The borrowing cost of companies with lower ratings has risen sharply compared to higher-rated firms ever since the Reserve Bank of India (RBI) started raising the repo rate to fight inflation.

Returns on corporate bonds rated AA and lower have risen by more than 300 basis points (bps), while returns on A1 and lower-rated commercial papers have risen by 400-500 bps, according to data sourced from Prime Database showed.

One basis point is one hundredth of a percentage point.

On the other hand, borrowing rates for AAA-rated companies has risen by 150-170 bps.

Typically, ratings equal to or lower than AA signal that the instruments carry relatively higher risk compared to AAA ratings, which are considered most secure.

AAA is the highest rating, followed by AA. This is followed by an A rating.

Also read: Uday Kotak thinks central banks will hike rates for longer

What does data say?

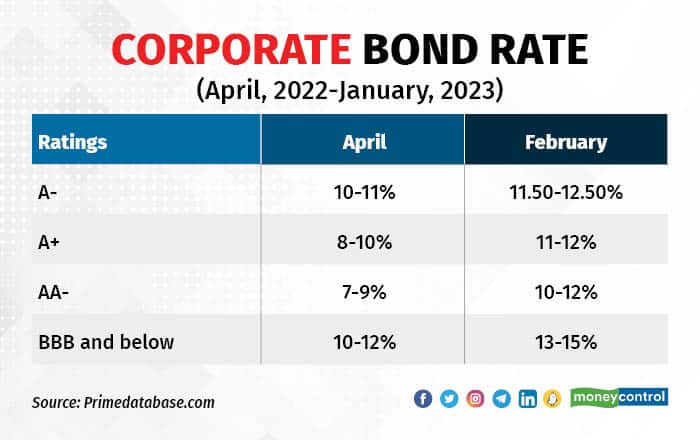

According to the data, corporate bonds rated 'A-' were trading at 10-11 percent last April, which has now risen to 11.50-12.50 percent. Similarly, A+ papers, which were trading at 8-10 percent, are now trading at 11-12 percent. The yield on bonds rated BBB and lower has jumped from 10-12 percent to 13-15 percent.

For instance, in the BBB category, Akara Capital Advisors had raised money at 11.04 percent in November 2022, but sold bonds at a 14 percent coupon rate in December, 2022.

Similarly, Annapurna Finance, rated A-, sold bonds at a coupon rate of 10.85 percent in July 2022, but offered a coupon rate of 12.20 percent when it sold bonds in September 2022.

Since the start of this financial year, corporate bonds worth Rs 1.03 lakh crore have been sold by companies rated AA and lower as on January 31, per data from Prime Database.

Companies rated A1 and lower raised Rs 2,474.15 crore in the same period.

RBI rate hike

Since May 2022, the RBI has raised the repo rate by 250 bps to 6.50 percent in order to tame higher inflation.

India's headline retail inflation rate jumped to a three-month high of 6.52 percent in January, from December's one-year low of 5.72 percent.

Retail inflation has returned to the 6 percent-plus territory after a two-month break. As for the medium-term target of 4 percent, CPI inflation has now been above it for 40 months in a row.

The CPI inflation eased in November and December to 5.88 percent and 5.72 percent, respectively, after remaining above the RBI’s upper tolerance band for the first 10 months of 2022.

Reacting to the inflation rate, most money market instrument yields have also risen. Banks have also increased their deposit and lending rates.

Also read: What will happen if Pakistan defaults on its debt?

Way ahead

In a report, India Ratings said that it expects short-term money market rates to stay elevated amid the seasonally strong credit demand. The agency attributed it to rate hikes by the central bank and falling liquidity in the banking system.

Presently, the liquidity in the banking system is in a deficit of around Rs 20,000 crore, said a dealer with a state-owned bank.

“We expect system liquidity to be the key guiding factor for the coupon rates, while the policy rate could stabilise at the current level,” the India Ratings report said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.