Highlights:

- Consumer base continues to expand on a sequential basis

- Commercialisation of Home and Enterprise broadband a big positive

- Investment cycle is almost over for Jio- Leverage and return ratios to improve

-------------------------------------------------

Reliance’s entry into telecom has altered the dynamics of the industry. Through aggressive pricing and marketing strategies, Jio has transformed the digital connectivity in India with affordable data tariffs and free voice services.

The company has penetrated the mobile broadband market at an exponential rate and garnered a user base of more than 300 million subscribers within three years of its launch in 2016. Since the start of this fiscal year, Jio has nosed ahead of Bharti Airtel in terms of subscriber base and now has a market share of around 28 percent. Vodafone Idea continues to dominate the market, but its user base has been shrinking since the launch of Jio.

At the AGM, the management gave insights into industry as well their business strategy for Jio, which assumes prime importance in Reliance’s overall business. The company would continue to disrupt the entire value chain and intends to expand further deeper and wider market penetration into existing and newer markets.

Growth rates to moderate

Jio’s financial performance has been improving on a sequential basis as the company continues to gain share from its competitors. In FY19, Jio’s top line stood in excess of Rs 38,000 crore as the company increased its user base by nearly 50 percent. The operating margins were stable throughout and stood close to 38.9 percent for the full year.

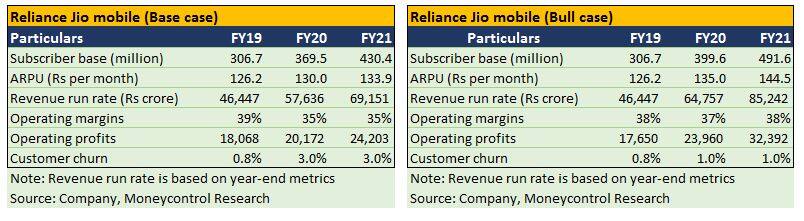

While the consumer base has expanded, the pace of addition has slowed due to competitive intensity and base effect. During Q1, the company added 24 million subscribers at a run rate of 8 million per month. At this pace, the company is on track to achieve 500 million subscribers in the next 18-20 months. Considering the existing operating metrics in a favourable scenario, Jio’s revenue run-rate would double over the next two years.

Our base case assumes a conservative stance taking into account a moderation in growth rate, higher customer churn rate and lower operating margins. Revenue as well as operating profits are anticipated to grow by 50 percent even under the base case.

New businesses have high revenue potential

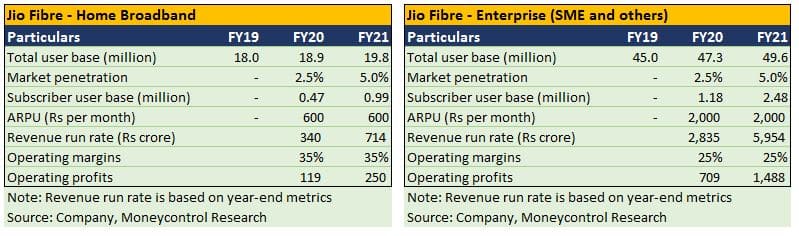

Jio has already disrupted pre-paid mobile market and the company now plans to leverage the technology, infrastructure and user base to enter into newer business segments of the telecom market. At the AGM, the company announced that the trial runs for Jio Fiber are nearing completion and the home broadband services are expected to be rolled out commercially in the first week of September.

Similarly, the beta phase of enterprise broadband services are under way and the services will be rolled out officially next year. The company is also targeting Internet of Things (IoT) as it is an extension of Internet connectivity into physical devices and everyday objects. Through smart meters and other such devices, Jio aims to transform basic homes into smarter ones and gain share in the 20,000 crore IoT market.

The market size for home and enterprise broadband is pegged at 18 million and 45 million, respectively. At 5 percent market penetration, these two segments together could add another Rs 6,000 crore to Jio’s top line in the next 2 years. The digital offering also stands to benefit from complimentary revenue streams such as interactive gaming as well as revenue and cost synergies related to the acquisition of cable operators - GTPL Hathway and Den networks.

Cash flows to improve, balance sheet to strengthen

Jio has been on an aggressive expansion spree as the company has invested nearly Rs 3.5 lakh crore towards establishing the largest optical fiber footprint in the country. The company has been going through structural and operational changes in recent months and has demerged about Rs 1.17 lakh crore of hard infrastructure into separate infrastructure investment trusts (InvITs).

The objective of this demerger is to take fibre and tower assets off the balance sheet, which would also lead to the debt associated with those assets being taken off. Jio has already entered an agreement with Brookfield Infrastructure for an investment of Rs 25,215 crore into Tower InvIT. The money will be used to repay existing financial liabilities of Jio, which are estimated at around Rs 1,70,000 crore (EBITDA cover of ~9x ).

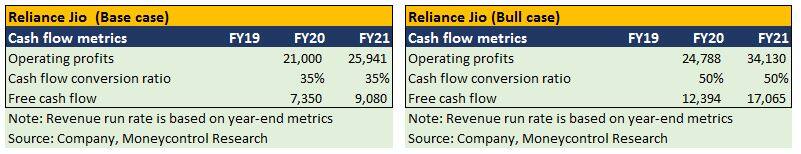

Jio’s high capex, leverage and weak cash flow have been a key concern for Reliance’s shareholders. However, the business is 5G ready and the capex cycle is nearing the completion phase and has enough spare capacity to match up to the growing demand. Going forward, free cash flows should improve substantially on the back of monetisation of tower assets, commercialisation of fibre business and minimal capex requirements. This augurs well for shareholders as increasing free cash flows would help deleverage the balance sheet and improve its return ratios over the next couple of years.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here. Reliance Industries Ltd is the sole beneficiary of Independent Media Trust, which controls Network18 Media & Investments Ltd.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!