Fund mobilisation by India Inc came down by 26 percent in the first half of the current financial year from the same period of the previous year, data provided by Prime Database shows.

As many as 31 companies raised Rs 26,300 crore through main board initial public offerings in the April-September period against Rs 35,456 crore through 14 IPOs in the year-ago period.

“While we have seen companies from multiple sectors tapping the IPO market in the last six months, one key sector which was missing was BFSI with just Rs 1,525 crore (or 6 percent) being raised by companies from this sector,” Prime Database Group managing director Pranav Haldea said.

Banking, financial services and insurance firms accounted for 61 percent of the funds raised during the same period of the previous year.

Best IPOs of 2023: Here are the stocks that have gained the most after listing“Just one out of the 31 IPOs (Yatra) was from a new age technology company pointing towards a continuing slowdown in IPOs from this sector,” Haldea said.

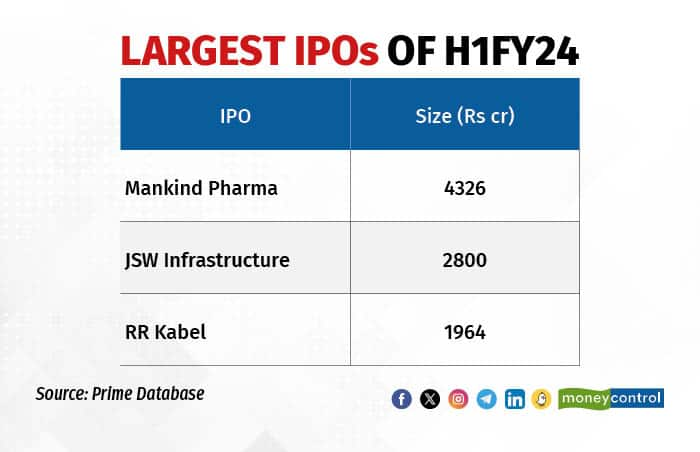

The IPO pieThe largest IPO in the first half of 2023-24 was the Mankind Pharma offer that raised Rs 4,326 crore. This was followed by JSW Infrastructure (Rs 2,800 crore) and RR Kabel (Rs 1,964 crore).

At the other end, the smallest IPO is from Plaza Wires, which is looking to raise Rs 67 crore. The offer, which opened on September 29, closes October 5.

The average deal size was Rs 848 crore. As many as 21 of the 31 IPOs came in just two months of August and September, highlighting the surge in activity as the market conditions improved.

Investor response to the IPOs was enthusiastic. Of the 28 IPOs for which data is available, 19 were subscribed more than 10 times and four were over three times.

Average listing gains, based on the closing price on listing date, increased to 29.44 percent in comparison to 11.56 percent in the first half of 2022-23.

Overall, public equity fundraising – including offer for sale (OFS), SME IPOs, InvITs, etc – increased by 69 percent to Rs 73,747 crore from Rs 43,694 crore in the first half of 2022-23, data shows.

Follow our market blog for more updatesDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.