Highlights

No wonder, many of these companies are looking up to this pre-election budget, hoping that the central government will try to please every voter, which in turn could provide the much-needed fillip to overall consumption.

However, many would argue that, given the high chances of victory of the ruling party in the forthcoming general election and the compulsion to move back to the fiscal consolidation roadmap, the budget would be devoid of freebies. However, data on consumption slowdown may force a rethink.

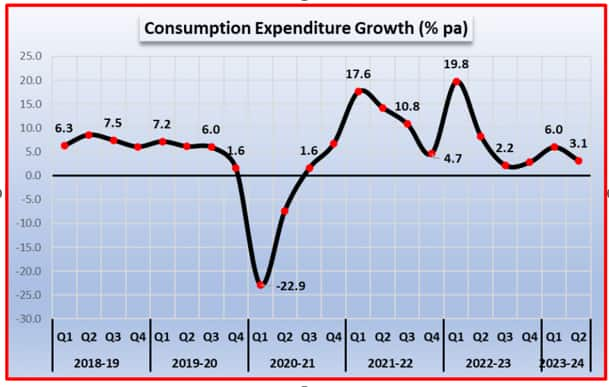

Consumption slowdown is worrisome

Private final consumption expenditure (PFCE), which is the largest contributor to the Gross Domestic Product (forming close to 60 percent), has been sluggish over the past four to five quarters. On an average, the PFCE growth has been in low single digits — the lowest since the Global Financial Crisis in 2008-09 (excluding the COVID-19 period).

The distress is especially pronounced in rural areas, hit by the double-whammy of erratic rainfall and high inflation.

The companies are pinning hopes on history — the previous interim budget of 2019 had something for every constituency.

Several measures to boost consumption in the interim budget of 2019

The previous interim budget (prior to the general election in 2019) saw the government making efforts to boost income levels, thereby indirectly boosting consumption demand. The government had announced the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) to provide income support to small and marginal farmers. Landholding farmer families having cultivable land up to 2 hectares were provided direct income support to the tune of Rs 6,000 per year. In addition, the government doubled the tax rebate limit to Rs 5 lakh and raised the standard deduction from Rs 40,000 to Rs 50,000, leading to increased disposable incomes in the hands of consumers.

Finances in fine fettle; why the government could be generous

Government finances have been strong with revenue receipts increasing year on year (YoY) at a robust 21 percent in the April-November 2023 period to Rs 17.2 lakh crore. While tax revenues are up 17 percent YoY to Rs 14.4 lakh crore, non-tax revenues have grown 43 percent YoY to Rs 2.8 lakh crore.

With a strong revenue profile and a subdued PFCE, markets have enough reasons to expect that the government will dole out measures to boost consumption.

In December 2023, the government took approval for the first batch of supplementary grants worth Rs 129,000 crore (supplementary grants need Parliament’s approval for additional spending beyond the initial approval taken in the Budget). Out of the approved amount, about Rs 20,000 crore is expected to be towards the MNREGA (Mahatma Gandhi National Rural Employment Guarantee Act) scheme to boost rural employment.

We expect the government to take measures to increase disposable incomes in the hands of consumers via increased capital expenditure on infrastructure projects, higher allocation to rural development schemes such as the MGNREGA, Pradhan Mantri Awas Yojana, and Pradhan Mantri Gram Sadak Yojana, as well as incentivising manufacturing operations through the Production-Linked Incentive schemes. The government may also provide tax relief to boost consumption.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.