Valuation guru Aswath Damodaran believes that Adani Group, despite all its flaws, remains competent in India's infrastructure space that's full of incompetent players. He pegs the fair value for Adani Enterprises at Rs 947.

"It is possible that Hindenburg was indulging in hyperbole when it described Adani to be 'the biggest con' in history. I am puzzled that Hindenburg's short thesis spends as much time as it does trying to convince us that the company is over-levered. Being over-levered is not a con game, but a risk that equity investors in many investments take to increase their returns," Damodaran wrote in his blog on Sunday.

While valuing the stock at only Rs 947 apiece, he factored in upbeat assumptions on revenue growth and operating margins. That is a 38 percent downside from the stock's Friday close of Rs 1,531.

The reason behind this, he says, is that the company's profitability has lagged, partly because investments take time to pay off and partly because it is in low-margin businesses.

Also Read: Uday Kotak on Adani-Hindenburg fiasco: 'Don't see systemic risk to Indian financial system'"The market was over-stretched when it valued the Adani companies collectively at $220 billion (Rs 17,600 billion) and Adani Enterprises at $53 billion (Rs 4,243 billion)," Damodaran said.

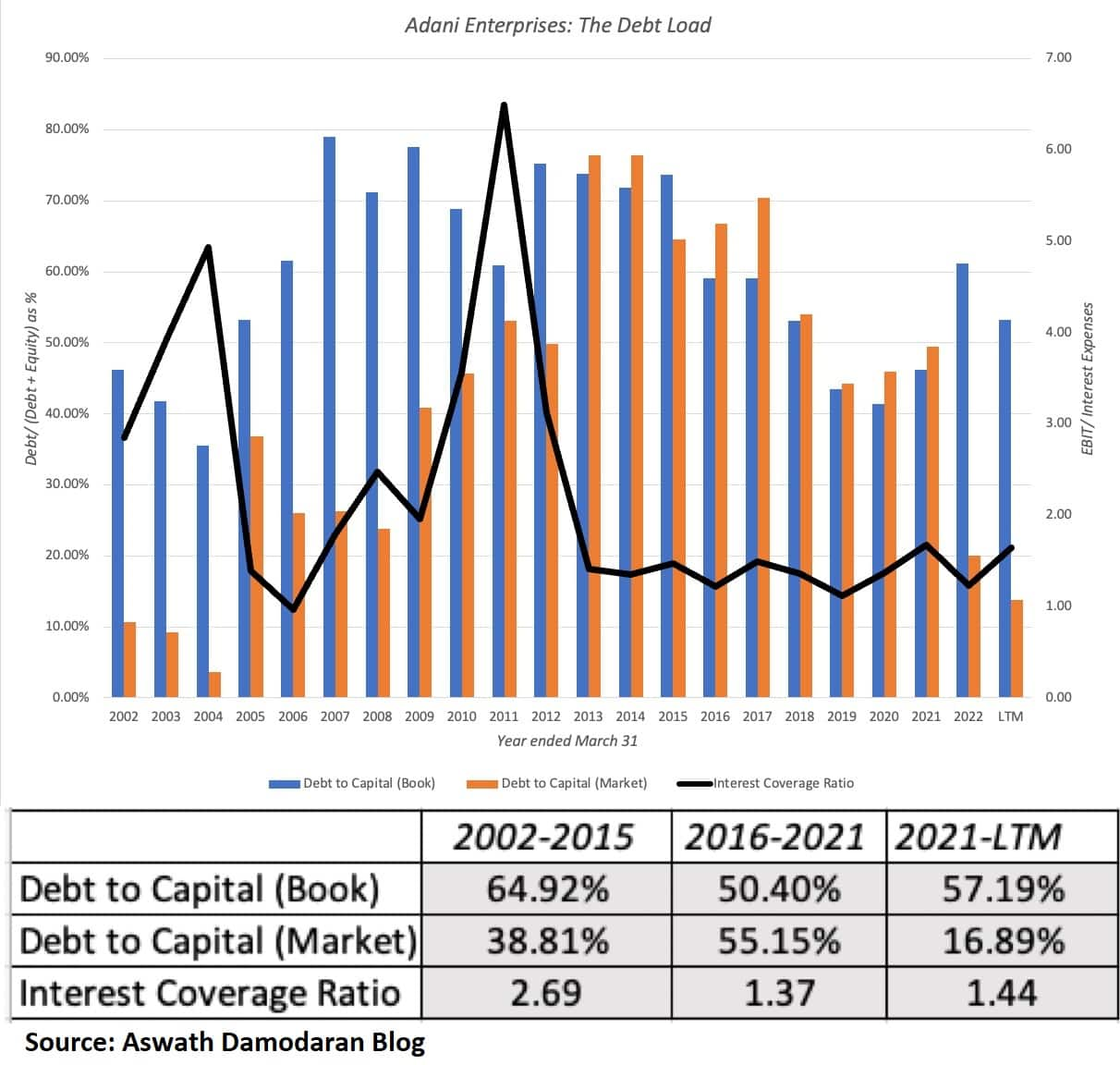

Dissecting the group's debtFor his calculations, Damodaran has split the past 20-year history into three parts: 2002-2015 - when the company grew its revenues steadily; 2016-2021 - when major restructuring spun off Adani Ports, Adani Power and Adani Transmission; and the recent period, when the group bought Holcim's stake in ACC and Ambuja Cements.

The debt to book capital ratio has stayed high through the period, but the rise in market capitalization in 2021 and 2022 lowered the debt to market capital ratio, he notes.

"The interest coverage ratio better captures the limited buffer that the company has on its debt load, since the operating income is barely higher than interest expenses," Damodaran explained.

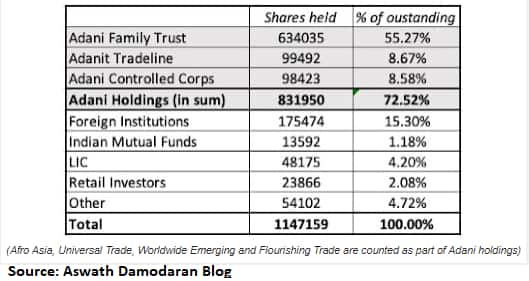

Dissecting the ownership structureConsolidating across the Adani companies, the valuation guru explains that the family owns about 73 percent of the outstanding equity in these companies.

Of the 27.5 percent that is not held by the family, a significant percentage is held by foreign institutional investors, largely through index funds holdings.

"One benign explanation is that foreign institutional investors are using Adani listed shares to make a joint bet on Indian growth, infrastructure investment and Indian politics, and that the pricing was pushed up because of the limited float," he pointed out.

Also Read: Adani Enterprises puts Rs 1,000-crore bond plan on backburner after market routMeanwhile, retail investor presence is small, while some traders have been drawn to the counters due to the surge in pricing over the past two years.

Will he buy the stock?"No," he said. "And, it has little to do with the Hindenburg report."

He likens buying shares in a family group company to "getting married, and then having all of your in-laws move into the bedroom with you".

According to the finance professor at the NYU Stern School of Business, investors in family group companies are buying into cross-holdings, opacity and the possibility of wealth transfers across family group companies.

"Those risks increase, if the family group companies are built around political connections, where you are one political election loss away your biggest competitive advantage," he notes.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.