SBI Life is expected to deliver a muted performance for the January–March quarter (Q4FY25), mainly due to modest growth in annual premium equivalent (APE) and value of new business (VNB). The life insurer is scheduled to announce its Q4 results on April 24, 2025.

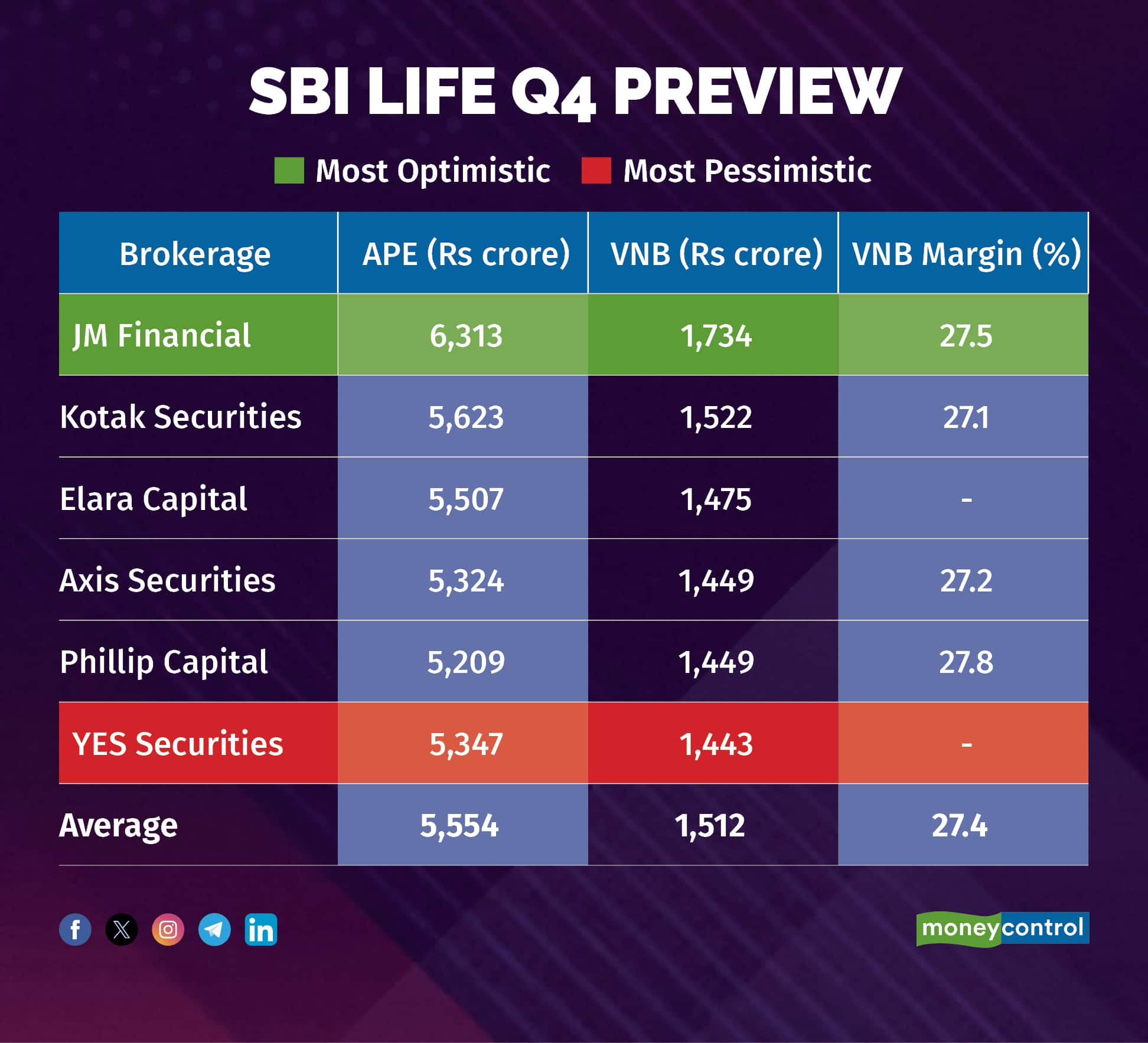

According to Moneycontrol's poll, SBI Life is expected to post a 4.2 percent year-on-year (YoY) growth in APE (an insurance term that measures the annualised value of new policies sold), rising to Rs 5,554 crore from Rs 5,330 crore in the same quarter last year. The company's VNB (a metric that shows how profitable the new insurance business is expected to be) is likely to stay flat or grow by just 0.1 percent YoY, increasing marginally to Rs 1,512 crore from Rs 1,510 crore in Q4FY24.

Estimates of analysts polled by Moneycontrol are shown to be in a narrow range, meaning any positive or negative surprises may elicit a sharp reaction in the stock price. Among the brokerages polled, JM Financial rolled out the most bullish projections while YES Securities forecasted the slowest growth for SBI Life.

What factors are driving the earnings?

Contracting VNB margins: Most brokerages expect a dip in SBI Life’s VNB margins by 70 basis points (bps), falling to 27.4 percent in Q4FY25 from 28.1 percent in Q4FY24. This is due to nearly flat VNB growth. However, compared to the previous quarter, margins are expected to improve by 88 bps from 27 percent, helped by a more favourable product mix.

Modest APE growth: The growth in APE is expected to remain muted, mainly because of lower group single premiums (single premiums refer to one-time payments for group insurance policies). Analysts at Phillip Capital mentioned that individual APE growth also seems to be slowing down, likely because of weaker sales of ULIPs (unit-linked insurance plans, which are insurance products tied to market investments).

Rise in EVs: Embedded value (EV), which reflects the present value of future profits from existing policies, is projected to grow 19 percent YoY. This rise is being driven by around 19 percent return on EV (RoEV), along with modest positive economic variances (unexpected economic factors that worked in favour of the insurer), according to analysts at Phillip Capital.

What to look out for in the quarterly show?

Investors will be paying close attention to SBI Life’s management commentary regarding growth expectations for FY26 and how they plan to manage margins going forward.

During the January–March period, shares of SBI Life rose by 11 percent, outperforming the Nifty 50 index, which gained 3 percent over the same time.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!