The flavours of milk this season seem to be both political and statistical.

Ahead of the state assembly elections in Karnataka, political parties are having a go at each other after Amul said it would sell milk and curd in the southern state, pitting it against local brand Nandini. Meanwhile, milk prices are burning larger and larger holes in consumers' pockets.

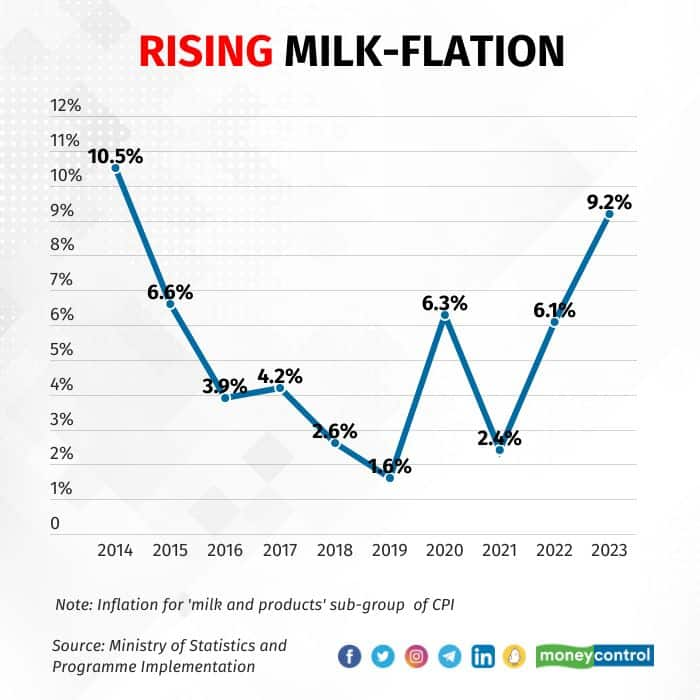

Data released on April 12 showed inflation for the 'milk and products' a sub-group of the Consumer Price Index (CPI), was 9.31 percent in March. In the first quarter of 2023, 'milk and products' inflation averaged 9.25 percent — the highest it has been since October-December 2014.

While milk is clearly important politically — as Karnataka and the rest of the country are finding out — the 'milk and products' sub-group is a sizeable constituent of the CPI, accounting for 6.61 percent of the entire basket. Add the fact that it is a key input in a few other items, and milk prices can influence as much as 8 percent of CPI inflation.

No feeding frenzy

At the heart of the rising milk inflation is a mix of rising input costs and falling domestic supply.

"Major milk cooperatives like Amul and Mother Dairy raised retail prices by Rs 2-3 per litre in two and three spells since September, respectively, followed by other state cooperatives, attributed to increase in feedstock costs," the Reserve Bank of India noted in its latest Monetary Policy Report, released on April 6.

The cost of feeding cattle has been increasing rapidly for some time now. Wholesale price data from the commerce ministry shows fodder inflation has been in double-digit territory since February 2022 and was as high as 30.9 percent in November. In February, fodder inflation remained elevated at 24.3 percent.

Cattle-feed inflation too has surged. From -0.4 percent in February 2021, inflation of prepared cattle feed as per the WPI jumped to 21.6 percent in September 2021. Since then, it has cooled, although it still remains high, with the latest print for February being 8.4 percent.

Ailing supply

A fall in demand for dairy — and consequently prices — as soon as the coronavirus pandemic struck India in early 2020 has also contributed to today's high prices.

"Farmers had to reduce the size of their herds to control costs, while they also began to underfeed them, especially the calves and pregnant cattle that were not giving milk at the time," Emkay Global Financial Services' Madhavi Arora and Harshal Patel said in a note last month.

"Thus, the underfed and undernourished calves from the Covid period are the milk-producing cows of today. Milk yields have dropped, and dairies have been reporting lower milk procurement throughout the year," they added.

High international prices mean India's dairy exports have surged too, further adding to domestic supply woes.

Then there is the small matter of cows' health.

"The supply of milk has been impacted with a lumpy skin disease infecting millions of cattle in late 2022. Limited supply coupled with high fodder and transportation costs led to multiple rounds of price hikes by dairy suppliers across the country," noted CareEdge economists Rajani Sinha and Shambhavi Priya in a note on April 12.

In December, the government informed the Rajya Sabha that the lumpy skin disease had affected nearly 31 lakh cattle and caused 1.69 lakh deaths.

No respite

In his address on April 6, RBI Governor Shaktikanta Das had said that milk prices may "remain firm going into the summer season". As such, consumers are unlikely to get a respite from spiralling prices anytime soon.

However, the matter is tricky enough for the government to consider importing milk. How that plays out politically is another matter, considering India is the world's largest producer of milk and accounted for nearly a quarter of global output in 2021-22.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!