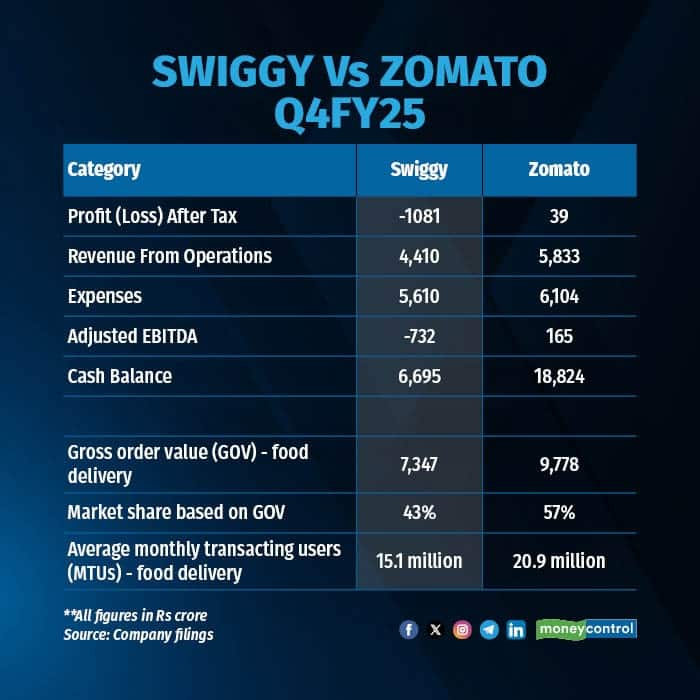

Swiggy reported a net loss of Rs 1,081.18 crore for the fourth quarter of financial year 2025. This marks a rise of over 94 percent from the Rs 554.77 crore net loss reported in Q4 FY24.

Swiggy’s revenue from operations rose 45 percent YoY to Rs 4,410 crore in Q4, up from Rs 3,046 crore a year ago. It had reported a revenue of Rs 3,993 crore in the previous quarter.

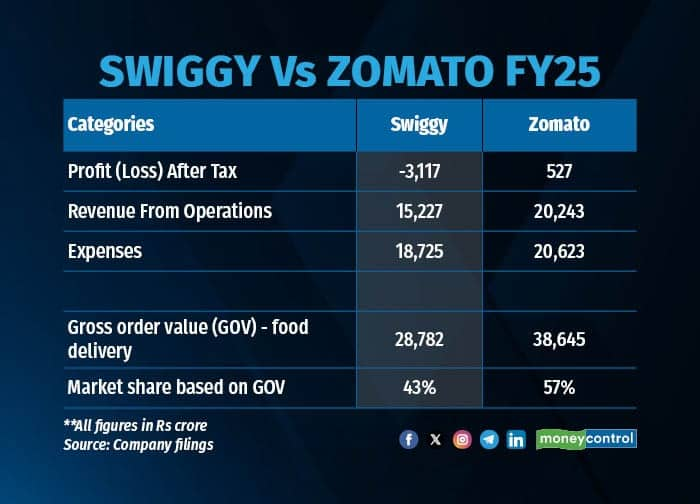

Swiggy's loss for the full financial year came in at Rs 3,117 crore, up 33 percent compared to Rs 2,350 crore in the previous fiscal. For the full year (FY25), the company reported a consolidated operational revenue of Rs 15,227 crore, up 35 percent from Rs 11,247 crore in FY24.

Meanwhile, its chief rival Zomato posted a 78 percent YoY decline in profit after tax (PAT) at Rs 39 crore during the March quarter. For the full year, Zomato’s profits increased 50 percent YoY to Rs 527 crore.

And Zomato saw its revenue rise 64 percent YoY to Rs 5,833 crore in Q4, and a full-year revenue growth of 67 percent to Rs 20,243 crore.

Swiggy vs Zomato

Swiggy vs ZomatoALSO READ: Swiggy Instamart adds 316 dark stores in Q4 as quick commerce wars heat up

Speaking about the company's performance, Swiggy Group CEO & MD Sriharsha Majety said, "FY25 was a year of many firsts for Swiggy. We launched multiple new apps, across Instamart, Snacc and recently, Pyng; all of which are aimed at opening up new user-segments and markets. Our Food delivery engine delivered best-ever results across innovation and execution, driving category-leading growth and rising profitability in lockstep."

Swiggy vs Zomato head to head

Swiggy vs Zomato head to headTotal expenses for Swiggy, the Bengaluru-based firm, meanwhile, increased to Rs 5,609.6 crore in the quarter ended March, up from Rs 3,668 crore a year ago and Rs 4,898 crore a quarter ago. For the full year, Swiggy’s expenses came in at Rs 18,725 crore, up 34 percent from Rs 13,947 crore in the previous year.

Swiggy's shares changed hands at Rs 314 apiece on the BSE, down 0.19 percent, at the close of market hours on May 9.

"Quick-commerce is in a phase of rapid expansion and heightened competitive intensity, for which we have ramped-up investments aimed at market expansion (Megapods), reach (1000+ stores across 124 cities) and differentiation (Maxxsaver). Our Out of Home Consumption business turned profitable in Q4, within just 2 years of its integration. Overall, we remain focused on growth, on the back of delivering unparalleled convenience to consumers," Majety added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.