Moody's Investors Service has defended its decision to comment on India's political risks while affirming its rating on India, saying it had to do so as its underlying assessment of the same had changed. In an interview to Moneycontrol, Christian de Guzman, a senior vice president and the primary analyst for India, said Moody's assessed political risks – domestic and geopolitical – as well as social risks for every country it rates.

"We highlighted this in our statement because our views on domestic political developments did lead to a change in our underlying assessment of political risk. If nothing had changed, we wouldn't be highlighting it," de Guzman said.

On August 18, Moody's affirmed its Baa3 rating on India and maintained the stable outlook. However, it noted that "curtailment of civil society and political dissent, compounded by rising sectarian tensions, support a weaker assessment of political risk and the quality of institutions", citing the ongoing violence in Manipur as an example.

According to de Guzman, these current events had to be mentioned because Moody's had changed its assessment of political risk in India.

"We didn't change our view on India's government liquidity risk or external vulnerability risk, or the quality of legislative and executive institutions or banking sector risks. But because we made a change to our assessment of political risk, we had to explain that change to the market," he said.

Also Read: Moody's to re-examine India's fiscal strength when deficit well below 4.5%

While Moody's affirmed its rating on India, it repositioned India's political risk score to 'baa' from 'a'.

Moody's has a score of 'a' for both, India's government liquidity and external vulnerability risks, with a banking sector risk score of 'baa'.

View on risks

Moody's comments have sparked a backlash, with Shamika Ravi, a member of the Economic Advisory Council to the Prime Minister, rejecting the assessment and calling for a more objective picture. India, which has been pitching global rating agencies for an upgrade, has had a fractious relationship with rating agencies and has accused their methodologies of being biased against emerging economies.

"Under our old assessment of India's political risks, when you look at geopolitical aspects in particular, we were basically saying that India was as susceptible to cross-border tensions as very stable countries like Ireland, Andorra, or Costa Rica," de Guzman said.

"But as we all know and understand, there are in fact periodic tensions that do flare up in the case of India with its neighbours. And these periodic tensions do sporadically escalate into actual physical conflicts, such as the border skirmishes with Pakistan or China. So, it is a combination of our assessment of domestic political risks and geopolitical risks that led us to change our overall view on political risks," he added.

Although Moody's has lowered its view on India's political risk to 'baa' from 'a' due to rising sectarian tensions and intensifying domestic political polarisation, it does not expect them to result in "material destabilisation" of the government.

Break-up of assessment

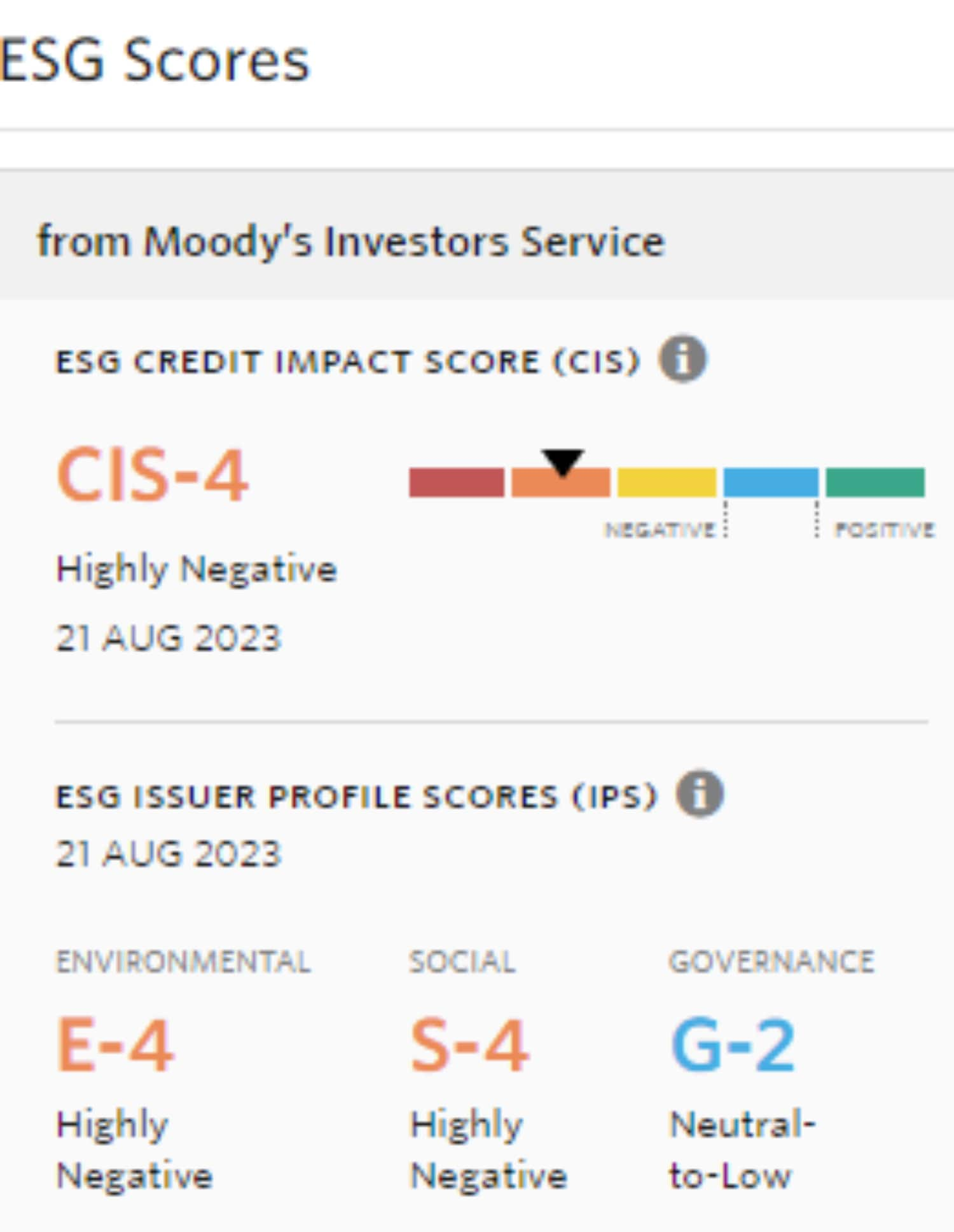

Even as Moody's lowered its political risk score for India, its assessment of India's governance improved to G-2 (neutral-to-low) from G-3 (moderately negative). When asked how this had occurred, de Guzman explained that Moody's assessment of a country's governance was based on four aspects: the quality of legislative and executive institutions, strength of civil society and judiciary, fiscal policy effectiveness, and monetary and macro policy effectiveness. Crucially, the latter two have a larger weight.

Source: Moody's Investors Service

Source: Moody's Investors Service

While the ratings agency's political risk concerns were reflected in a lower score for the strength of civil society and judiciary, it was more than made up by the increased score for macro policy effectiveness on the back of strengthening of the economy, including the rehabilitation of the financial system and the Reserve Bank of India managing inflationary pressures "relatively well" over the past year.

"We wanted to acknowledge all these improvements in terms of managing the economy. So, our higher assessment of monetary macro policy effectiveness – because of the larger weight placed on policy effectiveness – more than offset that lower score for the strength of civil society and judiciary. This effectively pushed up the overall score for governance," de Guzman said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!