August 06, 2021 / 15:59 IST

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments:

The Nifty took a breather today which is possibly due to the weekend knocking on the doors. The overall trend of the market continues to remain bullish and any dip or correction should be utilized to go long. 16,300 is the short term resistance which was crossed yesterday and today as well. If we can keep above that level, the index should zoom to 16,500-16,600.

August 06, 2021 / 15:58 IST

Ashis Biswas, Head of Technical Research at CapitalVia Global Research:

The market witnessed some lackluster movement and an attempt to hold the support level around the Nifty 50 Index level of 16200. The expected levels of the market are likely to be in the range of 16200 and 16500, and it is going to be crucial for the short-term market scenario to sustain above the 16200 Nifty50 Index level. The momentum indicators like RSI and MACD indicating a positive outlook to continue.

August 06, 2021 / 15:37 IST

Rupee Close:

Indian rupeeendedflat at 74.15 per dollar, amidsellingsawin thedomestic equity market after theReserve Bank of India (RBI) has kept the key rates unchanged.

It opened 7 paise higher at 74.10 per dollar against Thursday's close of 74.17 and traded between 74.08-74.22

August 06, 2021 / 15:34 IST

Market Close

: The benchmark indices ended lower on August 6 after Reserve Bank of India (RBI) has kept the repo rate unchanged at 4 percent and also maintained policy stance as ‘Accommodative’.

At close, the Sensex was down 215.12 points or 0.39% at 54277.72, and the Nifty was down 56.40 points or 0.35% at 16238.20. About 1728 shares have advanced, 1400 shares declined, and 120 shares are unchanged.

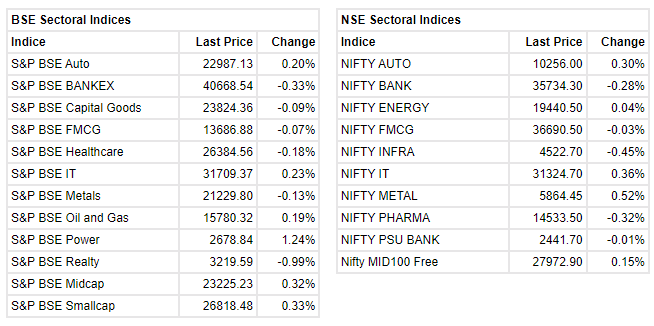

On the sectoral front, the metal, auto and IT indices ended higher, while selling was seen in the pharma, FMCG and infra names.

The midcap and smallcap indices rose 0.2 percent each.

Cipla, Reliance Industries, Shree Cements, UltraTech Cement and SBI were the top Nifty losers. IndusInd Bank, Adani Ports, IOC, Bharti Airtel and Tata Consumer Prodcts were among the top gainers.

August 06, 2021 / 15:34 IST

Mohit Ralhan, Managing Partner & Chief Investment Officer, TIW Private Equity:

RBI has maintained the accommodative stance indicating that the primary focus area remains growth and economic recovery is more critical than inflation. This was on expected lines as RBI has been demonstrating sustained commitment to growth. The September and December quarters are critical given the risk of third wave of COVID-19 and RBI has implemented proactive measures to maintain adequate liquidity in the system.

The markets are in strong bull phase indicating significant confidence on India’s growth prospects and RBI’s policy stance extends a strong support to it.

August 06, 2021 / 15:25 IST

Berger Paints Q1 results:

The company has posted net profit at Rs 140.5 crore versus Rs 15.1 crore and revenue was up 93.2% at Rs 1,798 crore versus Rs 931 crore, YoY.

Berger Paints India was quoting at Rs 821.40, down Rs 16.90, or 2.02 percent on the BSE.

August 06, 2021 / 15:20 IST

Madhavi Arora, Lead Economist, Emkay Global Financial Services:

The MPC expectedly kept the key rates unchanged unanimously and reiterated its accommodative stance both on rates and liquidity. However one dissent on continuation of accommodative stance for foreseeable future shows the emerging split getting generated within the MPC. The MPC maintained that growth is still sub-par and needs consistent firm traction, and that continued policy support is vital for a durable growth revival.

However despite emerging inflation risks and sharp upward revision in FY22 inflation, MPC retained the view that inflation has transitory aspects, led by supply-side bottlenecks, even when they see inflation hugging the higher end of their tolerance band in the near term.

However, the focus was on Communication on liquidity management key amid evolving market risks and the yield curve management. The RBI reaffirmed longer tenor VRRRs as the first step toward normalization amid current bumper liquidity surplus and reinstated that the normalization of liquidity operations should not be confused with liquidity tightening.

August 06, 2021 / 15:16 IST

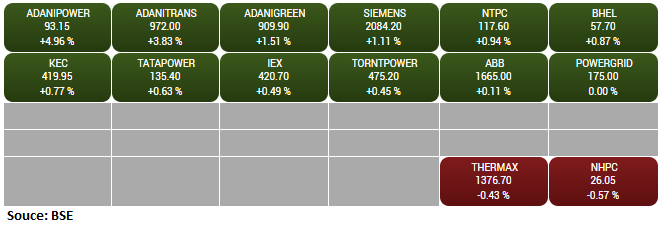

BSE Power index rose 1 percent led by the Adani Green, Adani Transmission, Adani Green:

August 06, 2021 / 15:14 IST

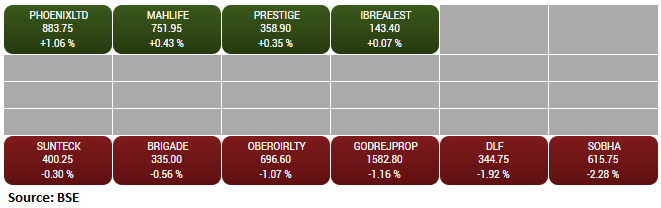

BSE Realty index shed 1 percent dragged by the Sobha, DLF, Godrej Properties

August 06, 2021 / 15:09 IST

Devyani International IPO issue subscribed 44 times on final day

The initial public offering (IPO) public issue of Devyani International, the operator of quick-service restaurants chain KFC and Pizza Hut, continues to receive a strong response from investors as the issue had been subscribed 44.41 times by the afternoon of August 6, the last day of bidding.

The offer has garnered bids for 499.95 crore equity shares against an IPO size of 11.25 crore equity shares, generating bids of Rs 44,995 crore, the subscription data available on exchanges showed.

Retail investors have gone big on the IPO subscribed their portion 33 times. The portion set aside for employees was subscribed 3.96 times.

August 06, 2021 / 15:07 IST

Richa Agarwal - Senior Research Analyst, Equitymaster

It is good to see more and more getting listed and becoming public across sectors amid the ongoing market rally and IPO rush.

However, we see this more as a long term option than a profitable proposition at current juncture.

Most of these IPOs are priced at exorbitant valuations that we would not be comfortable paying for even well established companies and promoters with a track record. We don’t think it will be prudent to compromise on margin of safety. We would rather wait to see how this companies perform on execution front post listing, and would prefer to enter at reasonable valuations for the ones that do well.

August 06, 2021 / 15:01 IST

Market at 3 PM

Benchmark indices trading near the day's low level with Nifty below 16250.

The Sensex was down 222.30 points or 0.41% at 54270.54, and the Nifty was down 52.70 points or 0.32% at 16241.90. About 1640 shares have advanced, 1297 shares declined, and 94 shares are unchanged.