There is heightened activity in the primary market, especially since the second half of calendar year (CY) 2020. With availability of ample liquidity, several companies have been in the queue for raising funds through initial public offerings (IPOs).

After easing lock down measures last year, 16 companies hit Dalal Street in the July to December 2020 period, raising Rs 20,773.3 crore.

Jyoti Roy - DVP- Equity Strategist at Angel Broking told Moneycontrol: "We expect a continued strong flow of IPOs in the coming quarters given the fact that the benchmark indices continue to hit all-time highs. We expect a strong global recovery in 2021, which will ensure continued capital flows to emerging markets like India."

Before the COVID crisis, SBI Card was the only company to garner Rs 10,355 crore through an IPO in early March 2020. Some other firms did not do as well. Antony Waste Handling Cell had withdrawn an IPO while Rossari Biotech decided to cancel their IPO press briefing at the eleventh hour in March.

The current year is turning out to be promising and optimistic; since the beginning of 2021, there has been rush of IPOs. Nine IPOs have already been launched with companies raising Rs 13,316.62 crore so far, through their maiden public issues.

Easy Trip Planners with an Rs 510 crore IPO is under subscription period now, while three more - Laxmi Organic Industries, Craftsman Automation and Anupam Rasayan - will open their IPOs in the coming days. The three, in total, are going to raise Rs 2,183.7 crore from the primary market. All the information is available in public domain.

A total of 16 companies have received approval from the capital market regulator, the Securities and Exchange Board of India (SEBI), to launch IPOs. Four of these companies have already announced dates while 12 are yet to come out with their IPOs.

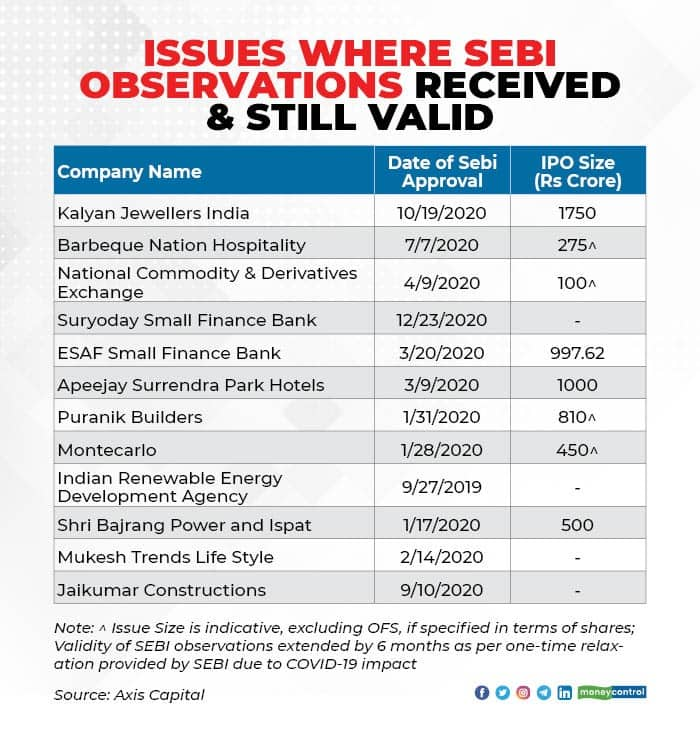

An Axis Capital report indicated that the 12 companies, which received SEBI’s nod, include Suryoday Small Finance Bank, Kalyan Jewellers India, Barbeque Nation Hospitality, National Commodity & Derivatives Exchange, ESAF Small Finance Bank, Apeejay Surrendra Park Hotels, Puranik Builders, Montecarlo, Indian Renewable Energy Development Agency, Shri Bajrang Power and Ispat, Mukesh Trends Life Style, and Jaikumar Constructions.

In late February, Moneycontrol reported a list of IPOs expected in March 2021. Of this list, five companies, including MTAR Technologies that closed issue last week, have already announced dates. The rest can hit Dalal Street any time or are waiting for the SEBI’S go ahead.

One of the reasons behind the rush of IPOs is the positive sentiment in the secondary market. The market already doubled from the lows of March 2020, driven largely by liquidity.

Since 2020, Indian equities have received more than Rs 2.2 lakh crore so far. Improving economic data points and better-than-expected corporate earnings are other key reasons that have attracted foreign institutional investor (FIIs) money, though now, rising US bond yields and increasing oil prices are acting as a risk to equity.

Added Angel Broking’s Roy: ``Continued strong global flows along with improvement in recovery in earnings in FY22 should lead to more upsides for India markets, which will create a positive environment for IPOs," he said.

Vaibhav Agrawal, Chief Investment Officer at Teji Mandi, said as market sentiments have revived after the COVID-19 pandemic, around Rs 1 lakh crore of public issues (excluding LIC) are waiting to hit the market in the near term as the Bull Run is likely to continue in the next financial year as well.

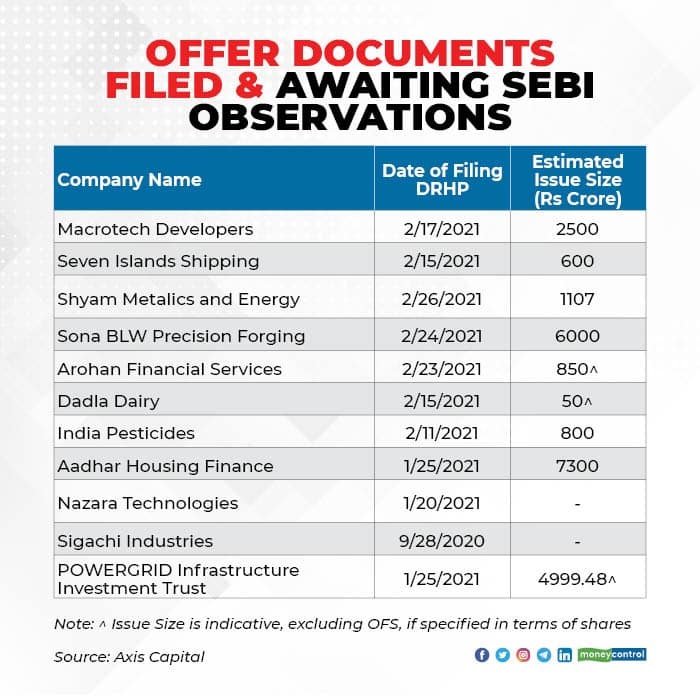

Axis Capital report indicated that 11 companies, including the POWERGRID Infrastructure Investment Trust, are awaiting SEBI approval to launch IPOs as majority of them filed draft red herring prospectus (DRHPs) in current year itself.

Macrotech Developers, Seven Islands Shipping, Shyam Metalics and Energy, Sona BLW Precision Forging, Arohan Financial Services, Dadla Dairy, India Pesticides, Aadhar Housing Finance, Nazara Technologies and POWERGRID Infrastructure Investment Trust filed their draft red herring prospectus with SEBI in January-February 2021, while only Sigachi Industries had filed a DRHP in September 2020.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!