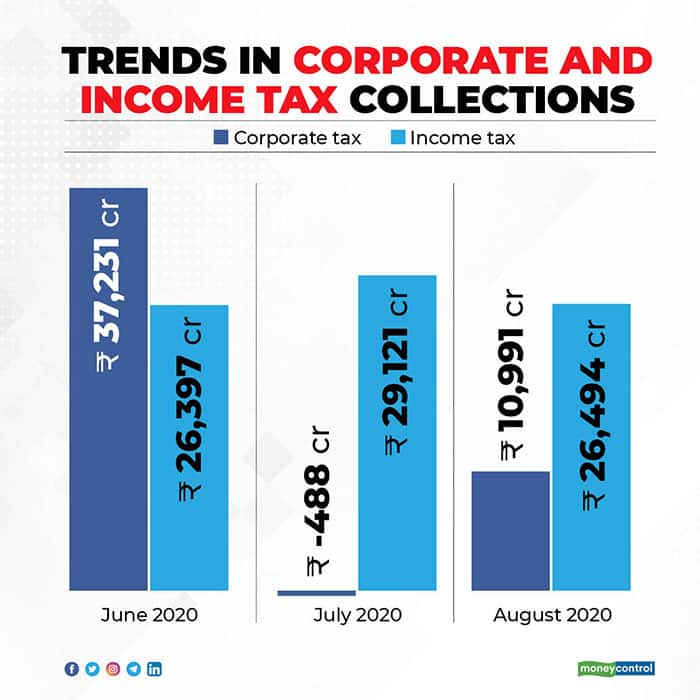

While income tax collections from June onwards have shown signs of stabilisation, corporate tax collection for the same period shows a declining trend, according to Controller General of Accounts (CGA) data.

Corporate tax collection for August 2020-21 came in at Rs 10,991 crore. In July, corporate tax collected was Rs -488 crore, implying that more money was being spent on refunds than what was being collected.

However, corporate tax collection in August fell more than half of what it was last year, which was at Rs 22,785 crore.

"The lockdown and cessation of economic activities in the first few months of the financial year are manifesting itself in the dip in corporate earnings," Rohinton Sidhwa, partner, Deloitte India, said.

Income tax collected in August came in at Rs 26,494 crore, against Rs 29,121 crore in July. Income tax collected in August this financial year too fell more than half of what was collected in the same period a year ago, which was Rs 36,748 crore.

While monthly income tax data shows that collection stabilised from June onwards, monthly corporate tax collection for the same period shows a declining trend.

"Income tax is paid on gross income generally (e.g. salaries) with few adjustments. Corporation tax is paid on profits. Hence while the salaries have roughly remained stable, the profits of corporations have taken a beating," Sidhwa said.

The government's net direct tax collection fell 31 percent year-on-year to Rs 1.92 lakh crore in April-August 2020, Anurag Singh Thakur, Minister of State for Finance said in Parliament. Net direct tax collection was Rs 2.79 lakh crore in April-August 2019.

Advance tax collection for the first quarter is down by 76 percent, indicating subdued earnings outlook of the corporate sector for financial year 2020-21. Corporation advance tax collection was down 79 percent at Rs 8,572 crore as against Rs 40,488 crore last year.

To tackle the outbreak of COVID-19 pandemic, the government had imposed a nationwide lockdown in March. While lockdown restrictions have been eased considerably across the country, the months-long closures since the end of March have taken a toll on the economy, and demand and growth have suffered.

India's gross domestic product (GDP) growth for the April-June quarter contracted 23.9 percent, the steepest drop since records began, against a growth of 5.2 percent in the same period last fiscal.

Since business activities came to a standstill and even after resumption, businesses are functioning with social distancing norms, thereby affecting production.

The Budget 2020-21 estimated a 12 percent growth rate in tax collection to meet the target of Rs 13.19 lakh crore. However, now to meet the same target, a growth rate of around 33 percent would be required.

The Centre missed the downward revised target for direct tax collection for 2019-20 by Rs 1.17 lakh crore, a 7.8 percent fall over the previous year.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.