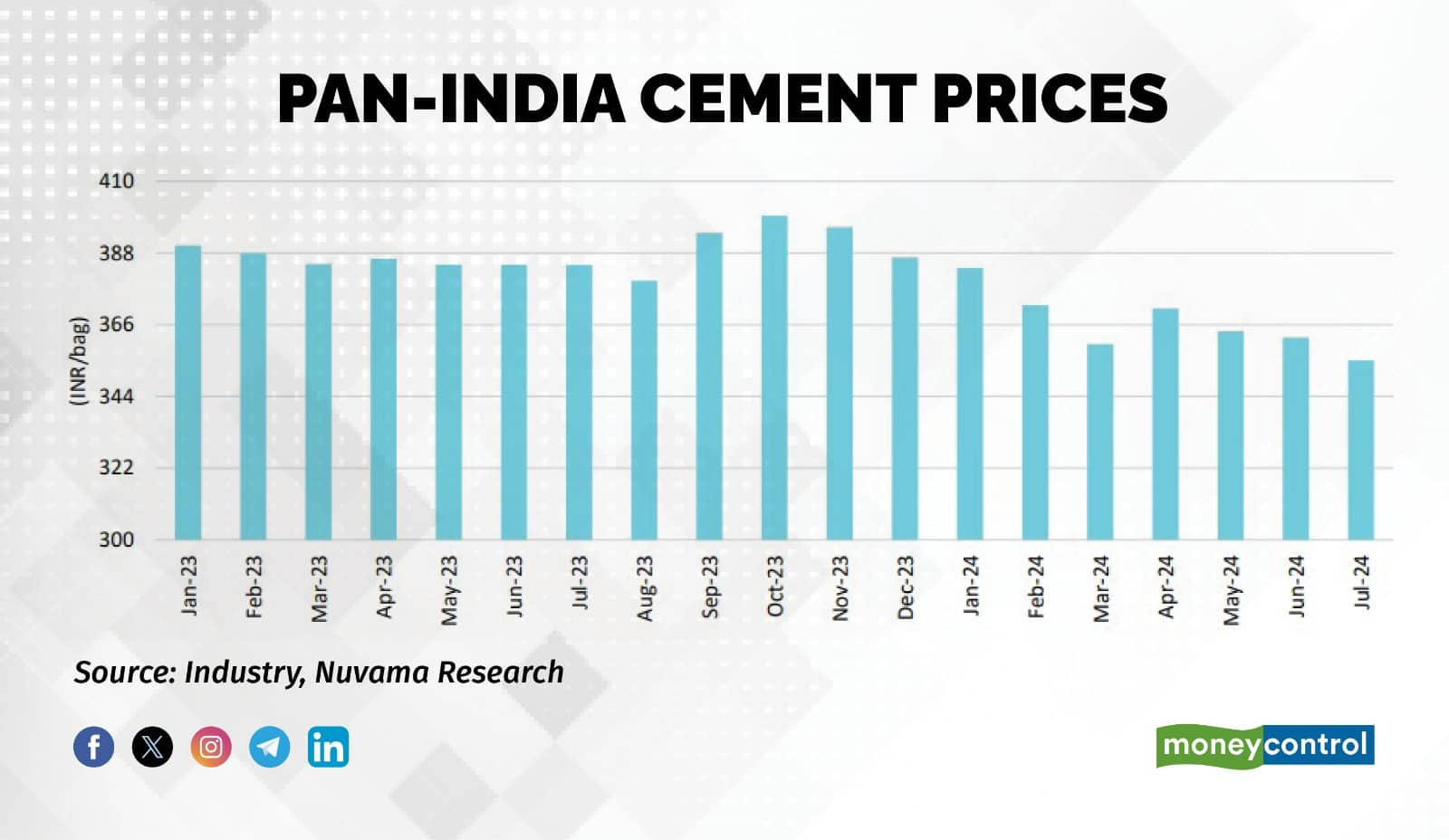

The cement industry faced a challenging July 2024 as prices fell steadily across various regions, leading to a decline in profitability. The overall decline in cement prices in July 2024 is attributed to the subdued demand during the monsoon season, a period traditionally marked by lower construction activity.

As a result, cement companies are grappling with reduced margins and subdued market conditions, with expectations that demand will only pick up in the latter half of FY25.

Price trends and demand dynamics

In the eastern region, prices dropped by Rs 8-10 per bag, with demand expected to recover only in the second half of FY25. The southern region saw a sharper decline, with prices down by Rs 30 per bag in the non-trade segment. Demand is expected to remain subdued until the third quarter of FY25, with further recovery expected only by FY26.

In the northern region, labor shortages and the monsoon led to a Rs 5-7 per bag price cut, but dealers anticipate improvement in the third quarter. The central and western regions experienced price reductions of Rs 5 per bag, with demand and pricing power likely to revive after the second quarter of FY25.

While prices have remained stable in the first week of August 2024, there are concerns that they may weaken further as the month progresses. To counteract the adverse impact of falling prices, cement companies have undertaken various cost-efficiency measures and are benefiting from softening power and fuel costs.

These initiatives are expected to help mitigate some of the profitability challenges in the near term.

The cement industry faces a tough road ahead and competitive pressures are likely to keep prices subdued in the short term, according to analysts. However, the sector's long-term prospects may improve as demand rebounds in the latter half of FY25.

Outlook and profitability

According to Nuvama Institutional Equities, high competitive intensity within the industry means that companies are passing on the benefits of cost-efficiency measures and lower fuel prices to customers.

As a result, the brokerage expects pricing to remain tepid until demand picks up, likely in the third quarter of FY25. It maintains a neutral stance on the cement sector, with JK Cement being its top pick with a 'BUY' rating.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.