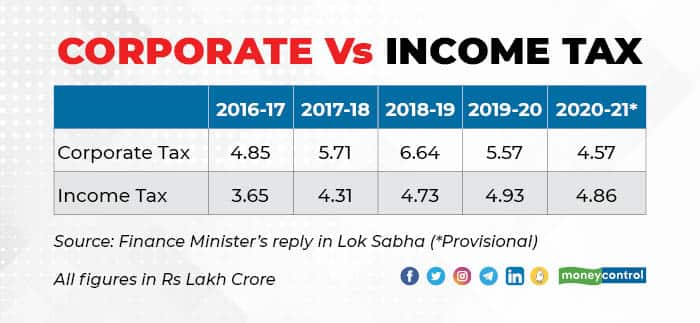

Provisional corporate tax collection in 2020-21 was Rs 4.57 lakh crore, while taxes from income came in at Rs 4.86 lakh crore. In 2018-19, corporate tax collections had touched Rs 6.64 lakh crore while income tax collections were Rs 4.73 lakh crore.

This and other data were tabled by Union Finance Minister Nirmala Sitharaman in the Lok Sabha on August 2 as a written reply. The question, on revenue collections over the past five years, was asked by Bharatiya Janata Party’s (BJP) Kanpur Member of Parliament (MP) Satyadev Pachauri.

As expected, both income and corporate tax collections were lower in 2020-21, compared to 2019-20. While income tax collections reduced by Rs 7,000 crore, corporate tax collections fell by a massive Rs 1 lakh crore.

In September 2019, Sitharaman had cut corporate tax rates for existing and newly incorporated companies to 25 percent and 15 percent, respectively, for those not seeking exemptions.

The corporate tax cuts, coupled with the economic impact of COVID-19 and the lockdown in April-June 2020, impacted taxes collected from companies to quite a large extent, as data shows.

But what of devolution to states?

The data tabled by the finance minister showed that the states’ share of the divisible tax pool was Rs 5.95 lakh crore in 2020-21, down from Rs 6.51 lakh crore in 2019-20. The highest devolution to states since 2016-17 was Rs 7.61 lakh crore in 2018-19.

On the other hand, the Centre’s net tax revenue last fiscal year was Rs 14.24 lakh crore, compared with Rs 13.57 lakh crore in 2019-20 and the highest in the past five years.

“There are two important facts at play here. First, the share of states as mandated by the 15th Finance Commission is less by one percentage point after two Union territories were created from the state of Jammu and Kashmir. Second, there has been a substantial increase in the share of cess in taxes,” said Devendra Kumar Pant, Chief Economist, India Ratings.

The 15th Finance Commission, in its reports for 2020-21 and 2021-22 to 2025-26, has recommended the reduction in devolution to states to 41 percent of the divisible tax pool, compared with the earlier 42 percent.

This 1 percent reduction has been due to the erstwhile state of Jammu and Kashmir now being the Union territories of J&K and Ladakh. Union territories get money from the Centre’s share of the divisible pool.

However, various cess collected by the Centre, like Krishi Kalyan cess, infrastructure cess, and health and education cess are not part of the divisible pool, and, hence, not shared with the Centre.

An important number in the data shared by Sitharaman was the Union excise duty collection in 2020-21, which was Rs 3.9 lakh crore, a staggering 62 percent higher than the Rs 2.4 lakh crore in 2019-20, and slightly higher than the Rs 3.82 lakh crore garnered in 2016-17.

Out of the Rs 3.9 lakh crore, Rs 3.45 lakh crore was collected only in excise duties on petroleum products as reported earlier. The Centre levies duties on petrol and diesel, which are at an ad valorem basis, and not absolute figures, and, hence the rise and fall with the price of crude oil.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.