The Aditya Birla Group's announcement of its entry into the Cables and Wires (C&W) segment sent ripples in the sector.

Investors say that the group's flagship UltraTech Cement's foray into the space is similar to the entry of group company Grasim Industries' entry into the paints sector with Birla Opus, which had caused a similar hullabaloo. But will the same story play out in the W&C space? Experts are mixed on their outlook.

On February 26, UltraTech Cement said it will set up a wires and cables plant in Bharuch, Gujarat, with an expenditure of Rs 1,800 crore over next two years. The plant is expected to be commissioned by December 2026.

Market participants rushed to sell-off their holdings in C&W stocks. KEI Industries, Polycab India, Havells India, and RR Kabel were among the biggest losers in trade, crumbling over 17 percent as selling pressure mounted. Even shares of UltraTech Cement fell around six percent. Is this reaction justified?

According to Motilal Oswal, this entry, along with the Aditya Birla Group's intention to become a significant player in the segments where they operate into could pose a threat to the valuation multiples of C&W companies. As a result, while the earnings of C&W companies will not be impacted until the plant is commissioned, multiple erosion in the stocks could occur earlier.

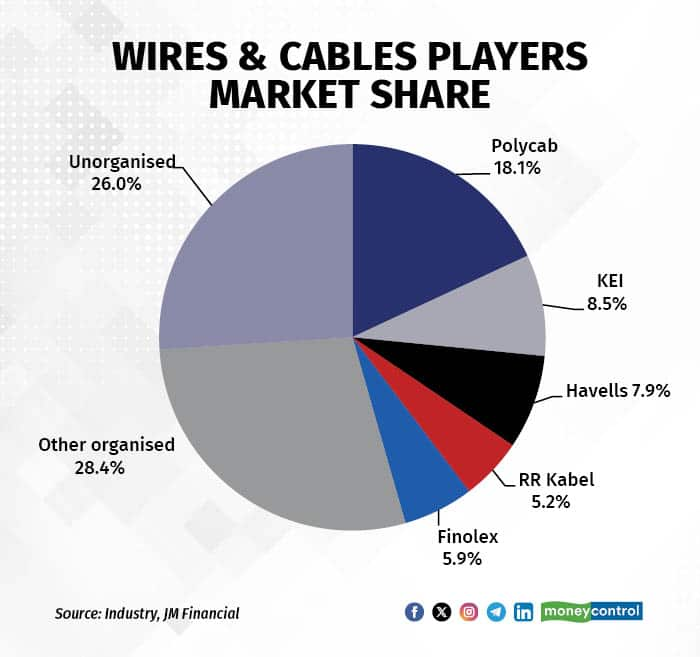

Currently, there is a significant divergence in the C&W industry, where no one player commands a market share of over 20 percent in either segment. "The industry comprises nearly 400 players, ranging from SMEs to large enterprises, with revenue between Rs 50 crore and Rs 400 crore. The industry is, therefore, ideal for a new entrant with deep pockets," JM Financial noted.

What can work for UltraTech Cement's C&W foray?

Motilal Oswal downgraded its rating on KEI Industries and RR Kabel to 'neutral', from its earlier 'buy' tag, while retaining its 'buy' call for Polycab India shares and 'neutral' for Havells India stock. On the flip side, Nuvama Institutional Equities retained its bullish stance on KEI Industries, Polycab India and Havells India shares.

What's the path forward for UltraTech Cement?

The views remain sharply mixed. According to Nuvama, the entry of UltraTech Cement into the C&W segment is unlikely to have any impact on FY25–28 earnings of C&W players. Further, the industry has significant growth opportunity in exports and hence some players may be able to divert capacities, thus further limiting the impact of such new additions.

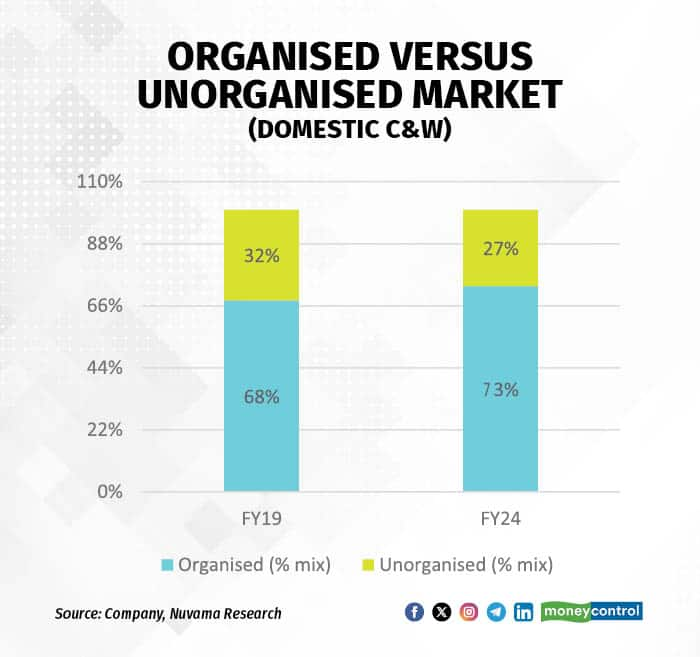

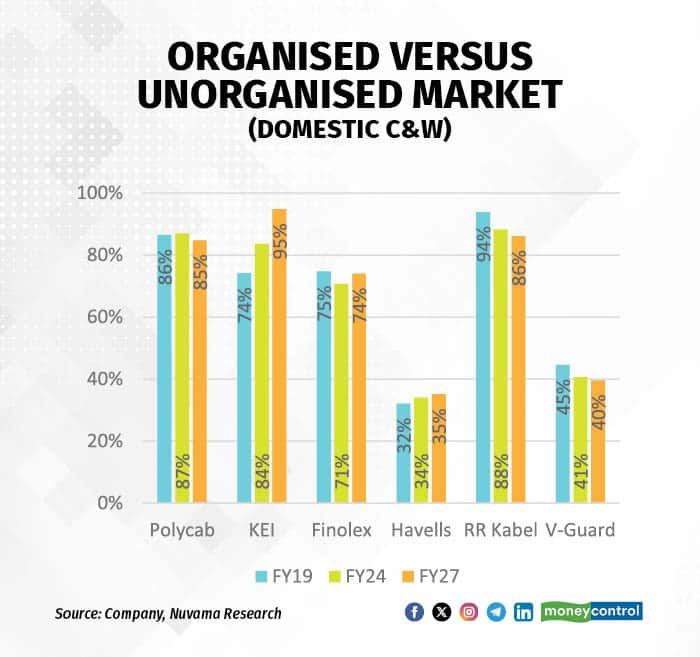

"This entry shall have a modest impact on C&W industry volume/margins in the medium term. We believe this shall further drive unorganised to organised market share (organised share is likelyto have gone up from 68 percent in FY19 to 73 percent in FY24) while creating further healthy

competition among organised players," added Nuvama Institutional Equities.

However, JM Financial said, "The revenue scale-up will depend upon how fast the company is able to ramp up its manufacturing and distribution. At full scale revenue, and based on industry growth expectations, UltraTech Cement could possibly garner a 5 percent market share by FY28 in the W&C industry, and even a double-digit share in the wires segment alone."

While there will be no change in earnings estimates for C&W companies over the next two years, there could be a de-rating in their valuation multiples due to the entry of a sizeable player, as per Motilal Oswal. The brokerage added that the C&W business also appears to be highly competitive, with margins lower than UltraTech Cement's existing business. Additionally, the company’s strategy of entering the distribution channel needs to be observed.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.