Indian markets experienced a robust start in the first three days of the week. However, a terrorist attack on tourists in Kashmir and concerns about potential retaliatory actions from India led to a sharp decline on Friday. Despite this, the markets managed to finish the week positively, with a gain of 0.79 percent.

The IT sector performed particularly well, posting a 6.5 percent increase, while auto stocks followed with a three percent gain. The markets also benefited from consistent buying by foreign institutional investors (FIIs), who extended their buying streak for eight days. During the week, FIIs purchased Rs 17,796.39 crore, although the monthly figures indicate net sales of Rs 2,175.6 crore.

While Indian markets faced challenges over the weekend, global markets rebounded sharply, led by a rally in the US market (see chart). US equities surged on reports suggesting that trade tensions between the US and China may be easing, along with progress in negotiations with other trading partners, which contributed to the upward momentum.

Looking ahead, Indian markets may remain unsettled as they await government responses to the terrorist attack. Nevertheless, the market fundamentals appear to be strong.

Indicators reflect bullishnessThe Nifty closed the second week on a positive note and is approaching the 61.8% retracement level near 24560. Once we surpass that hurdle, breaking through 25000 and potentially testing the all-time high will be easier. The market is facing negative news and concerns about a recession or war. However, positive developments, like the finalisation of trade negotiations between India and the U.S., could take precedence as bad news gets priced in.

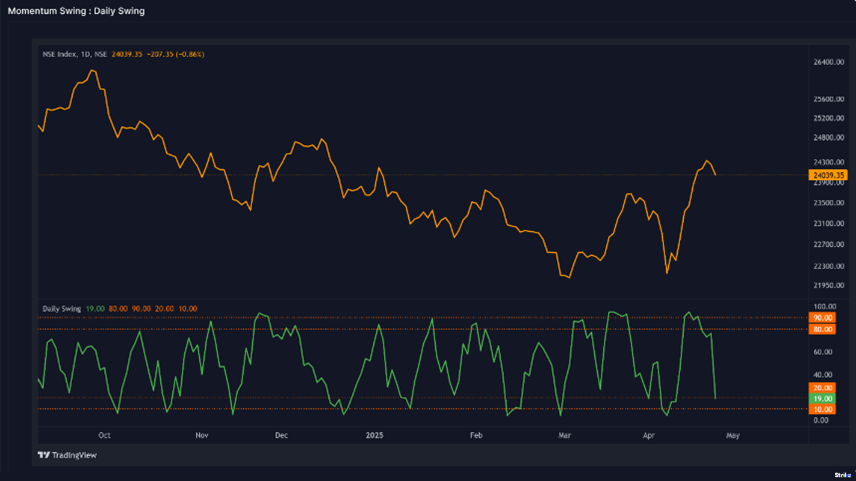

Weekly momentum indicators remain bullish, and net trading positions in the market are still short, which keeps the possibility of short covering open. The daily swing has dropped to 19 and is nearing oversold territory. If the overall market trend remains positive, a reading below 20 could trigger a bounce back, especially following the two days of selling at the end of the week.

Source: web.strike.money

The combined positions of clients and Foreign Institutional Investors (FIIs) offer valuable insights, especially at a time when both groups hold net short positions in index futures. Typically, these two groups tend to oppose each other, but the situation has shifted. Clients have transitioned from long to short positions, while FIIs have reduced their short positions, although they remain short.

The chart below indicates that the combined positions have reached extreme levels in the past, but these instances usually occur near or after market lows. In other words, the prevailing short positions have often led to continued short covering, resulting in upward movements in the market.

Source: web.strike.money

The group opposing the two mentioned earlier is the DIIs, who have maintained and even increased their long positions throughout April. Although they have realised some gains in the past few days, their positions remain well above critical thresholds, indicating significant levels from a historical standpoint. This continued and strong positive sentiment from domestic institutions serves as a strong signal to investors. Their support is crucial in keeping the markets buoyant despite the challenging news flow we've encountered recently.

Source: web.strike.money

Sector RotationNifty 50 closed above the 24000 mark at 24039.35 (+0.79%).

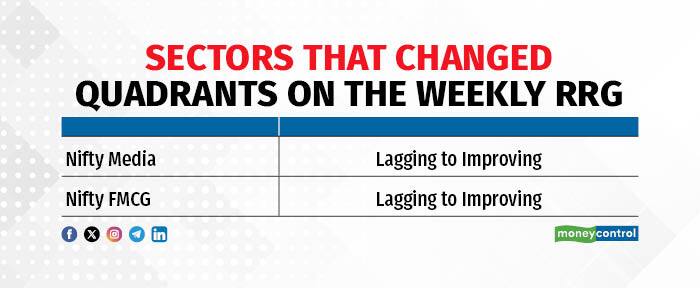

Indices positioning on Weekly Timeframe

Weakening Quadrant: None of the sectorial indices are in this quadrant.

Lagging Quadrant: Nifty IT continues to perform poorly, whereas sectors that showed some signs of Momentum recovery were Nifty Realty, Nifty Consumer Durables, Nifty Pharma, Nifty India Consumption, and Nifty Auto to a certain extent.

Improving Quadrant: Nifty PSU Bank, Nifty Infrastructure, Nifty Oil & Gas and Nifty Energy showed improvement in Momentum and are headed towards the Leading quadrant.

Leading Quadrant: Nifty Bank, Nifty Private Bank and Nifty Financial Service are still holding on to their Momentum and performing better than Nifty 50. Nifty Metal showed good improvement in its relative performance with the Benchmark.

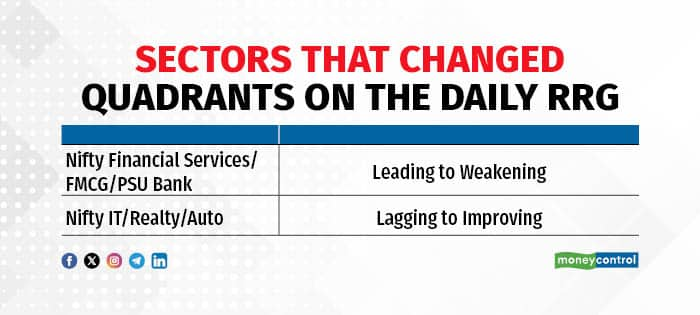

Indices position on the daily timeframe

Weakening Quadrant: Nifty Oil & Gas and Nifty Energy have shown an increase in their momentum and are headed North towards the Leading quadrant. A bit more strength and momentum can take them to the Leading quadrant.

Lagging Quadrant: Nifty Metal shows a notable positive change in momentum. If it continues, the Index can enter the Improving quadrant next week.

Improving Quadrant: The three indices that entered this quadrant from the Lagging position have shown good momentum. Nifty Auto and Nifty Realty are headed towards the Leading quadrant.

Leading Quadrant: Nifty Consumer Durables, Nifty Media, Nifty India Consumption, Nifty Bank and Nifty Private Bank are losing momentum.

Stocks to watchAmong the stocks expected to perform better during the week are ICICI Bank, Patanjali, Shree Cements, MFSL, Chambal Fertiliser, HDFC Bank, SRF, Bajaj Finserv, Kotak Bank and JSW Steel.

Among the stocks that can witness further weakness is Syngene.

Cheers, Shishir AsthanaDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.