A change in Indian monetary policy may not be far away, the Reserve Bank of India's (RBI) latest monthly bulletin has indicated.

The Monetary Policy Committee's (MPC) October 6 resolution "reflects the approaching of an inflection point in the conduct of monetary policy in India". An inflection point is a moment when a significant change takes place.

Also Read: Four years of 4%-plus inflation – how RBI lost and is regaining controlAt the same time, the RBI bulletin mentioned that it is "too early to declare victory" and that there are "many miles to go".

After hiking the policy repo rate by 250 basis points to 6.5 percent in 2022-23 to bring down inflation, the MPC left the interest rates unchanged for the fourth meeting in a row on October 6. Economists are now penciling in the first interest rate cut around April-June 2024, although the central bank's hawkish focus on the 4 percent inflation target has left markets concerned.

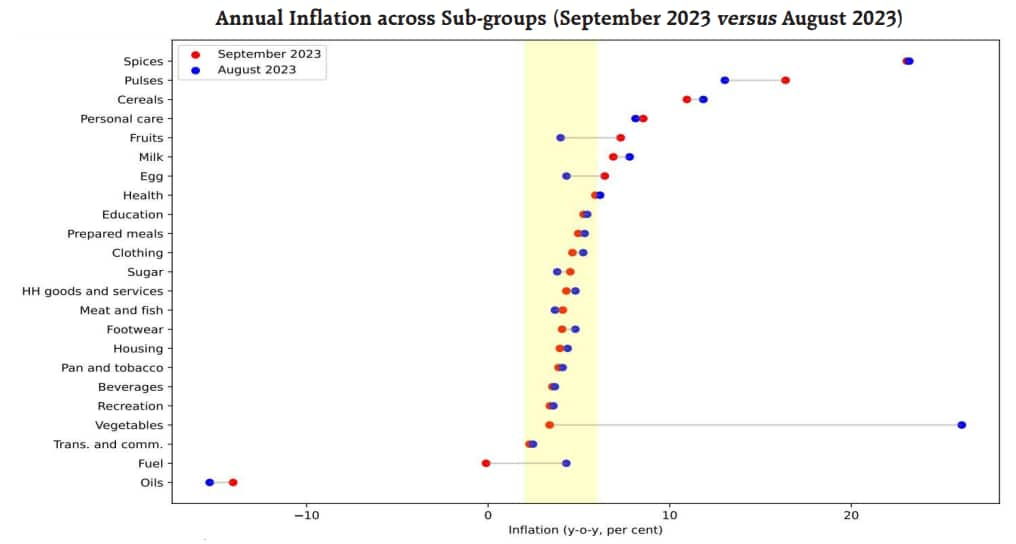

"The MPC observed that the expected correction in vegetable prices from the spike of July-August, along with the recent reduction in LPG prices could improve the near-term inflation outlook. A major positive development is the relative stability in core inflation, with services inflation muted," the central bank's State of the Economy article, released on October 19, said.

"While risks are evenly balanced, with weather conditions and volatile global energy and food prices weighing in on the upside, firms across manufacturing and services sectors expect moderation in growth of selling prices," it added.

The monthly State of the Economy article includes Deputy Governor Michael Patra - one of the three RBI representatives on the MPC - as one of its co-authors. The views expressed in the article do not reflect the central bank's official stance.

Source: Reserve Bank of India

Source: Reserve Bank of IndiaData released after the MPC's October 6 decision has shown that the headline retail inflation fell more than expected to a three-month low of 5.02 percent in September. Core inflation - or inflation excluding food and fuel - hit a new multi-year low of 4.5 percent last month, which the RBI article said is a result of "staying the straight and narrow course of excoriating inflation enduringly".

Economists expect the headline inflation to fall further in October - data for which will be released on November 13 - and come closer to 4 percent, with the RBI article saying that vegetable prices may correct even more in October.

"The accumulated force of monetary policy actions and an unswerving disinflationary stance of withdrawing accommodation are yielding results in the form of dissipating the persistence of price pressures, aided by the receding of input costs," the article said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.