Startups eyeing investment funds from National Pension System (NPS) will have to wait longer as the Pension Fund Regulatory and Development Authority (PFRDA) is not immediately looking to allow investment of pension funds into startups.

Supratim Bandyopadhyay, Chairman, PFRDA said during a virtual address that while the proposal is not completely off the table, there are valuation-related issues that need to be studied.

This is amidst reports that the government is in talks with the Life Insurance Corporation of India (LIC) and the Employees' Provident Fund Organisation (EPFO) to set up a fund for startups.

"In our sector, the pension funds declare the net asset value on a daily basis. This is not true for EPFO and LIC. We will have to look at the valuation of these startups and then take a call," he added.

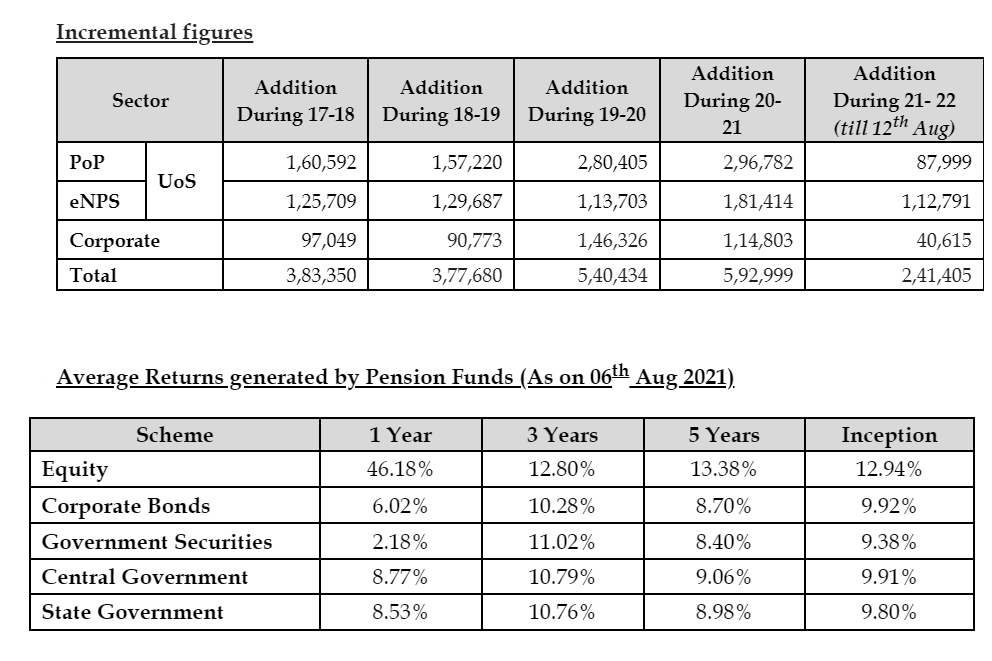

NPS has crossed a milestone of 3 million subscribers in the private sectors (corporate customers plus retail buyers) as on August 14.

"This is a big landmark for us. We are seeing a growth in corporate subscribers as well as inflows that have touched Rs 97,000 crore," he added.

The corporate sector had 2,41,000 customers as of mid-August (FY22) compared to 1,60,000 last year.

The Asset Under Management (AUM) under NPS Private Sector registered a YoY growth of 48.2 percent to Rs 97,314 crore as of mid-August.

Here, 546 new corporates have already adopted NPS in FY22 and total number of registered corporates as on August 7, 2021 reached 9,126.

On the equity side, Bandyopadhyay added that the returns stood at 12.94 percent over 12 years.

When it comes to new pension fund managers, the PFRDA chairman said Axis Mutual Fund which was to be added as a private sector pension fund manager is waiting for RBI approval. PFRDA has also permitted on-tap licenses for selecting PFMs.

As of August 14, the total number of subscribers under the various schemes governed by PFRDA is 4.48 crore and the total assets under management (AUM) is Rs 6.37 lakh crore.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.