Analysts expect the Sensex to reach 73,000 before next year's general elections, which are due by May, although they caution that high valuations could deter investors. Indian equities are witnessing favourable momentum, with the Sensex breaching 70,000 on December 11 and the Nifty exceeding 21,000.

At close, Sensex was up 0.1 percent to 69,928 levels, while Nifty 50 shut shop with 0.1 percent gains at 20,997 levels on December 11.

"As the Nifty jumps above 21,000 mark, it is trading at 21 times (x) the FY24 earnings, turning out to be the most expensive market globally. We expect it to remain expensive in the near-term too as heavy inflows splurge in from foreign and domestic investors. However, the problem with high valuations are that if an unknown event takes place, the market may undergo correction," pointed out VK Vijayakumar, chief investment strategist at Geojit Financial Services.

The momentum may drive the BSE benchmark index to 73,000 level in the next few months, Equinomics Research founder Chokkalingam G says, as the recent victory of the Bharatiya Janata Party (BJP) in three state polls has stoked the optimism for its success in the general elections next year.

But, there was a note of caution over high valuation in his views as well. India was trading at premium valuations when compared to developed or emerging markets. "But it was justified on the grounds of India's strong GDP forecast of 7 percent growth for FY24 in a peaking interest rate scenario," he said.

Read: As Sensex tops 70,000 long-term momentum intact, but some profit booking possible

"Despite peaking out of interest rates, India is confident of growing at 6.5-7 percent. On the contrary, China, Japan, and European nations have been the victim of elevated rates as they trimmed their GDP forecasts," he added.

The return of foreign inflows, growing hopes of a stable government after the 2024 elections, retreating bond yields, easing crude oil prices, and strong macro-economic indicators have kept investors upbeat.

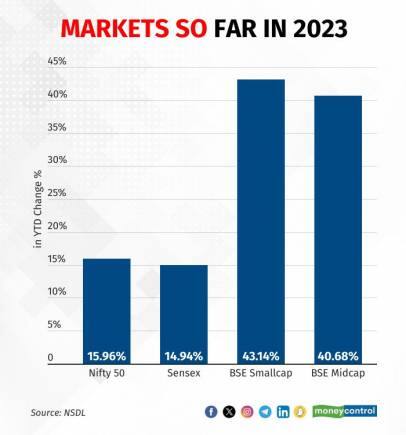

On the broader markets front, analysts saw exerted exuberance in mid-and smallcap pockets as against largecaps.

Also read: F&O Manual | Benchmarks shed early gains, trade in a range as more consolidation looks likely

Dwelling on the broader market dynamics, Deven Choksey, managing director of KR Choksey Holdings, said that he favours largecaps over mid-and smallcaps as they have been playing a catch-up after a strong July-September quarter and valuations remain attractive at over 15 percent.

On the other hand, Chokkalingam G said that he expects some correction in BSE Smallcap due to its valuation gap with the BSE Sensex. "The word of caution is broader markets as we expect correction substantially. The BSE Smallcap is trading about 30x premium as against the BSE Sensex. Historically, when there is a valuation gap between BSE Smallcap and BSE Sensex, corrections take place. We expect the trend to remain the same."

So far this year, the BSE Sensex and Nifty50 have jumped 14 percent and 15 percent. The BSE Smallcap and BSE Midcap indices, on the other hand, have soared 43 percent and 40 percent in this period.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!