The momentum of SME IPOs shows no signs of slowing down, despite concerns raised by various market participants and even the regulator about potential overvaluation in the segment.

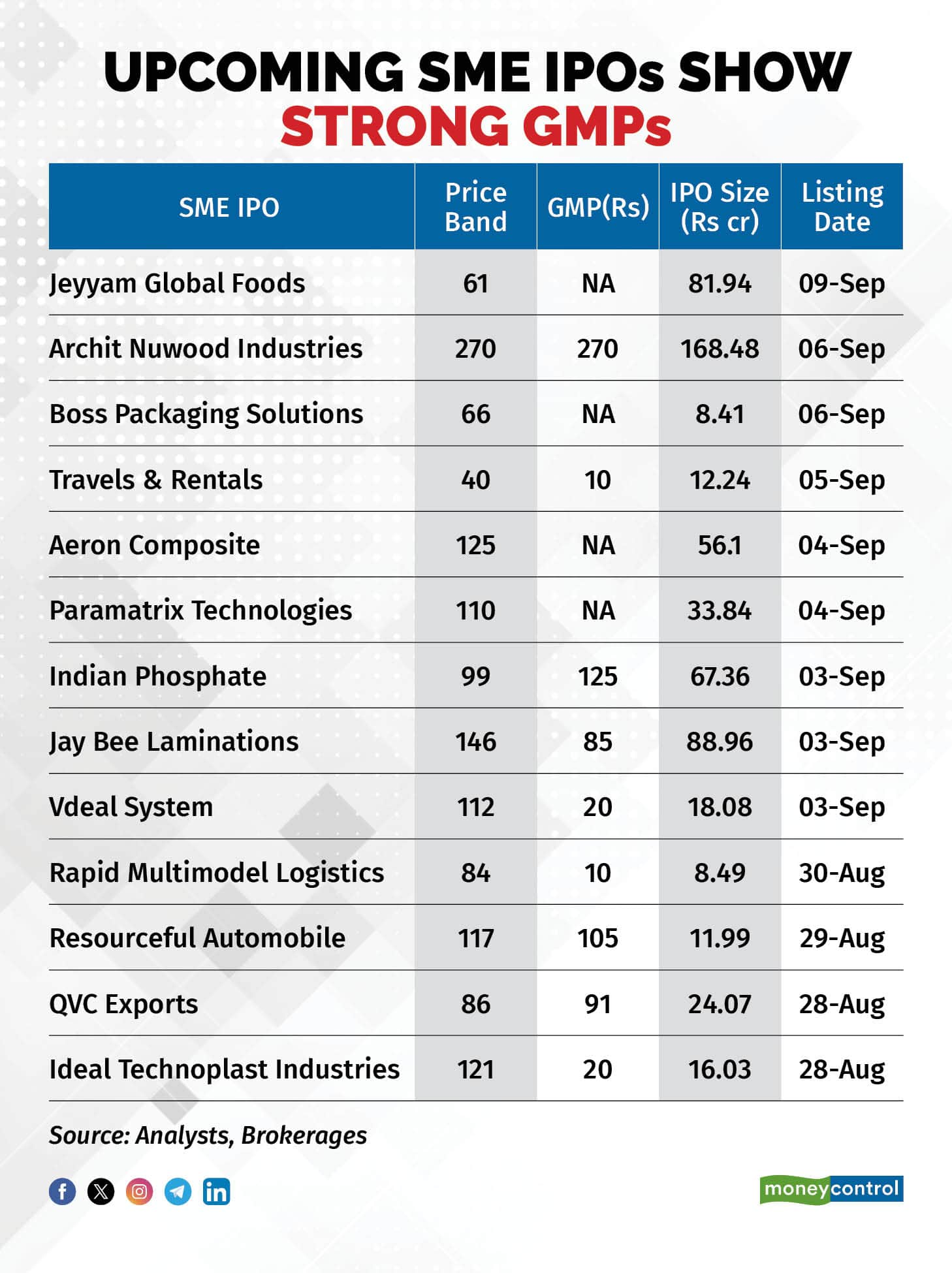

Currently, 13 SME IPOs are set to list soon, with many showing a robust grey market premium (GMP). Notably, four of these IPOs boast a GMP exceeding 100%, while another four are trading with a GMP between 25% and 60%.

Additionally, there are five SME IPOs for which grey market trading has not yet begun, but analysts are anticipating a strong premium once it does.

Market experts attribute the high investor interest in the SME IPO segment to the impressive performance of some recently-listed companies. However, they caution that investors should remain vigilant and exercise due diligence.

“The demand for SME IPOs has become absurd. In anticipation of listing gain, inflow is showering despite the quality of the paper. Oversubscription is leading to huge listing appreciation, which continues to rock the stock price as demand remains elevated post-listing. We can expect such a type of overenthusiasm to vanish over the medium term as the stock market rally consolidates,” said Vinod Nair, Head of Research, at Geojit Financial Services.

In terms of the grey market premiums, OVC Exports, which is set to list on NSE Emerge on August 28, has a GMP of Rs 91 per share, up from its price band of Rs 86. Resourceful Automobile, listing on BSE SME on August 29, shows a GMP of Rs 105 per share from its price band of Rs 117.

Indian Phosphate, listing on NSE SME Emerge on September 3, has a GMP of Rs 125 per share, up from its price band of Rs 99. Archit Nuwood Industries, listing on BSE SME on September 6, is trading at a GMP of Rs 270 per share, matching its price band.

Other SMEs with GMPs ranging between 10-90 percent include Ideal Technoplast Industries, Vdeal System, Jay Bee Laminations, and Travels & Rentals. Meanwhile, the GMPs for Jeyyam Global Foods, Boss Packaging Solutions, Aeron Composite, Paramatrix Technologies, and Rapid Multimodal Logistics have yet to open.

In 2024, SME IPOs have set a record with 173 listings raising over Rs 5,965 crore. In 2023, 182 SME IPOs were launched cumulatively raising Rs 4,684 crore.

Ajay Bagga, an independent analyst, explained that the SME segment poses minimal market risk since the amounts raised are small relative to overall market size and liquidity. The oversubscription trend is driven by ASBA’s “safe mode” investment process, where funds are only deducted upon actual subscription.

Investors are leveraging idle bank funds to buy a synthetic option, with the minimum return being their savings interest and the maximum being the potential 100 percent GMP gains, he says.

The combination of FOMO, liquidity, and a risk-reward scenario with potential 100 percent gains is attracting attention, but Bagga warns that investors should avoid chasing post-listing prices at inflated levels, which could lead to significant losses.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.