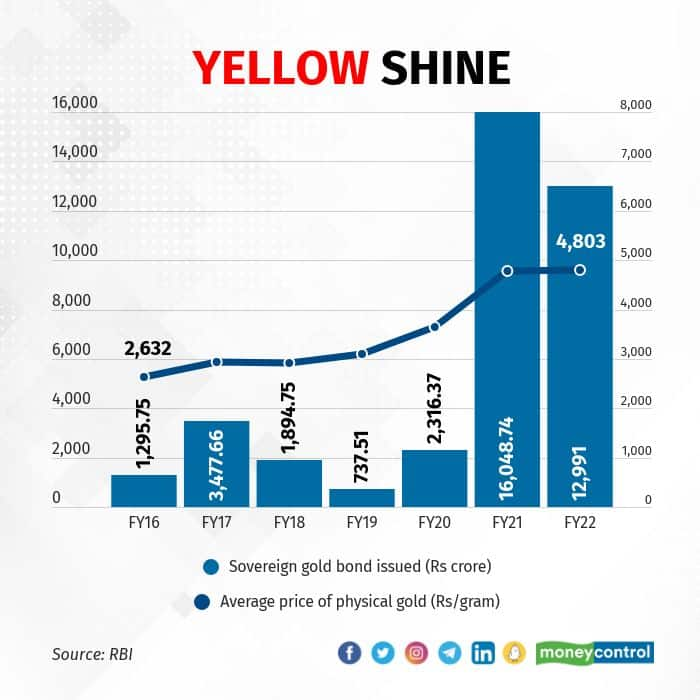

Sovereign gold bonds were first introduced in November 2015 as an alternative to physical gold. While the initial response was tepid, the bonds have gained popularity over the years. Awareness about the costs associated with physical gold and the ease of buying paper gold has contributed to this. Further, the bonds pay an interest of 2.5 percent over and above the capital gains expected through rise in the price of gold. In FY16, the mop-up through sovereign gold bond issuance was a mere Rs 1,295.75 crore. This has surged to Rs 12,991 crore in FY22. The pandemic has also contributed to increased investment in sovereign gold bonds. Above all, the clear trend is that a rise in physical gold prices has meant that investors are more willing to invest in gold bonds as well. The average price of a gram of gold was Rs 4803 in FY22, which is 82 percent higher than what was in FY16. The Reserve Bank of India (RBI) has set the price of gold for successive gold bond issuances higher as well keeping with the rise in international bullion prices. While gold prices have risen in response to the sharp rise in inflation globally, a strong dollar is acting as a check. Nevertheless, the latest sovereign gold bond issuance that is currently open is expected to see robust interest. The nominal value of the bond will be Rs 5,091 per gram of gold which is higher than previous issuances. It would be interesting to see if the issuance matches that of the pandemic years.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.