November 2021 turned out to be great for the primary market as 10 main board companies closed their public issues during the month and reported a record fundraising of Rs 36,113 crore in a single month.

Funds raised in the year to November, too, were at a new high of Rs 1.14 lakh crore via 53 IPOs (initial public offerings), beating the previous best of Rs 74,035 crore seen in 2017. In fact, several new peaks were scaled following a healthy trend in the secondary market and a recovery in the economy after the COVID-19 crisis.

The year saw the decade’s highest number of IPO launches. One97 Communications, the operator of leading digital payments platform Paytm, boasted of the biggest ever IPO in the history of Indian capital markets, mobilising Rs 18,300 crore in November, contributing significantly to the month’s blockbuster fundraising, followed by food delivery giant Zomato’s Rs 9,375-crore IPO in July.

Policybazaar operator PB Fintech, Nykaa operator FSN E-Commerce Ventures, cement company Nuvoco Vistas Corporation, auto components maker Sona Comstar and PowerGrid Infrastructure Investment Trust were the other big IPOs of the year with fundraising of Rs 5,000 crore and more.

Click Here To Know All IPO Related News

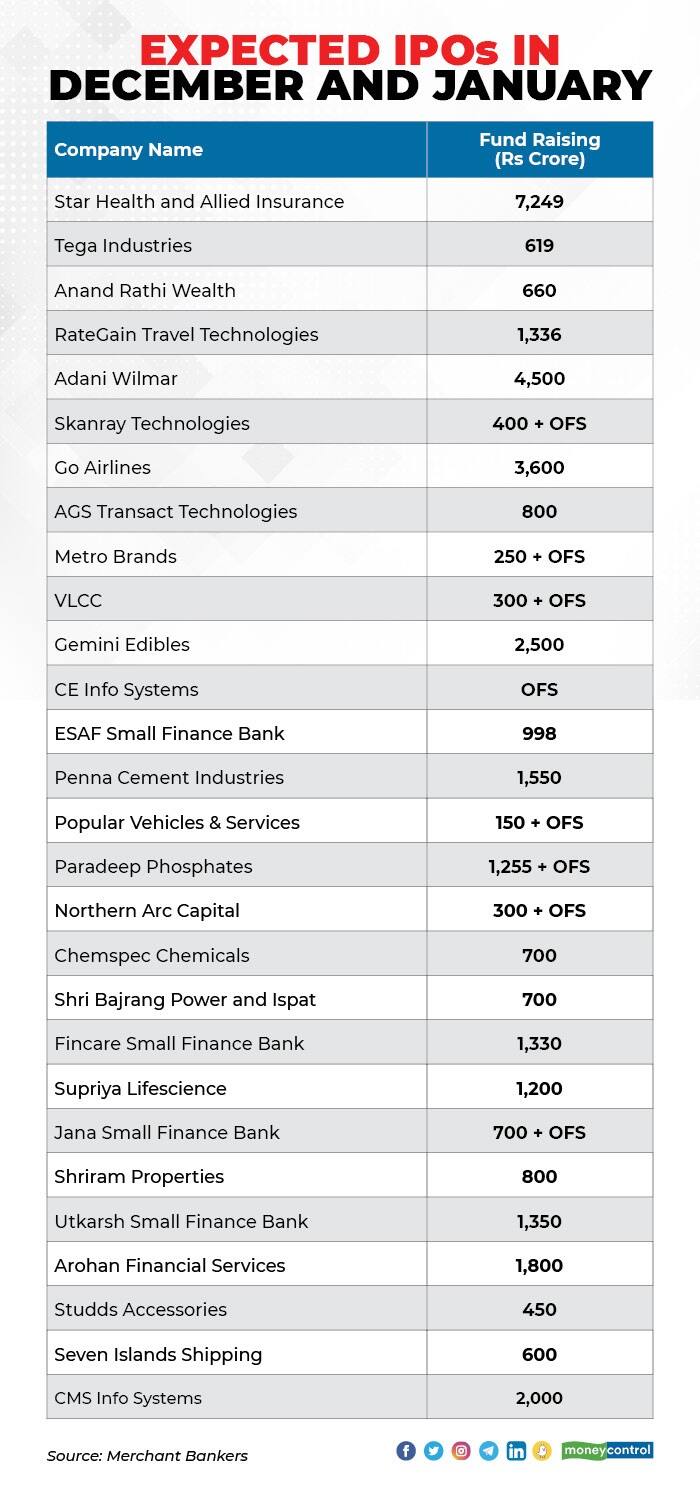

The primary market activity is expected to be strong in December as well. Experts anticipate at least eight companies to come out with share sales.

Ace investor Rakesh Jhunjhunwala-backed Star Health and Allied Insurance and Tega Industries have already opened their public offers for subscription, aiming to raise Rs 7,249 crore and Rs 619 crore, respectively. Anand Rathi Wealth will also open its Rs 660-crore offer on December 2 and RateGain Travel Technologies will launch its Rs 1,336-crore IPO in the coming week on December 7.

Also read: Anand Rathi Wealth IPO opens: 10 things to know before subscribing the issue

“Altogether, the primary market is projected to showcase IPOs of over Rs 30,000 crore in December 2021, subject to there being no deferments of IPO dates or size due to learnings from the Paytm listing and market correction,” said Vishal Balabhadruni, senior research analyst at CapitalVia Global Research.

In December, “There are around 8 to 10 big IPOs are planned including Star Health, Go Airlines, Adani Wilmar, Metro Brands, VLCC, Gemini Edibles and others,” he added.

Prashanth Tapse, vice-president, research, at Mehta Equities, believes 20-odd companies are in the IPO pipeline. “Out of these, as many as 10 companies are looking to launch their IPOs in December 2021 and rest in January 2022. Collectively, all these companies are expected to raise over Rs 35,000 crore,” said Tapse.

Also read: Tega Industries IPO: Should you subscribe to it?

Apart from the above-mentioned names, AGS Transact Technologies, Skanray Technologies, Paradeep Phosphates, Penna Cement, ESAF Small Finance Bank, Chemspec Chemicals, Fincare Small Finance Bank, Arohan Financial Services and CE Info Systems are among other companies waiting in the wings to launch IPOs.

The secondary market conditions have also remained strong during the year, though the benchmark indices have turned volatile and corrected sharply in the last couple of weeks amid weak global cues and selling by foreign institutional investors (FIIs). The Nifty50 has rallied more than 22 percent so far this year, though it corrected nearly 8 percent from its record highs touched on October 19.

FIIs pulled out nearly Rs 40,000 crore from the cash segment in November, on top of over Rs 25,000 crore of selling in the previous month. Now the market is facing the worry of new Covid variant Omicron that has already spread in more than a dozen countries, which could be another wrinkle in new listing plans.

“Following Paytm's feeble listing against investors' expectations and deferment of MobiKwik IPO on valuation concern and volatile secondary markets, I believe and remain cautious on upcoming IPOs weighing more risks on high valuation issuers,” said Tapse.

He added that given the market situation and performance of recently listed IPOs where several are trading below their issue prices, “I argue upcoming IPO issuers/book runners should rethink their listing pricing strategy before going public.”

He believes the primary market outlook largely depends on the secondary market mood and the mood is volatile in the near term, given concerns over high inflation risk, lower than expected Q2 earnings and weakness in global markets ahead of the US Federal Reserve's quantitative easing programme which could trigger a sell-off. "Going forward, sentiment is expected to remain cautious given the absence of fresh triggers and high valuation amid growing scepticism around new-age business valuation models,” he said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!