Becoming the second-largest cement player in the sector hasn’t come cheap for the Adani Group. For Holcim’s stake in Ambuja and ACC, the group has paid $10.5 billion, which implies an EV/T of $164/tonne. This is the highest amount paid for a cement deal in the last few years. Ultratech Cement paid $150/tonne for Binani Cement in 2018.

Now, the new cement major will need to work on protecting its margins.

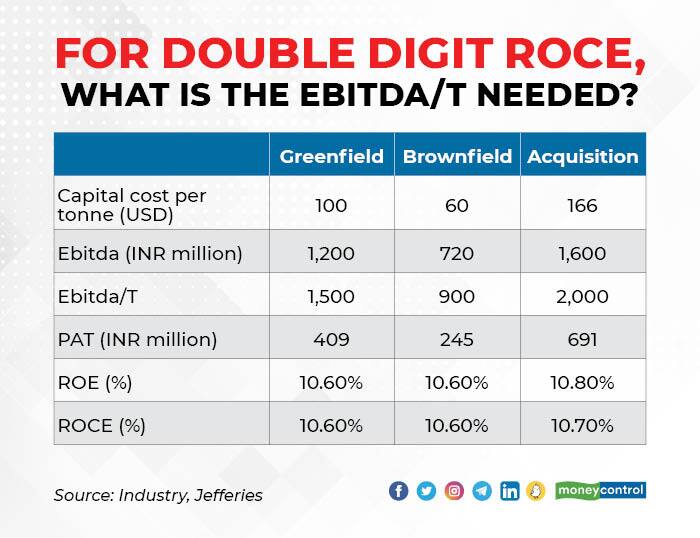

It may have to stick to the premium end of the market to deliver double-digit ROE and ROCE.

Greenfield and brownfield projects need to make an EBITDA/T of Rs 1,500 and Rs 900 respectively to deliver ROE and ROCE of 10.6%, according to a Jefferies report. The Adani Group entity will need to make an EBITDA/T of Rs 2,000 to get similar margins – of an ROE of 10.8% and an ROCE of 10.7%, it added.

A table in the report breaks it down (see below). This is because the capital cost per tonne, or the price paid by Adani, is far greater than what it would cost to put up similar capacities through greenfield or brownfield expansion. While greenfield and brownfield projects cost Rs 7,700 per tonne and Rs 4,620 per tonne, this acquisition has come at Rs 12,782 per tonne for Adani.

Source: Jefferies report; Graphics: Rajesh Chawla

Source: Jefferies report; Graphics: Rajesh Chawla

As the Jefferies report said, “While Adani's strategy would be keenly watched, premium valuations could mean higher targeted unit profitability, likely banking on maintaining brand premium, saving from royalty reduction and synergies from other group adjacencies.”

With profitability crucial, the brokerage does not see the Adani acquisition getting into a price war with competitors to gain market share. “As a result fight for market share by reducing cement prices is less likely, in our view by the acquirer given the average Ebitda/t is ~Rs1000 for both the industry and Ambuja+ACC,” it said.

To sustain profitability, retaining brand premium will be key, according to the report. Ambuja and ACC have a strong brand premium; in all markets, the brands feature among the top three, according to Jefferies. It has helped it cement its position in the trade-sales channel– it has a “very high trade sales component” of ~80%, according to the report. But, with a trend of non-trade sales catching on in the country, retaining the brand position will become all the more important, it added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!