Titan is expected to report a strong revenue growth in Q3FY24, despite rising gold prices due to a strong festive and wedding season.

The company will declare its results on February 1.

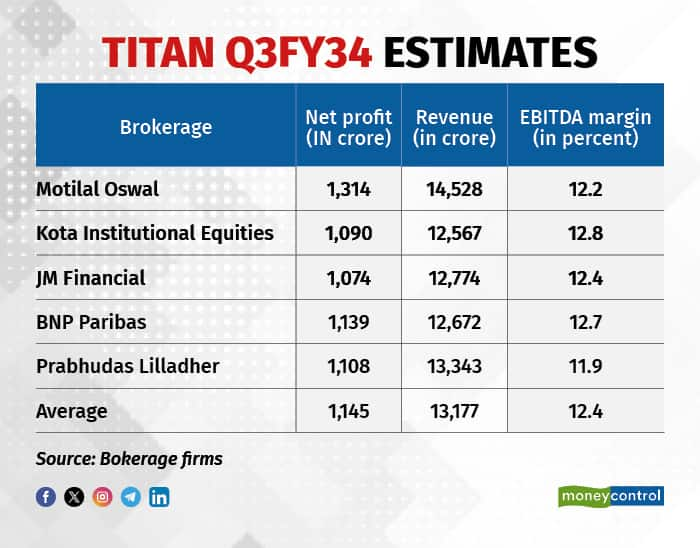

Titan is expected to report a 16.6 percent growth in net profit year on year (YoY) to Rs 1,145 crore in Q3FY24, according to the mean estimates of five brokerage firms. The jewellery company is expected to report a 25 percent increase in revenue to Rs 13,177 crore in the quarter.

Sequentially, net profit is expected to rise 17.9 percent. Revenue will increase 16 percent on a quarter-on-quarter (QoQ) basis.

.

.

Earnings before interest, tax, depreciation and amortisation (EBITDA) margin is set to rise by 55 basis points YoY to 12.4 percent in Q3FY24. Even though Tanishq took some price corrections in solitaires, its impact was not seen on operating margins because of solitaires' limited contribution to the top line, said Kotak Institutional Equities.

Prices of 24 carat gold have increased 3 percent YoY and 16 percent QoQ in the October-to-December quarter of FY14, according to Kotak Institutional Equities.

Q3 update

Titan, in its Q3FY24 update, said that revenue from the jewellery segment grew 21 percent YoY, helped by an improvement in average selling prices. The growth in plain gold and coins during the festive quarter exceeded the studded sales growth, even with elevated gold prices and volatility.

Titan's watches and wearables domestic business grew 23 percent YoY, with an 18 percent growth in analog watches and 64 percent growth in wearables. Revenue from analog watches was strong because of the double-digit growth in Titan, Sonata, Helios and other international brands.

CaratLane revenue grew 13 percent YoY from new collections, wedding gifting curations, and its first-ever mangalsutra campaign. The company added a total of 164 stores during the quarter.

Industry scenario

The jewellery sector saw a strong quarter, with demand aligning with the expectations of the companies. This was because of the strong festive season and a thriving wedding period, Prabhudas Lilladher said in its quarter update.

The brokerage firm said that the eyewear segment continues to face pressure due to strong competition from the unorganised sector. “The outlook for this segment remains uncertain, with a continuous supply of cheaper materials, with heavy discounts coming in from organised branded players,” said Prabhudas Lilladher.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.