The companies that went public since last Diwali seem to have churned out bumper returns in a booming secondary market.

Out of the 56 companies that went listed since Diwali 2022 after collectively raising Rs 47,890 crore from the primary market, the shares of 48 firms are trading above their issue price, Prime Database shows. Seven companies have seen over 100 percent returns, nine delivered 50-100 percent, and 26 fetched 10-49 percent.

The IPO market had slowed down since January 2023 with no significant offerings, but regained momentum after March, when the local equity markets accelerated. Since April 1, both the benchmark Sensex and Nifty have gained around 10 percent. Out of the 56 IPOs between the two Diwalis, 38 stocks hit the Street after March.

Follow our latest coverage on Diwali and Samvat 2080 here

According to Deepak Jasani, head of retail research at HDFC Securities, the IPO market has done well over the past year, aided by buoyant secondary markets, and most public issues have opened and traded in the positive. Unlike in 2021, IPOs have been priced reasonably, leaving something on the table for investors. From manufacturing companies banking on the China+1 pivot and production-linked incentive schemes, and small finance banks to gold retailers and healthcare firms - all have seen brisk buying and attracted investor interest on listing.

Read: Vedanta to raise $1 billion by December end to repay bonds

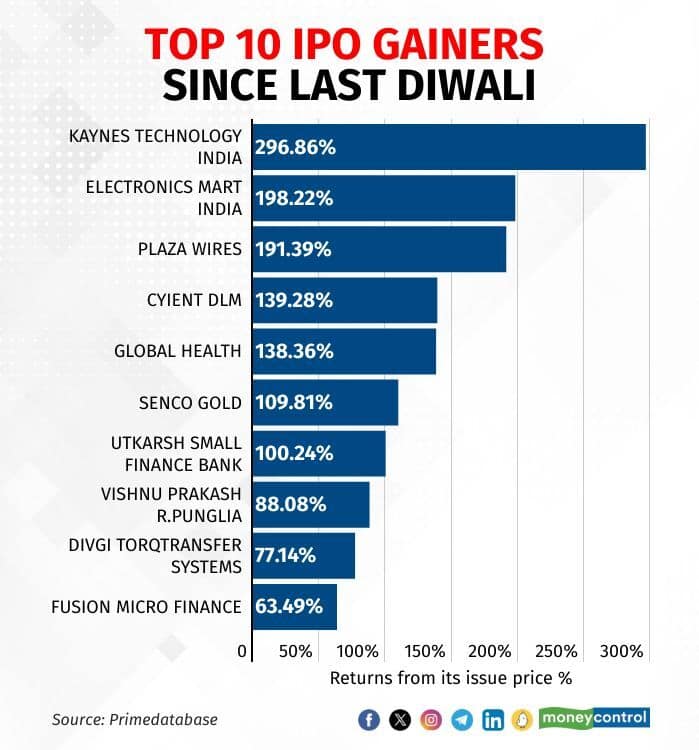

Kaynes Technology, which listed last November, is the top performing stock among these, followed by Electronics Mart, Plaza Wires, Cyient DLM, Global Health, Senco Gold, and Utkarsh Small Finance Bank.

Kaynes Technology listed at about a 17 percent premium and is now trades 296 percent above its issue price. Electronics Mart and Plaza Wire, that gained 43 and 48 percent on the listing day, trades 198 and 191 percent higher, respectively. Cyient DLM has so far spiked 139 percent, while Global Health surged 138 percent, Senco Gold 110 percent, and Utkarsh Small Finance Bank advanced over 100 percent.

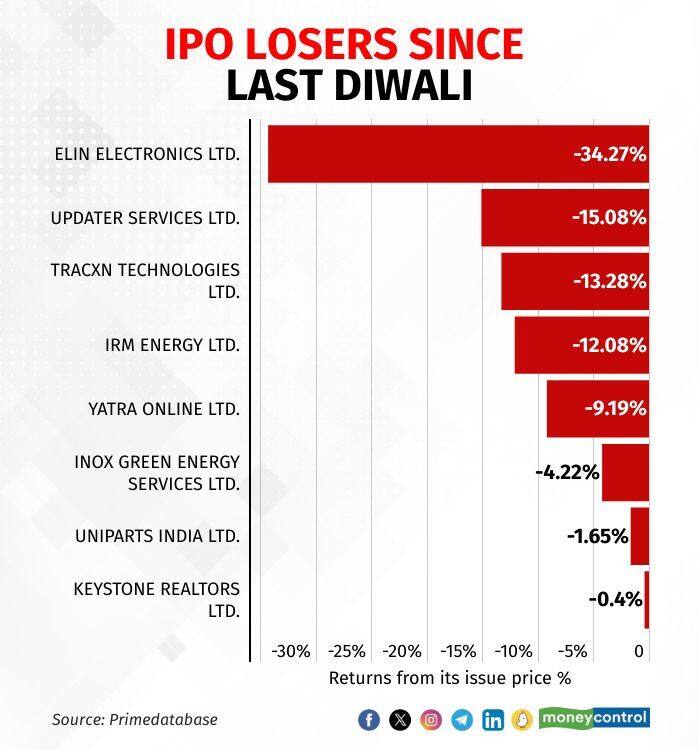

Elin Electronics has been the worst performer in this league, after Updater Services, Tracxn Technologies, IRM Energy, and Yatra Online. Elin Electronics, which listed at a 7 percent discount, is now down over 34 percent from its issue price. Updater Services has lost nearly 15 percent, Tracxn Technologies over 13 percent, IRM Energy is down 12 percent, and Yatra Online has tanked 10 percent.

However, Prashant Singhal, an EY Global member firm partner, notes that India's economy is thriving due to government initiatives. Secondary markets are mostly at all-time highs, reducing reliance on FII funding, due to strong market sentiment and macroeconomic indicators.

Several analysts predict sustained IPO momentum, driven by patient investors valuing long-term, profitable businesses.

Read: Buzzing Stocks: SBI, Indigo, Vedanta, Adani Ports, L&T, Bharti Airtel and others in news

There are 27 IPOs in the pipeline, which plan to sell Rs 32,000 crore worth of shares. Another 42 companies, looking to offer Rs 43,000 crore worth of shares, are awaiting the Sebi green light to go public.

Narendra Solanki, of Anand Rathi Shares and Stock Brokers, sees no major risks in the IPO, or the primary market, in the short term. Companies with strong valuations and growth potential will continue to draw investors, and a robust IPO pipeline is in the making, he said.

But analysts advise caution with the general elections coming closer. Retail investors should be selective during bullish phases, as underperforming companies might struggle if the optimism fades. Recent history shows that fintech IPOs suffered when secondary markets weakened, according to analysts.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.