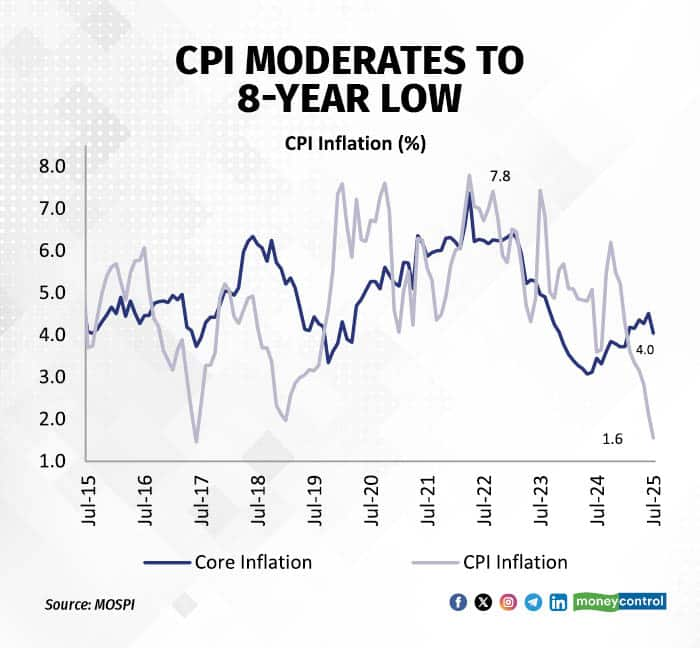

Consumer price inflation eased to eight-year lows in July at 1.6 percent, prompting analysts and experts to expect retail inflation to undershoot the Reserve Bank of India’s estimate for FY2026.

For the current fiscal year, the central bank expects consumer price inflation to clock in at 3.1 percent, which was revised downwards in the previous Monetary Policy Committee meeting.

In July, the 97-month low print was a result of a favourable base effect and a strong monsoon, which kept food inflation in check. Analysts noted that lower prices for pulses, meat & fish, and cereals contributed to the deflation in food prices, even as vegetable prices continued rising sharply, led by tomatoes.

“Underlying inflationary pressures remain soft and are likely to stay subdued through the year. Food inflation should be contained by a high base and an above-average monsoon while growth uncertainties keep core inflation in check,” noted Nuvama Institutional Equities.

With incoming CPI inflation prints consistently surprising on the downside and current vegetable price momentum undershooting the run rate, brokerages trimmed their CPI forecasts for the year. The broad-based consensus among economists is that CPI for FY26 will come in at 2.7 percent, 40 basis points under the RBI’s expected print.

The rapidly moderating inflation figures are mildly exaggerated, as a result of deflation in vegetable prices. However, economists at Nomura said, ex-vegetable prices, CPI eased to 3.6 percent in July, down from 3.8 percent in June. At a broader level, rural inflation (1.2 percent) eased at a steeper rate compared to the elevated urban inflation (2.05 percent) in July.

JM Financial noted that while the inflation trajectory continues to trend lower, based on RBI’s inflation expectations, we are close to the bottom. Nomura concurred, expecting the inflation trajectory to bottom here, but trend in a tight range around 2 percent until November, before it gradually starts rising.

Going ahead, while CPI readings may temporarily increase above 4 percent later this year due to a low base, the broader backdrop remains benign with core inflation below 4 percent and subdued pricing power.

“Overall, even with potential global trade tensions, likely inflationary for the US, but deflationary elsewhere, India’s benign inflation outlook remains firmly anchored,” added Nuvama.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.