unchanged at 6.5 percent for the fifth time in a row.

Riyank Arora, technical analyst at Mehta Equities Ltd expects some consolidation before the next leg of up-move. “The Nifty may consolidate between the 20,850 and the 21,000 zones before the next up-move stars towards 21,250 and 21,300. Any move below 20,850 would negate this view,” Arora said.

HDFC Bank, which has the highest weightage in the Nifty 50 index, gained over 1 percent. “With the stock trading well above all its important moving averages, it should likely head higher towards Rs 1,670 and Rs 1,700. Any pull-back towards Rs 1620 should offer a good buying opportunity with a stop loss placed below Rs 1,590,” Arora said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.