Highlights:

-Jio continues to post healthy numbers led by stable ARPU, customer addition & operational efficiencies

- Strong performance in retail segment contributed to overall margin improvement

-Impacted by global headwinds, petchem business saw sharp dip in margins

-Decent show in refining segment, slight sequential decline in GRMs -Lower crude prices impact topline for oil and gas segment

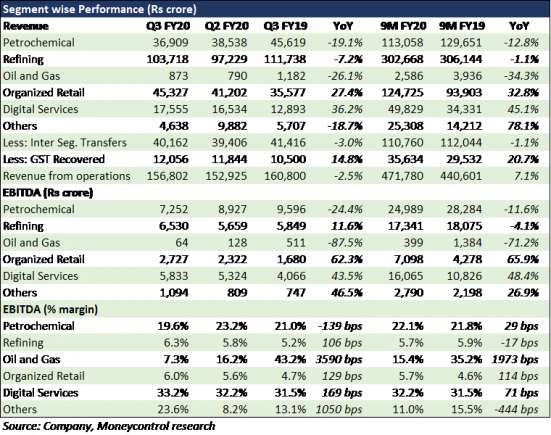

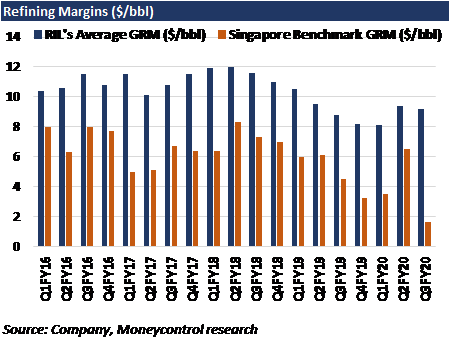

Reliance Industries (RIL) reported a mixed set of numbers for the quarter ended December 2019. Consumer businesses continued to perform well, and the legacy energy businesses struggled. Petchem margins contracted significantly and gross refining margin (GRM) at $9.2 per barrel was in line with our expectations.

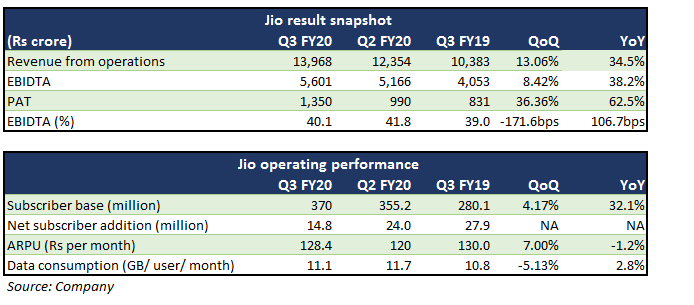

Jio’s reported yet another quarter of stellar performance with strong topline growth and better margins. Launch of JioGigaFiber services, coupled with a tariff hike is expected to drive growth further.

RIL’s push towards consumer businesses was visible in the robust numbers of its retail division as well. A strong show by the retail segment contributed to the overall margin growth during the quarter.

Financial performance

Key Positives

The market for crude remained volatile on account of geopolitical tension, which affected the freight markets and heavy crude sourcing. Refining revenues were down 7 percent year-on-year.

Still, defying both global and industry-specific headwinds, the segment reported a 106 basis point YoY uptick in margins. The gross refining margin (GRM) at $9.2 per barrel was a tad lower than the previous quarter (Q2FY20: $9.4/bbl). However, it was at a significant premium to the Singapore GRM which was at $1.6/bbl (Q2FY20: $6.5/bbl).

-The telecom business reported a 7 percent quarter-on-quarter growth in ARPU (average revenue per user), primarily, on the back of implementation of IUC (interconnect usage charges) tariffs for recovery of termination charges. Year-on-year (YoY), ARPU was down 1.2 percent.

-Jio’s net revenues rose 34.5 percent year-on-year (YoY) growth to Rs 13,968 crore. The growth was driven by a net addition of 14.8 million subscribers in the quarter. Jio subscribers’ base stood at 370 million.

-Jio continues to surprise us in terms of its operating margin. Its earnings before interest, tax, depreciation and amortisation (EBITDA) margin for the quarter expanded 106.7 bps. The management highlighted that it was driven by operational efficiencies and the implementation of IUC charges.

-Revenue of the retail vertical rose 27 percent YoY during the quarter. Revenues of the core retail business, which includes fashion & lifestyle, grocery and consumer electronics, grew much faster at 36 percent YoY. New store additions (456) and expansion of product portfolio aided with strong growth during the festive quarter.

-The margin profile in the retail segment continued to improve sequentially. Economies of scale, cost control measures and better supply chain management aided the operating margins during the quarter. Operating profit of Rs 2,727 crore showed 62 percent YoY growth.

Key negatives

-Lower realizations across product categories impacted the topline of the petrochemical segment. With new capacity additions and destocking globally due to US-China trade tensions, margins across petchem products remained under pressure, which impacted the overall segment margins (down 139 basis points YoY).

-Lower crude prices during the quarter led to a 10 percent YoY dip in the realizations for the oil and gas segment.

-While Jio’s subscriber base continued to expand, the pace of the growth moderated primarily due to base effect.

- The revenue growth in the retail segment came in much ahead of its peer Dmart (23 percent) and was fairly impressive in a muted demand environment. However, the margins continued to remain weaker than Dmart, despite the expansion in recent quarters. There exists a significant scope of margin improvement through better market positioning and operating efficiencies.

Outlook

Results were broadly in line with our expectations barring the weakness in the petchem segment. The overall weakness in core energy businesses was majorly in line with global trends and volatility. However, we take a cue from the management’s comments about strength in domestic demand and expectation of improvement in volumes which should aid performance in the upcoming quarter. Moreover, the businesses are now at an end of all major capex, and benefits should start flowing in.

We believe Jio would continue its strength, going forward, on the back of its strategy of offering services at a reasonable price. Its focus towards deeper and wider market penetration has led it to become the largest telecom operator in India in terms of subscriber base.

There are a couple of factors that work in favor of the company. Implementation of IUC charges and an increase in tariff implemented in December 2019 would have a significant positive impact on Jio’s ARPU and would improve operating margins, going forward. Further, the launch of JioGigaFiber services has been well received by customers.

Additionally, another positive for Jio is that the group is planning to set up a wholly-owned subsidiary (WOS) to make Jio debt-free through the rights issue of optionally convertible preference shares (OCPS) aggregating up to Rs.1,08,000 crore to the WOS. Consolidating the group’s digital business under one umbrella would pave the way for getting in a strategic investor and enable value unlocking.

While the retail business continues to be a key growth driver for RIL, we expect the pace of growth to moderate on the back of high base and weak consumer demand, especially in rural India. Reliance Retail remains among the biggest and fastest-growing retail players in the world and the demerger of the business could unlock further value for shareholders.

- Nitin Agrawal and Sachin Pal also contributed to this report.

Disclaimer: Reliance Industries Ltd, which also owns, is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!