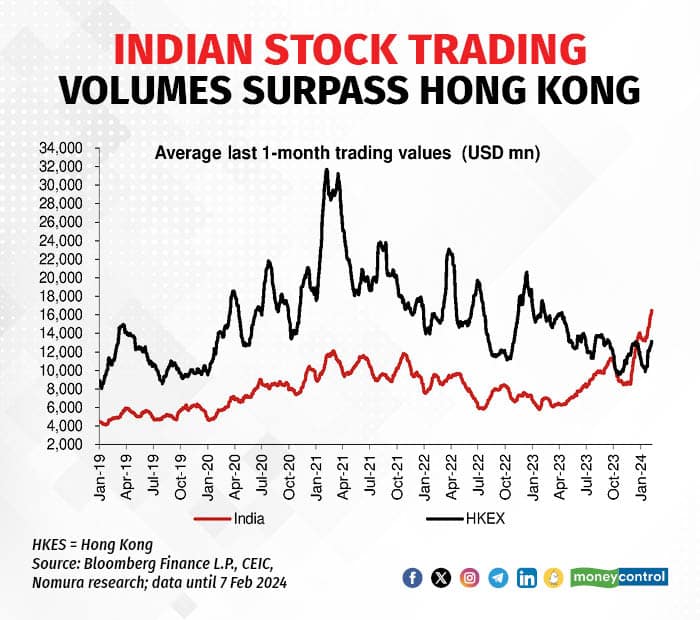

Indian stock trading volumes have surpassed that of the Hong Kong exchange, signaling a widespread positive outlook on Indian equities, despite rising concern over valuations.

The daily trading value of Indian stocks, BSE and NSE combined, averaged $16.5 billion on a one-month basis, compared to Hong Kong's $13.1 billion a day.

In contrast, a notable shift in investor sentiment is observed in the Chinese market. Billions are being withdrawn as China's growth slows, while India, the fastest-growing major economy, focuses on infrastructure expansion to attract global investment. The contrasting paths highlight economic challenges in China and India's efforts for growth amid a changing global order.

Grappling with the economic challenges, China has initiated a $278-billion rescue plan for the stock market, injected $140 billion into banks, and trying to address issues in the property sector. Despite exceeding the 2023 GDP growth expectations, a US research firm predicts slower growth of 3-4 percent for China, pointing to unresolved structural issues such as local government debt and limited progress in attracting foreign investment.

Low returns from the China market, coupled with India surpassing Hong Kong volumes, indicate a subdued investor appetite for Hong Kong/China stocks. Hang Seng has given negative returns for the fourth straight year, while the Shanghai index fell for two years in a row. So far in 2024, the Hang Seng index dropped nearly 6.8 percent, while Shanghai Stock index fell 3.5 percent. In 2023, Hang Seng lost 13.8 percent and Shanghai 3.7 percent.

The combined daily stock trading value in India recently soared to Rs1.4 trillion (5DMA basis), driven by the US Fed pivot, rally in global stocks, and positive state election results. The surge is also notably fuelled by rising non-institutional trading participation.

Positive vibes from the interim budget also bolstered investor sentiment with the continuation of key government commitments. Budget 2024 aims for ambitious economic growth, infrastructure development, and sector-specific initiatives while ensuring fiscal prudence. Emphasising innovation, green growth, and inclusive development, the government strives to propel India towards becoming a developed nation by 2047.

Brokerage Nomura has expressed concerns about the recent surge in trading values in India, considering it from a contrarian perspective and not ruling out the possibility of an "air pocket" for India stocks.

Nomura identified potential catalysts for a pullback, including a cyclical economic slowdown, earnings downgrades, concerns about tighter banking sector liquidity, profit-taking before general elections, stretched investor positioning and valuations, and potential reallocation of flows to other Asian markets like Korea and China.

Despite this, Nomura sees any pullback as an opportunity and remains structurally positive, aligning with the 'buy the dip' strategy.

In December and January, the cash segment experienced a significant spike, reaching a record high average daily turnover of Rs 1.20 trillion per month each on both the BSE and the NSE.

Indian markets surged since April 2023 on improved economic conditions, strong economy, rising earnings, political stability, and expected lower inflation. Foreign and domestic investments further boosted sentiments.

Since April 2023 till date, both Sensex and Nifty surged nearly 20 percent each while broader markets BSE midcap and smallcap jumped over 45 percent each. FIIs invested around $21 billion while DIIs bought Rs 1.81 lakh crore in Indian equities in 2023.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.