Shares of public-sector banks extended previous day's gains on November 18 after the Supreme Court of India said the resolution of Essar Steel would proceed as per the October 2018 plan, clearing the way for ArcelorMittal to acquire the bankrupt company.

All brokerage houses remained bullish on SBI and ICICI Bank, which would be biggest beneficiaries in resolution of IBC (insolvency and bankruptcy code) cases, including Essar Steel.

The Nifty PSU Bank itself gained nearly a percent on top of 3.3 percent gains in the previous session. Jammu & Kashmir Bank, SBI, Indian Bank, Syndicate Bank, Central Bank, Canara Bank, Union Bank, PNB, Bank of Baroda and Bank of India rose 0.5-2 percent while Corporation Bank rallied 16 percent on top of 17 percent rally in the previous trading session.

Essar Steel was one of 12 systemically large non-performing assets (NPAs) that the RBI had directed banks to refer to the National Company Law Tribunal (NCLT). Financial creditors had an exposure of Rs 49,500 crore, while operational creditors had an exposure of Rs 19,700 crore, as per July 2019 NCLT documents.

As per the October 2018 resolution plan, secured financial creditors will recover 92 percent of their exposure--Rs 42,000 crore--to Essar Steel, while operational and unsecured creditors make very low recoveries-- 2-4 percent.

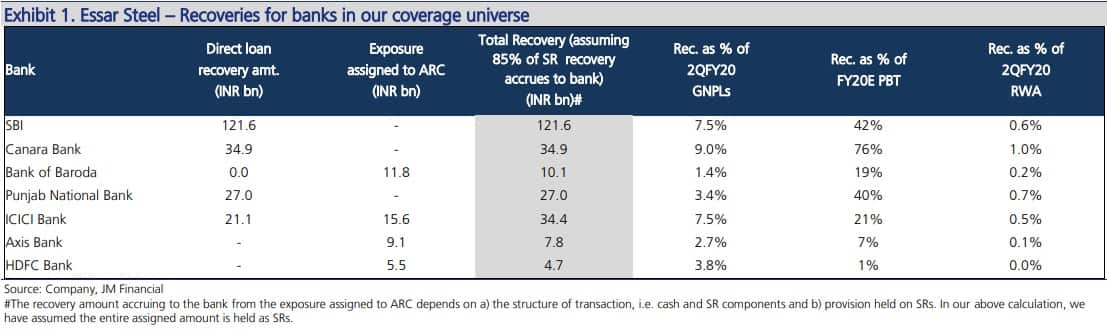

"Effectively, the court’s judgment sets forth two important precedents which are significant positives for future IBC-led resolutions, in our view: a) financial creditors are to be given precedence over the operational creditors (ex-workmen and employees) and b) NCLT cannot dictate distribution of recovery proceeds, which are determined by the Committee of Creditors. For our coverage universe, significant non-performing loans (NPL) recoveries are to be made by ICICI Bank/Axis Bank/SBI, and we remain constructive on these names," JM Financial said.

According to the brokerage house, healthy recoveries were also expected for Bank of Baroda, Canara Bank and PNB. It expects banks to have a high provision cover (in some cases 100 percent) on this exposure, given Essar has been an NPA for the sector since March 2016 – hence, most of the loan recovery should flow through the P&L as provision writebacks / recoveries from written-off accounts.

"HDFC Bank is our top pick in the sector, while we remain constructive on ICICI Bank and Axis Bank," JM Financial said.

JP Morgan said SBI and ICICI Bank were best exposed to play resolution cycle. Hence, the brokerage has a target for ICICI Bank at Rs 560, implying a 12 percent potential upside from current levels, and SBI at Rs 375, upside of 16.5 percent.

"The Supreme Court notification of Essar Steel resolution is a landmark judgment. Stressed NBFC resolution framework is positive," it said.

Japanese brokerage firm Nomura said the judgment favoured banks but key beneficiaries should be SBI and ICICI Bank.

"Recovery for banks in the case will be closer to 90 percent against 60 percent earlier. The judgment established Committee of Creditors' (CoC) primacy in allocating future proceeds from settlements. SBI could have a recovery of around Rs 12,000 crore as suggested by COC," it added.

According to Nomura, SBI can provide for a majority of their potential stressed loans. "We maintain buy on SBI, with a target at Rs 400 per share (upside 24 percent)," it said.

Citi also remained positive on SBI, ICICI Bank and PSU banks having exposure to Essar Steel.

SBI expects around Rs 17,000 crore of recoveries from three cases under IBC. Out of the three cases, Essar Steel is the biggest.

"Secured financial creditors will be able to recover around 92 percent of dues to Essar Steel," said Citi.

"We expect Essar deal to conclude by the end of November. We except for mandatory 330-day rule, SC has upheld all other clauses, which is a big positive," SBI chairman Rajnish Kumar told CNBC-TV18.

"We have provided 100 percent for Essar, so entire recovery goes to bottom line," he said.

He believes March 2020 would be for banks in terms of recovery. SBI's Bhushan Power exposure is Rs 20,000 crore.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.