The Reserve Bank of India (RBI) on August 6 revised upward to 5.7 percent the estimate for Consumer Price Index (CPI) inflation for the financial year (FY) 2022 from its earlier projection of 5.1 percent.

At its bi-monthly policy review, the bank held the repo rate at 4 percent and the reverse repo rate at 3.35 percent and also retained GDP growth target at 9.5 percent.

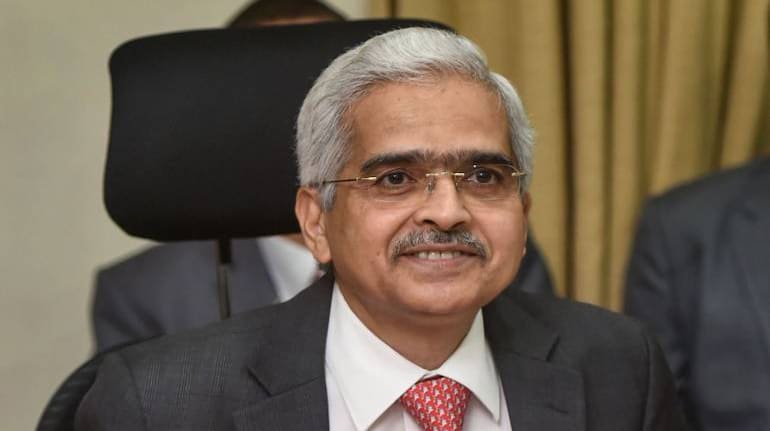

"The supply-side drivers could be transitory. Pre-emptive monetary policy response at this stage will kill the nascent recovery. Inflation may remain close to RBI's upper tolerance band until Q2FY22," RBI Governor Shaktikanta Das said.

The inflation is expected to be at 5.1 percent for Q1, 5.9 percent in Q2, 5.3 percent in Q3 and 5.8 percent in Q4 of FY22.

"Inflation may remain close to the upper tolerance band up to Q2 of 2021-22, but these pressures should ebb in Q3 2021-22 on account of kharif harvest arrivals and as supply-side measures take effect," Das said.

Follow LIVE Updates of the RBI Monetary Policy decision here

Consumer Price Index-based inflation (CPI) for June rose 6.26 percent, as food prices hardened and transportation costs rose due to hike in fuel prices. The June print was a tad lower from 6.3 percent in May, which was the highest in six months, but was still above the bank's comfort band of 2-6 percent.

Das said high-frequency food price indicators showed some moderation in prices of edible oils and pulses in July on the back of supply-side interventions by the government.

"The combination of elevated prices of industrial raw materials, high pump prices of petrol and diesel with their second-round effects, and logistics costs continue to impinge adversely on cost conditions for manufacturing and services, although weak demand conditions are tempering the pass-through to output prices and core inflation," he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!