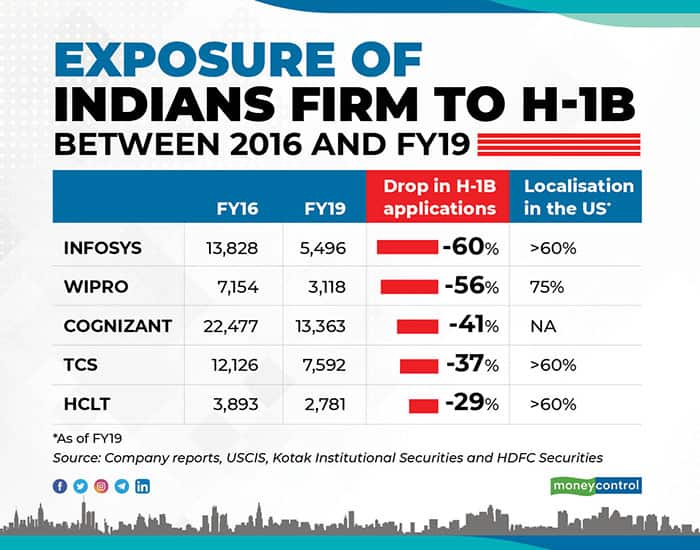

Top Indian IT firms have reduced their US visa dependency by 40-60 percent since President Donald Trump took office in 2017. In other words, the latest move by the American government to ban non-immigrant visas such as H-1B and L-1 may not make as big a dent as feared.

Share of Infosys in the H-1B pie fell the most, down 60 percent from 14,586 visas in FY17 to 5,496 in FY20. This is followed by Wipro at 56 percent, TCS at 52 percent and HCL Tech at 46 percent. For Cognizant, the drop in H-1B visas was 56 percent in FY19 compared to FY17.

This drop came on the back of increased denials and request for evidences due to stringent visa regulations in the US.

This resulted in companies stepping up their localisation efforts. Localisation in the US now stands at more than 60 percent for the top IT firms. According to experts, increased localisation will to an extent contain the damage caused by the disruption.

Currently, visa renewals of those in the US are unlikely to be affected. Till now denials and request for evidences or RFE, were high for renewals, resulting in many tech employees coming back to India. That will change and approval rates will increase. The new changes will come into effect in the next 90 days. Currently, on an average, only 70 percent of applications are approved.

This means that companies may not face a severe manpower crunch.

More offshoringAccording to many experts Moneycontrol spoke to, visa issues are likely to result in more offshoring in the coming years.

Institutional equities firm Emkay said in its report that revenue from offshore has been increasing since 2017.

For instance, Infosys' offshore volume growth in FY17 stood at 9.5 percent as opposed to 11.8 percent in FY20. In terms of revenues, offshore revenue growth stood at 6 percent compared to 8.2 percent for onshore. However, in FY20, offshore revenue growth was 9.3 percent as opposed to 6.7 percent onshore revenue growth.

As offshore volumes and revenues grow, experts added this trend is likely to stay.

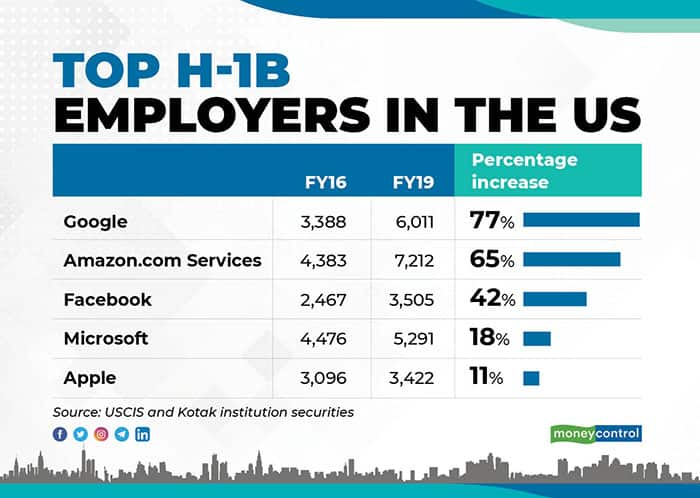

US tech firms will be hurtSheela Murthy, founder, Murthy Law firm, an immigration firm in the US, said in an earlier interaction that this shift would only hurt the US economy as not only Indian firms but also top US tech companies will look at countries like India to set up offshore centres.

The scenario is not too far off going by the recent H-1B approval rates. The top five US tech companies’ dependency on H-1B had increased 43 percent, whereas India’s dependency decreased by 50 percent over the last couple of years. Top employers include Amazon, Google, Microsoft, Facebook and Apple.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!