The sweeping GST 2.0 rate reductions are expected to free up nearly Rs 1.8 trillion in household savings annually, spurring demand across autos, cement, staples, durables and insurance. For fund managers, however, the biggest beneficiaries are precisely the sectors where domestic mutual fund portfolios remain underweight or neutral. Elevated valuations and earlier portfolio repositioning may keep allocations from rising meaningfully in the near term, several fund managers told Moneycontrol.

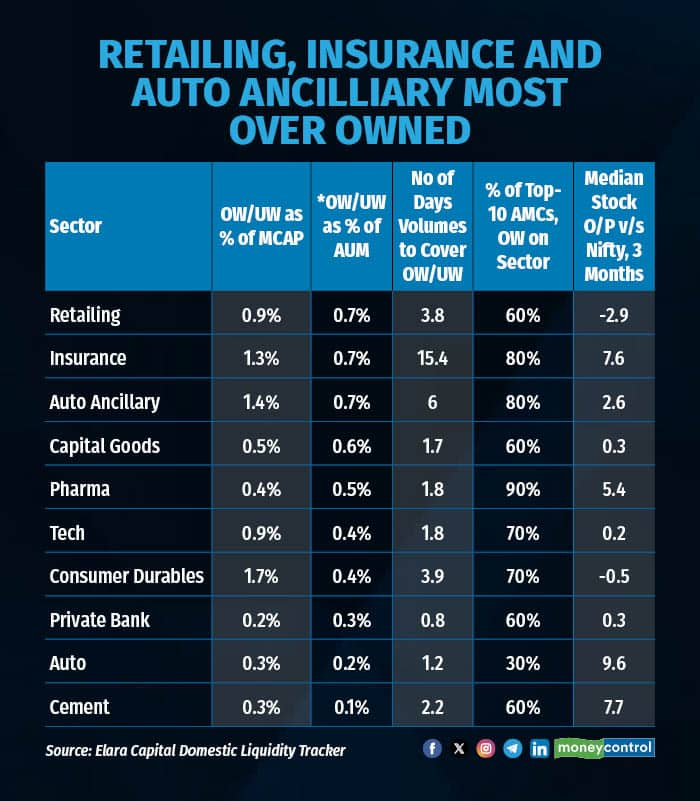

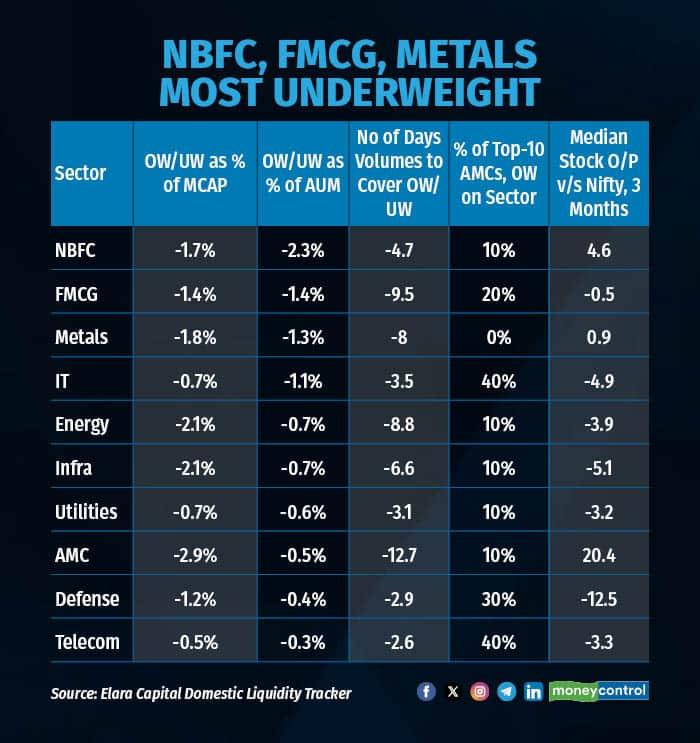

Underweight in key sectorsElara Securities data shows mutual funds are underweight FMCG at -1.4% of AUM, autos are only 0.2–0.3% overweight, and cement 0.1–0.3% overweight. These three are seen as the biggest winners from the GST cuts, but fund managers say sectoral weightages may not rise sharply given steep valuations and the fact that portfolios had already been adjusted last year in anticipation of stronger consumption.

“From a portfolio point of view, it is not just about the uptake but also about valuations and whether further upside is possible. Our approach will remain bottom-up,” said Harsha Upadhyaya, CIO – Equity at Kotak AMC. He added that while tax cuts are positive across the board, demand elasticity will vary by product, making stock selection critical.

Chirag Mehta, CIO at Quantum AMC, agreed allocations will evolve with earnings potential. “Growth dynamics across sectors will change because of the GST cut. That will influence earnings potential, and consequently our portfolio allocations,” he said, adding that the review would be “sector by sector and stock by stock.” He noted that growth in consumer segments has not recovered as expected after income tax cuts earlier this year, so managers will need to see clearer signs of volume growth before deploying money at current valuations.

Portfolios already adjustedDSP’s Vinit Sambre said his firm had already rationalized positions last year when capex momentum slowed. “We already have good positioning in these segments — banking, consumer, and some tech-oriented segments — maybe only incremental adjustments, more indirect or proxy plays,” he said. Among investment-oriented sectors, DSP still has exposure largely linked to the power sector, where capex remains strong.

ALSO READ: GST 2.0: Beyond blue chips – Watch these under-the-radar movers

Overall, Sambre expects a revival in demand across the board. “I believe the automobile sector should see higher price-elasticity-led demand improvement, followed by daily essentials, food and personal care products,” he said.

Autos and cement in focusAutos are viewed as the biggest near-term beneficiaries, with GST on two-wheelers, small cars and commercial vehicles cut sharply. Jefferies estimates this could lower on-road prices by 6–8%. Cement, which now attracts 18% GST, is expected to see margin expansion and working capital relief. Durables such as TVs and air-conditioners will also gain from tax relief.

In all these sectors, mutual funds are already mildly overweight, but managers say they will wait to see demand pick up and earnings accelerate before increasing exposure further.

Mehta said the implications go beyond consumer products. “While the gains are tilted towards consumption, there are broader implications too. Renewable energy will benefit from lower duties, cement duties have been cut which lowers housing input costs, and healthcare demand could rise as health insurance becomes cheaper.”

Sambre echoed this, noting that second-order effects will be more critical: “The second-order impact is on credit growth. With consumer demand rising, credit growth should also see a positive impact, and we are already at the lower end of the cycle.”

That translates into more bets on banks, apart from stock-specific opportunities across segments, fund managers said.

Valuations the sticking pointStill, managers caution that valuations remain the decisive factor. “Earnings could improve in the medium to long term, but valuations must still be looked at bottom-up,” Mehta said.

Sambre added that much of the news was already in the price. “In fact, on September 4, we saw a negative market reaction, as people were already positioned.”

As benefits percolate and consumption trends improve, investors are hoping GST 2.0 will still provide direction to the market.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.