Indian markets continued their sideways consolidation in April amid a surging second coronavirus wave in the country but strong global cues and robust earnings limited the losses.

The Nifty ended the month 0.4 percent lower. The broader market, however, outperformed the frontliners again, with the Nifty midcap index rising 2.12 percent and the smallcap adding 4.94 percent month-on-month.

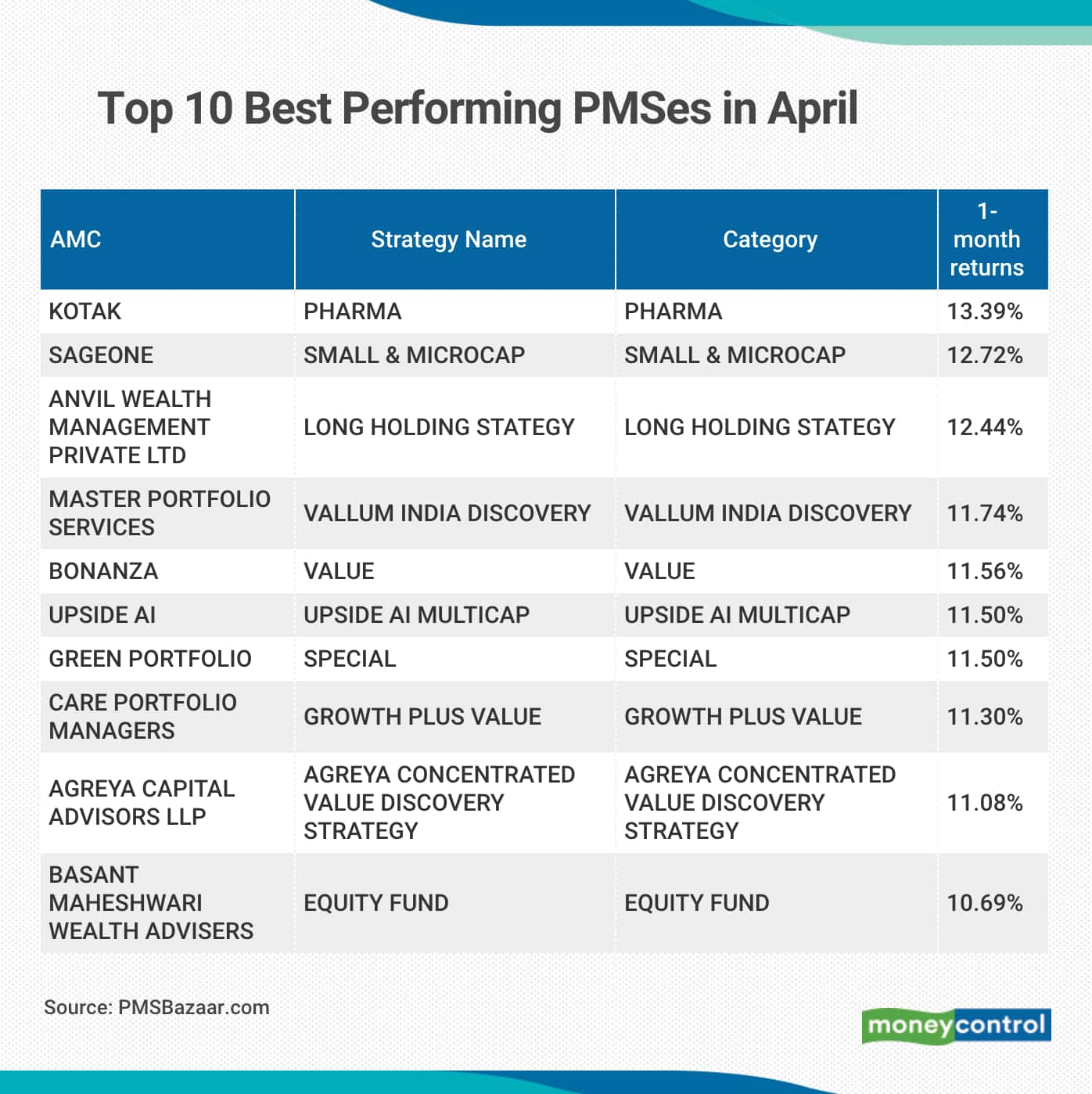

Despite a tepid market, about 85 percent of the portfolio management schemes (PMSes) managed did better than the Nifty in April. Of the 232 schemes PMSBazaar.com looked at, 185 (79 percent) generated positive returns during the month.

Portfolio management services cater to wealthy investors and the professional fee charged by them is higher than regular mutual funds.

Kotak Pharma was the top-performing scheme, rising 13.39 percent MoM. The sectoral fund managed by Anushul Saigal focuses on healthcare and pharma stocks and has Rs 35 crore of assets under management (AUM). It was also the best performing sectoral fund in March 2021 at 2.17 percent.

As of March 31, 2021, its top 5 holdings included Sun Pharmaceutical (18.45 percent), Dr Reddy's Laboratories (9.2 percent), Cipla (7.96 percent), Aurobindo Pharma (6.17 percent) and Hikal (5.91 percent).

Sageone Small & Microcap (12.72 percent), Anvil Wealth Management Private Ltd Long Holding Strategy (12.44 percent), Master Portfolio Services Vallum India Discovery (11.74 percent), Bonanza Value (11.56 percent), Upside AI-Upside AI Multicap (11.5 percent) and Green Portfolio Special (11.5 percent) were the other top performers in April.

Six of the top 10 funds were from the multicap space, three from mid and small-cap space and one was a sectoral fund.

In comparison, 46 funds slipped into the red in April, falling 4.75 percent, while one fund ended flat.

Who led the charge?

Of the 127 multicap funds, 89 outperformed the BSE 500. These include Anvil Wealth Management Private Ltd Long Holding Strategy (12.44 percent), Upside AI-Upside AI Multicap (11.5 percent) and Green Portfolio Special (11.5 percent).

About 63 percent of the largecap schemes beat the Nifty. ICICI Prudential Largecap Portfolio (5.42 percent), Varanium Capital Advisors Largecap Focused Fund (3.87 percent), Wize Market Analytics Capital Mind- Market Fund (2.93 percent) were some of the best performing largecap funds.

From the large and midcap space, Agreya Capital Advisors LLP Agreya Diversified Growth Strategy (6.55 percent), Bonanza Growth (2.49 percent), Care Portfolio Managers Large & Midcap Strategy (1.4 percent) were among the top gainers.

More than 51 percent of the midcap-focused funds outperformed the Nifty Midcap 100. These include Master Portfolio Services Vallum India Discovery (11.74 percent), NAFA Asset Manager Emerging Bluechip (8.51 percent) and Unifi Capital DVD (7.26 percent).

Of the 15 smallcap schemes PMSBazaar.com looked at, nine strategies outperformed the benchmark Nifty Smallcap in April. Sageone Small & Microcap, with gains of 12.72 percent, was the best performer in this space.

Accuracap Picopower (10.64 percent), Negen Capital Smappcap Emerging (9.04 percent) and NAFA Asset Manager Smallcap (8.39 percent) were some of the other top-performing smallcap schemes.

From the mid and small category, Geojit Financial Services Ltd Advantage Portfolio at 6.33 percent was the best performing PMS.

Green Portfolio MNC Advantage at 7.01 percent and Kotak Pharma at 13.39 percent led the charge in the thematic and sector fund category.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!