India’s falling currency may still have a silver lining for its federal government. Analysts are penciling in another year of windfall dividend by the Reserve Bank of India courtesy the profits earned on selling massive amounts of dollars in its attempt to support the rupee.

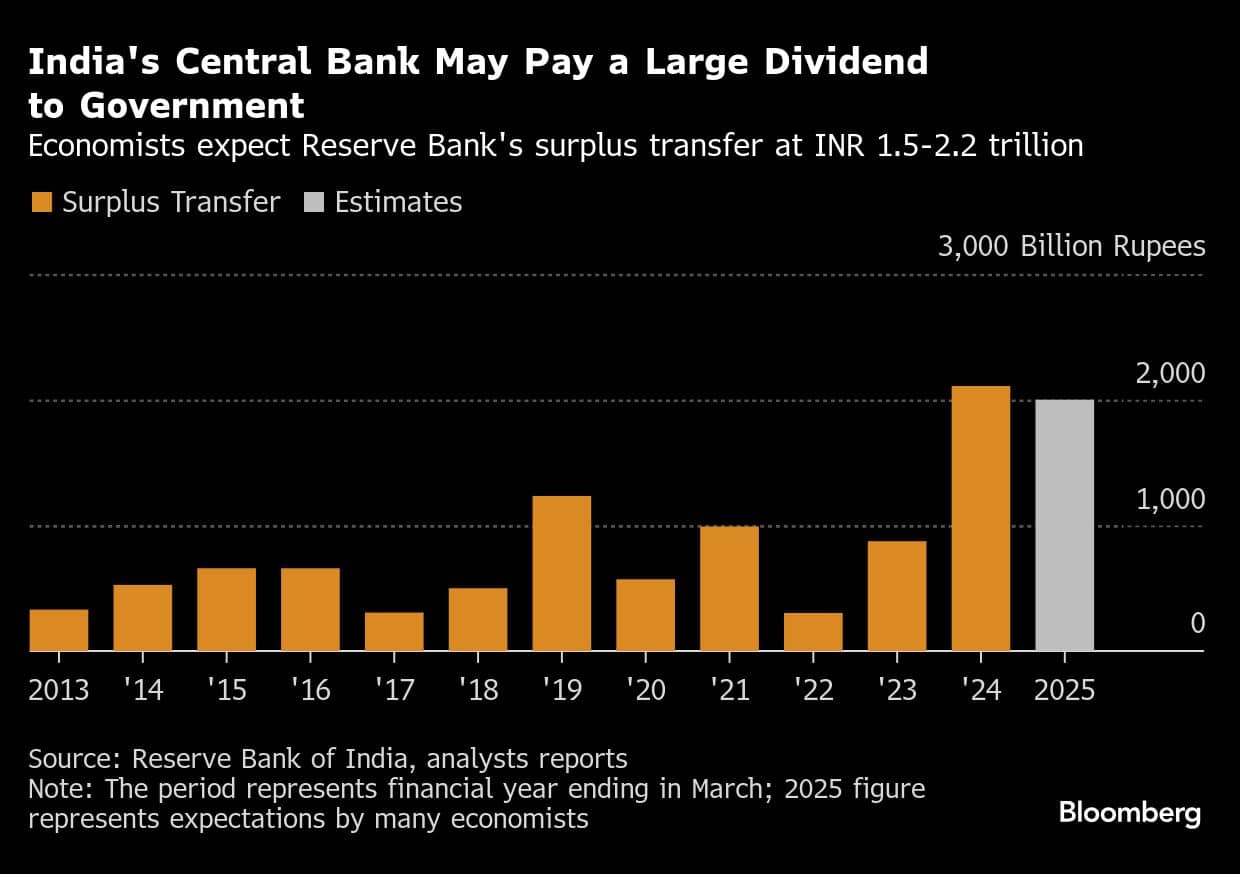

IDFC FIRST Bank estimates Rs 2 lakh crore of payout by the RBI while QuantEco Research pegs the dividend around Rs 1.5 lakh crore for the fiscal year that ends March. The payout stood at Rs 2.1 lakh crore in the earlier year. The dividend transfered for this year will be taken for next year’s budget accounting.

The likely bonanza comes at a crucial time as the government is trying to revive an economy weighed down by weak consumption, anemic private sector investments and moderating tax revenues.

The RBI has been selling dollars through the past year to cushion the depreciating rupee. It sold gross $196 billion of forex during April-November against $113 billion in the same period last year, according to IDFC First. The figure for the full financial year through March could be closer to $250 billion, estimate Standard Chartered Plc. economists led by Anubhuti Sahay.

The dollar sales are profitable for the RBI as the greenbacks were acquired at a cheaper exchange rate in the past. The profits, however, are hard to quantify as the the RBI doesn’t disclose the average acquisition value.

“The RBI is expected to maintain elevated dividend levels, likely around two trillion rupees, supported by increased income from foreign exchange transactions as it sold more dollars to stabilize the rupee in 2HFY25,” ICICI Bank economists led by Sameer Narang wrote in a note.

Under former Governor Shaktikanta Das, the monetary authority built up a record reserve pool of $705 billion in September. The stockpile has since fallen to $626 billion as the central bank sold dollars to quell the rupee volatility in the wake of Donald Trump’s re-election as US President.

Trump’s pledge to impose hefty tariffs on imports into US boosted the dollar and sent other currencies tumbling. The rupee fell to a record low of 86.7025 earlier this month.

Full year earnings from foreign exchange transactions for RBI are estimated at 1.85 trillion rupees in the fiscal year as against 836 billion rupees in fiscal 2024, according to IDFC FIRST estimates.

Some economists, however, said the dividend transfer could have been much higher but for the central bank’s need to set aside more money as provisions to account for an expanded balance sheet.

“The RBI may choose to transfer a higher amount to reserves for contingency provisions, which would reduce the dividends available,” wrote Nomura Holdings economists led by Sonal Varma in a note last week. “Overall, we do not expect any major adverse impact on the RBI’s dividend transfer to the government, though the quantum should be lower.”

Standard Chartered’s Sahay sees the economy’s reliance on RBI dividends likely remaining high, at around 0.5%-0.55% of gross domestic product against the usual norm of 0.1%-0.4% of GDP.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.