On August 13, Tamil Nadu Finance Minister P Thiaga Rajan announced a state tax cut on petrol by Rs 3 per litre as part of the 2021-22 state budget. The cut will result in a loss of Rs 1,160 crore a year to the state exchequer.

At a time when petrol and diesel prices are reaching record highs across the country due to incessant hikes in rates since May, this move will come as a relief to the residents of Tamil Nadu.

In February 2021, states like West Bengal, Assam, Rajasthan and Meghalaya had decided to cut taxes on fuel. However, Tamil Nadu is the first state to have cut fuel taxes in fiscal year 2021-22. This could have larger repercussions for the political economy of India.

Major source of revenue

Central and state-level taxes contribute about 55 percent of the retail price of petrol and 51 percent for diesel. Apart from central and state taxes, fuel prices also include freight charges and dealer commission. The tax component includes customs duty, excise duty and value-added tax by the state governments.

The Centre’s excise duty collection in 2020-21 was Rs 3.9 lakh crore, about 62 percent higher than the Rs 2.4 lakh crore in 2019-20. Out of the Rs 3.9 lakh crore, Rs 3.45 lakh crore was collected only in excise duties on petroleum products.

The Centre levies duties on petrol and diesel, which are at an ad valorem basis, and not absolute figures, and, hence the rise and fall with the price of crude oil. The petroleum excise duties collected by the Centre was Rs 1.98 lakh crore in 2019-20 and Rs 1.78 lakh crore in 2018-19.

In just the April-June quarter of the current financial year, the Centre collected about Rs 94,181 crore in revenue through excise duties on petrol and diesel. Currently, the Centre’s excise duties on unbranded petrol stand at Rs 32.90 per litre, and on diesel, it is Rs 31,80 per litre.

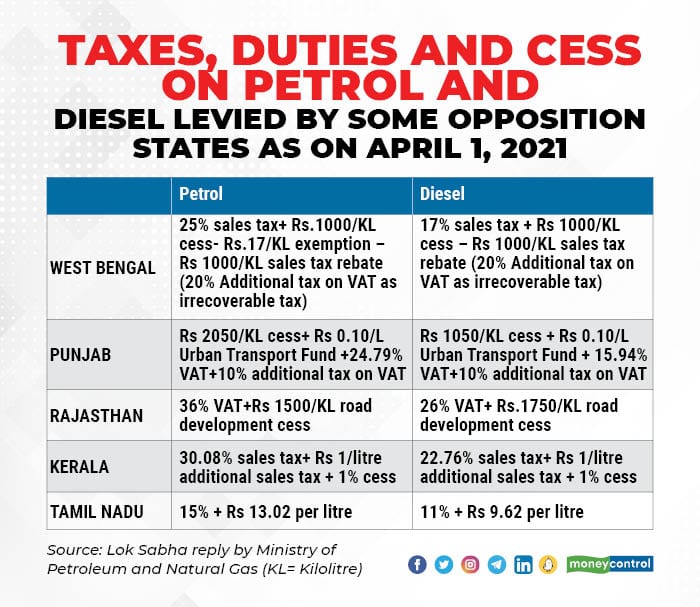

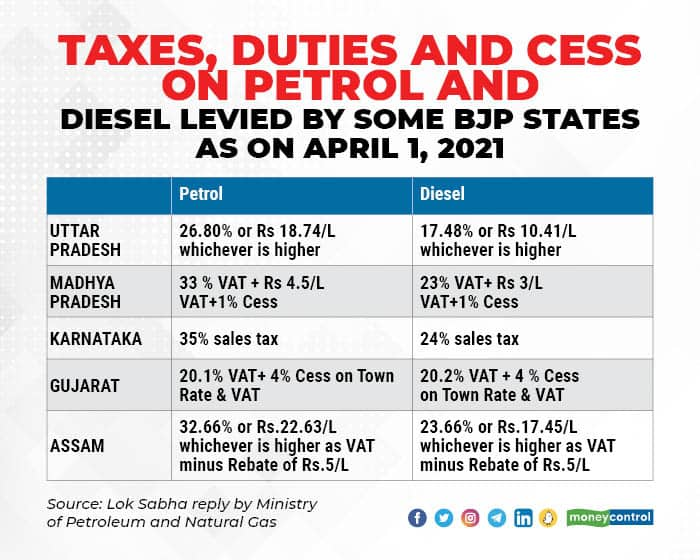

States have also used their taxation power on fuel to raise resources. The price of fuel differs from state to state, depending on the rate of local taxes like VAT and also freight charges in that state, as the attached charts show.

Data from the government’s Petroleum Planning and Analysis Cell (PPAC) shows that contribution to the state exchequer in the form of sales tax and value-added tax of petroleum, oil, and lubricants has increased by 46 percent from Rs 1.37 lakh crore in 2014-15 to Rs 2 lakh crore in 2019-20. For the first nine months of 2020-21, it was seen at Rs 1.36 lakh crore.

TN’s price cut may have political reverberations

High petrol and diesel prices have impacted retail inflation and eaten into household savings. Consumer Price Index-based inflation for the month of July, released just a day earlier, showed that while headline retail inflation has come down, many food sub-groups remain high due to transportation costs, and fuel and light and transportation and communication also remain at an elevated level.

An issue which should have been there for the taking, which the opposition parties could have capitalised on, has not really gained traction. ‘Mehengai’ the Hindi word for inflation, is a powerful, emotive word in Indian politics, especially the heartland.

But beyond social media and a few isolated street protests, the issue of high prices leeching into savings of the middle class and poor is not something the opposition has really focused on.

The reason for this is that opposition would be caught in a catch-22 situation if it confronts the government on petrol and diesel prices. After all petroleum excise duties are the proverbial drug which their states are as addicted to as the ones ruled by the Bharatiya Janata Party.

Any direct attack by the opposition would theoretically invite the retort from the Centre that the opposition-ruled states should walk the talk and cut their own duties and value-added tax first.

This is what Tamil Nadu’s fuel price cut has side-stepped. Now that the southern state has cut prices, it could be an indication to other opposition states to do the same, especially Congress-ruled Rajasthan, which has one of the highest taxes charged by states.

This is a move which could also force the Centre to bite the bullet, and could force the Union Finance Ministry into reducing excise duties as well. Will it though? And will the other opposition and BJP-ruled states cut their share of taxes? Watch this space.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.