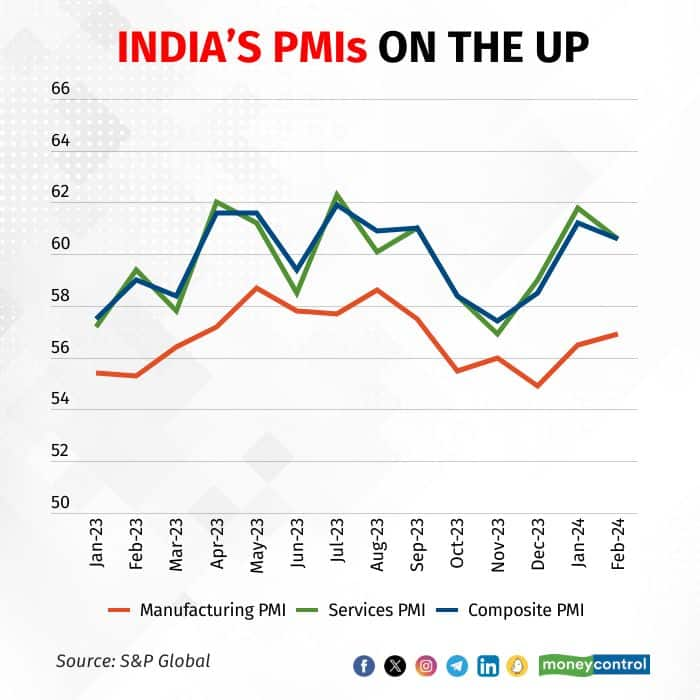

India's services activity continued to expand in February, with the HSBC Purchasing Managers' Index (PMI) for the sector coming in at 60.6, data released on March 5 showed.

At 60.6, the February services PMI is below the flash estimate of 62.0 released on February 22. It is, however, above the key level of 50, which separates expansion in activity from contraction, for the 31st month in a row.

The services PMI stood at 61.8 in January.

"India's services PMI suggests that the pace of expansion in the services sector eased in February from January. Due to a slowdown in growth in new orders and output, services companies' outlook for future business activity, while remaining strongly positive, weakened slightly," said Ines Lam, an economist at HSBC.

According to S&P Global, which compiles the index, there was a "notable upturn" in demand across the service sector in February, although the rate of increase in demand was lower than in January. External demand, meanwhile, rose for the 13th month in a row and at a pace that was "among the best in the nine-and-a-half-year series history", S&P Global said.

At the same time, while the order backlog of Indian service providers rose in February again, it did so at the weakest rate in three months. This hurt recruitment, with hiring growth slowest in 21 months.

"Survey members mostly indicated that workforce numbers were sufficient for current requirements," S&P Global said.

Like the services index, the composite PMI also eased to 60.6 in February from 61.2 in January, with data released on March 1 showing that the manufacturing PMI last month was at a five-month high of 56.9.

Even as the services and composite activity indices edged lower in February, there was better news on the inflation front, with the increase in prices charged by services firms being the least in two years.

This was on the back of firms' operating expenses rising in February at the second-weakest rate in three-and-a-half years.

Also Read: Case for rate cuts strong if inflation keeps declining, says MPC's Ashima Goyal

"Higher food, freight and labour costs pushed up input prices, according to anecdotal evidence," S&P Global said.

The fall in inflation faced by consumers for services will add to policymakers' belief that their focus on prices is having the desired effect. Data released on February 12 showed Consumer Price Index (CPI) inflation declined to a three-month low of 5.10 percent in January, with core inflation at an over-four-year low of 3.6 percent. CPI inflation data for February will be released on March 12.

On February 8, the Reserve Bank of India's Monetary Policy Committee left the repo rate unchanged at 6.5 percent for the sixth meeting in a row. While inflation is finally seen easing to the medium-term target of 4 percent in July-September before rising again to 4.6-4.7 percent in subsequent quarters, economists are increasingly of the opinion that India's faster-than-expected growth rates gives the Indian central bank more time to allow inflation, especially food inflation, to cool down on a durable basis.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!